Questor: This landlord mortgage lender is going cheap

This column has no idea where headline stock indices are going and even less clue where the share price of Nvidia is heading – especially as it had no expectation that it would rise 10-fold from the autumn 2022 lows.

But when Nvidia’s shares finally stumble, as they presumably will (one day), all of the attention will focus on the reasons for the decline and not upon how it reached such a lofty (and ultimately unsustainable) valuation in the first place, wherever the peak happens to be.

When financial market columns are already referring nervously to a 1.5pc daily drop in the Nasdaq as a “rout”, a one-sixth drop in Nvidia prompts much fevered comment (even after such a stunning run), and fans of the company are asking Jensen Huang, its chief executive, to sign their tops and shirts at technology conferences in Taipei, it feels like it is time to take extra care.

This column’s preferred way of taking that care, while seeking to avoid getting involved in the mug’s game that is trying to time the markets, is to buy securities as cheaply as possible, especially if their business model is sound, as reflected in good margins, cash flow and returns on capital employed.

This takes us (back) to a stock that has featured here before, OneSavings Bank (OSB). We took profits on the bank last spring when American banks were toppling and Credit Suisse was falling into the arms of its Swiss rival UBS.

We promptly got lucky, as OSB disgorged a profit warning in July and the share price plunged.

However, that may have been a bit of a one-off, as mortgage customers refinanced earlier than normal and OSB had to book a substantial impairment charge to reflect lower future net income and the impact of that upon the value of its loan book.

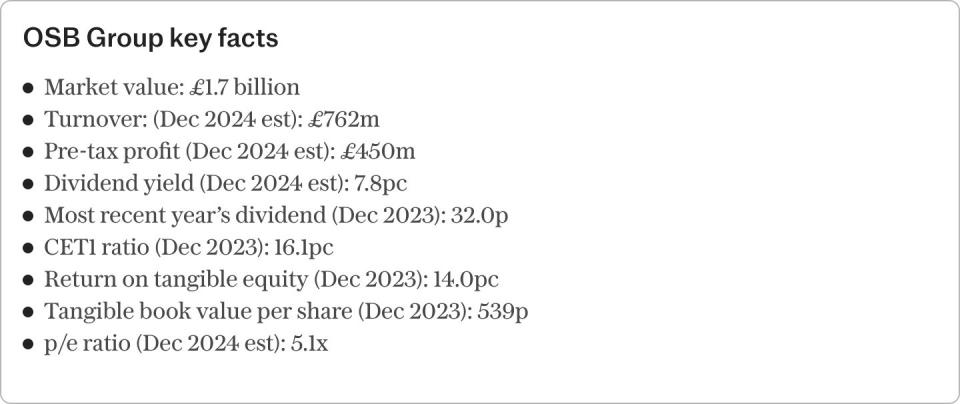

Nothing untoward has happened since at the so-called challenger bank, which owns Kent Reliance, Precise Mortgage and Charter Savings. The specialist buy-to-let, residential and commercial property mortgages provider has continued to grow its loan book and deposit base, keep its cost-to-income ratio pleasingly low, generate good returns on equity and also satisfy regulators with its capital strength.

It is also buying back stock, which makes perfect sense when the shares are trading at a near-20pc discount to book, or net asset value – and it is that lowly rating, coupled with a single-digit price/earnings ratio and 7pc-plus dividend yield that is tempting us to revisit the stock.

As John Bogle, the founder of Vanguard and the brains behind passive investing, noted in The Little Common Sense Book of Investing: “The stock market is a giant distraction from the business of investing – in the long run, investing is about returns earned by businesses, not the stock market.” The returns earned by OSB may just merit more attention that the markets are currently affording it.

Questor says: buy

Ticker: OSB

Share price at close: 431p

Update: Yellow Cake

A pull-back in the spot price for uranium to $86 (£68) per pound from January’s 17-year high north of $100 is weighing on the share price of Yellow Cake, which stores natural uranium ore concentrate in its specialist warehouses in France and Canada. We still have juicy paper profits on this one, and frankly feel no need to shift our positive stance, especially as nuclear power could yet be a solution to the world’s need to secure supplies of energy while managing carbon emissions.

As planned under a long-term deal with Kazatomprom, whereby it can buy $100m of the commodity each year until 2027, Yellow Cake has just taken supply of 1.5 million pounds of natural uranium ore concentrate, to take its total stockpile to 21.7 million pounds.

Adjusting for foreign exchange rates, cash and liabilities, this gives Yellow Cake a net asset value (NAV) per share of around 690p.

The shares stand 15pc below that level. That may catch the eye of some, and even more intriguing is an all-stock bid from Paladin Energy for Canada’s Fission Uranium. The Can$1.30-a-share offer represents a 26pc premium to the prevailing share price and equates to a total value for Fission Uranium of Can$1.1 billion (£635m), or a 108pc premium to the target’s $527m net asset value, a marked contrast to the discount that prevails at Yellow Cake.

Granted, Yellow Cake’s business model is very different to that of Fission Uranium, which is developing its Patterson Lake South project in Saskatchewan towards product in 2029, but the valuation disparity is interesting to say the least.

Questor says: hold

Ticker: YCA

Share price at close: 569.5p

Read the latest Questor column on telegraph.co.uk every Sunday, Monday, Tuesday, Wednesday and Thursday from 8pm

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance