Questor: Ignore the recent dip – investors could harvest great returns from this agricultural stock

To some investors, buying an agricultural stock in a digital age might seem a bit pedestrian. Perhaps they should try climbing into the cab of a John Deere tractor.

Or maybe drive one of its combine harvesters, which boast features including cab-mounted cameras that monitor crop heights and volumes, and satellite-linked data gathering systems that can predict and manage the year’s yields.

The American company that makes this distinctive green and yellow machinery, known to the stock market as just Deere & Co, has become a world leader in the design and manufacture of state-of-the-art agricultural equipment.

Its machines are a lesson in the way technology has become a central part of modern farming, helping to make every part of the process – from ploughing to harvesting – more productive, cost efficient and sustainable.

And as well as agricultural kit, where it is the world’s biggest player, Deere makes machines for use in construction, forestry and logging, and even the military, all of which add diversity to its appeal.

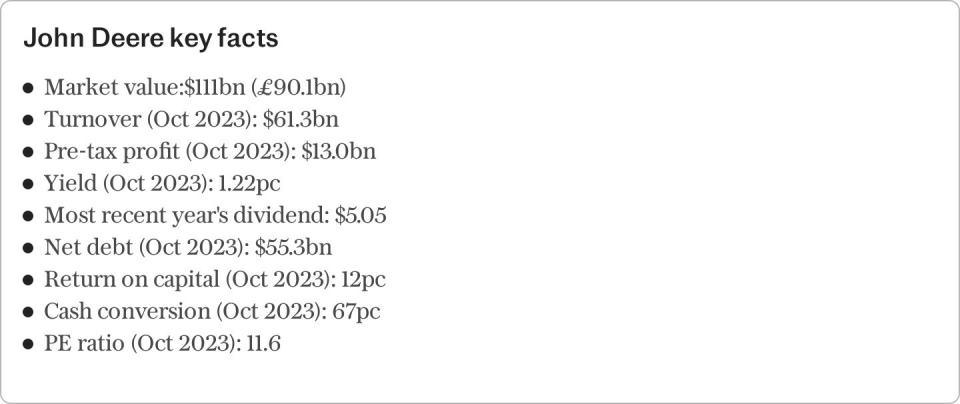

The company’s financial results look pretty user-friendly, too. Sales have grown by just under 40pc over the past three years, while net profits have risen by 70pc in the same period. The shares have been volatile for three years, but they have nevertheless delivered a nearly sevenfold return in sterling terms over the past decade.

Deere’s qualities have attracted the interest of some of the world’s best-performing investors. A dozen of them, each among the top 3pc of the 10,000 equity fund managers tracked by financial publisher Citywire, own shares in New York-listed Deere. As a result, the company has gained an AAA rating from Citywire Elite Companies, which rates companies based on their backing by the world’s best professional investors.

Among them are Paul and Thomas Meehan, who run the Meehan Focus fund. “Deere’s products enjoy intense brand loyalty from their customers, as well as healthy pricing power. The high capital investment and specialised nature of their machinery limit the desire for farmers to switch to a competitor,” they said.

“In addition to its strong competitive position, Deere’s shares are attractively valued, selling at a meaningful discount to their five-year average price-to-earnings ratio and to the overall market.”

The group, which generates around two-thirds of its sales from agriculture, has been riding high for the past two years as farmers bought new equipment again in the wake of a Covid-driven slump in 2020. Its strong position in its markets also helped it push through price rises as inflation began to soar.

However, Deere and its share price have been under pressure since February, when the company reported stronger-than-expected quarterly figures, but briefed investors to expect this year’s net profits to come in between $7.5bn (£6bn) and $7.75bn. This was as much as $500m below its previous guidance and considerably short of last year’s result; it prompted some analysts to argue that spending on agricultural equipment was heading for a downturn.

And this is where the investment case for Deere comes into its own. It is true that it will always be vulnerable to the ups and downs of economic cycles. Deere is moving to counter this by aiming to generate 40pc of its revenues from recurring sources such as software and maintenance contracts by the end of the decade.

Yet it is also true that Deere’s tech wizardry should be instrumental in helping farmers achieve what they need to over the longer term – and that is to grow more food, for more people, on ever decreasing amounts of land. The data-gathering iPads in its cabs are there for precisely that reason.

It is no accident that Deere has agreed a deal with Elon Musk’s SpaceX outfit to beam satellite-based internet services to farmers in remote locations through its Starlink network; trials are set to begin later this year for a partnership that can only help boost crop yields for more farmers.

Top-performing fund managers remain unworried by the near-term decline in Deere’s share price. Daniel Ong, of Avantis Investors, said: “It is common for a company’s stock price to be pushed down significantly after management provides disappointing guidance. These lower prices may present investors with return premiums that can be attractive.”

This column agrees.

Questor says: buy

Ticker: NYSE:DE

Share price at close: $400.32

Miles Costello is a contributing journalist at Citywire Elite Companies

Read the latest Questor column on telegraph.co.uk every Sunday, Monday, Tuesday, Wednesday and Thursday from 8pm.

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance