Questor: With its brands on the run it's time to ditch Unilever

IT has never been clear to me why fast-moving consumer goods are labelled as such. Bottles of shampoo or canned drinks don’t have a particularly short shelf life, although the overdue push for less plastic packaging means that in the future some groceries won’t be left to moulder in-store for as long as they have been.

The 2018 answer for who put the “F” in “FMCG” is either consumers or investors. The big companies whose brands line the supermarket shelves are under pressure to up the pace as shareholders fear that shoppers are turning their backs on the staples they have always loaded into their trolleys in favour of healthier, small-batch alternatives.

Witness the sale last week by Swiss food giant Nestle of its US confectionery business to chocolatier Ferrero for 2.8bn Swiss francs (£2.1bn). Mark Schneider, chief executive of the KitKat maker, is determined to put a healthier slant on his portfolio. Before Christmas, Unilever pocketed £6bn by offloading brands including Flora and Blue Band to private equity group KKR. Its spreads division dates back to Margarine Unie, one half of the Anglo-Dutch merger that created the business in 1930.

And then consider how Unilever has been restocking its store cupboard. Boss Paul Polman made 10 acquisitions last year, including Tazo teas and Schmidt’s natural deodorants, whose exotic varieties include charcoal with magnesium. He has assembled a collection of niche, edgy, organic brands that often still bear the name of the founder.

Unilever – which is still better known for Persil soap powder, Dove soap and Wall’s ice cream – has been on a quest to reinvent itself since an unwanted takeover approach last year from aggressive food group Kraft Heinz. That unsuccessful proposal celebrates its anniversary next month. Kraft’s slash-and-burn tactics are anathema to Polman, a disciple of profit with purpose, but the overture has forced him to think more about feeding investors than feeding the world. The City can gauge how well he is doing on Feb 1 when Unilever announces full-year results.

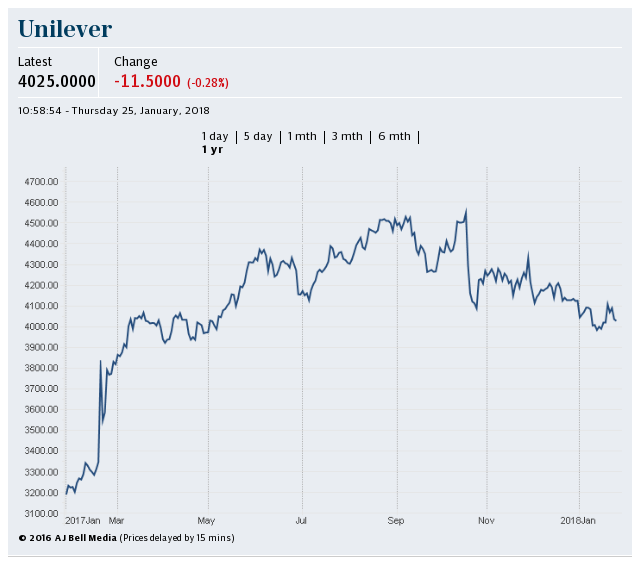

FMCG has been a poor investment of late. Consumer dissatisfaction has coincided with higher raw material costs and pitched battles with retailers about pushing through price rises. Unilever’s shares are barely changed since Questor declared they were a “hold” 10 months ago. Strepsils and Durex condoms maker Reckitt Benckiser, which this column advised readers to avoid in October, has fared little better.

Unilever and its peers are undergoing a tricky rebalancing as they strive to boost margins and therefore returns. The company cut deep into its marketing budget in the first half of the year with analysts fearing the net effect is that sales performance will continue to disappoint. RBC Capital Markets calculates that the cost to compete has risen sharply, with the sector’s incremental return on investment declining in recent years from 14pc to 6pc. A frenzy of deal-making is unlikely to reverse that trend.

Unilever was bullish at its annual investor day in November. It said its Connected 4 Growth programme, which includes supply chain savings and zero-based budgeting, is delivering faster than planned, and the integration of its food and refreshment divisions into a single unit is also progressing well. The company confirmed it expects underlying sales growth in the 3-5pc range from now until 2020.

The City appears to need more convincing. This month Goldman Sachs nudged down its forecasts for underlying sales growth, from 3pc, 2.9pc and 2.9pc for the next three years to 2.9pc, 2.6pc and 2.8pc. Last year, Unilever achieved 3.7pc.

In Europe, the company is likely to have gone backwards once again in 2017 and the group’s personal care division – including bathroom cabinet favourites Alberto Balsam, Radox and Brut – has had an underwhelming year. Goldman has also pencilled in a core profit margin of 17.3pc for the company, up from 16.4pc.

The City must decide whether slowing growth is a price worth paying for an extra 91 basis points on the hoped-for journey to a 20pc margin by 2020.

The conclusion I draw is that much furious activity cannot mask the fact that life has become much harder for these grocery giants that feed and clean the masses. The goods might be fast-moving, but shareholders should not rush to invest their money in Unilever. Sell

Yahoo Finance

Yahoo Finance