Questor: There’s never a perfect time to invest – this UK fund is a smart buy

There is never a perfect time to invest in the stock market.

Risks are omnipresent and investors who wait for all threats to the stock market’s future performance to disappear will never end up buying any shares.

The latest risk facing UK investors is, of course, political in nature.

Rishi Sunak’s decision to hold a snap general election in July means that investors in UK shares must now contend with a period of uncertainty in the lead up to the result.

They then face the prospect of a new government that implements changes to fiscal policy. And while polls currently suggest otherwise, a hung parliament could equate to an additional period of uncertainty for UK investors.

In Questor’s view, political risk should be viewed in the same way as any other potential threat to the stock market’s performance.

Investors should continue to purchase stocks, but only at prices that compensate them for the risks being taken.

In addition, a long-term view that is accepting of short-term volatility from both known and unknown risks will help an investor to look beyond temporary challenges that are somewhat inevitable.

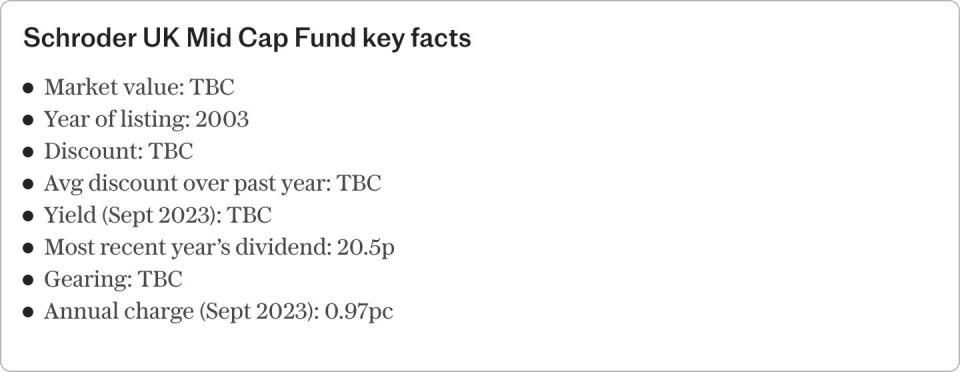

Given that UK stocks, particularly those in the FTSE 250, continue to offer a highly favourable risk/reward opportunity, we are increasing our wealth preserver portfolio holding in the Schroder UK Mid Cap Fund.

The investment trust was only added to the portfolio in February this year and has already produced a 14pc capital gain versus a 8pc rise for the FTSE 250 index. And since Questor first advised readers to buy the company in April 2020, its share price has surged 41pc higher.

Following the trust’s addition to our portfolio just over three months ago, the prospects for the UK economy have dramatically improved.

First-quarter GDP growth of 0.6pc is the strongest reading since the final quarter of 2021, while annual inflation’s decline to just 2.3pc shows that the cost-of-living crisis is now at an end.

This should not only prompt higher consumer spending that acts as a positive catalyst on UK-focused mid-cap shares, but also persuade the Bank of England to become more dovish.

Exactly when the old lady of Threadneedle Street will cut interest rates is, of course, a risk in itself.

In theory, any central bank should seek to cut interest rates before falling inflation reaches its target due to the existence of time lags.

But, as per 2021 when it was somewhat slow to react to the presence of above-target inflation, it would be unsurprising for the Bank of England to cling on to the status quo for a little while longer.

In any case, the continued fall in inflation means interest rate cuts are ahead.

They should stimulate mid-cap stocks to a far greater extent than large-cap shares not only due to the FTSE 250 index’s UK focus, but also because they are perceived to be riskier and are generally more cyclical.

Their rise should boost the Schroder UK Mid Cap Fund’s performance and help to narrow a discount to net asset value that has widened by one percentage point to 11pc since our notional purchase in February.

Typically, falling interest rates encourage savers to invest in risky assets such as shares by making cash less attractive.

Investors are also likely, somewhat counterintuitively, to become less risk averse and more bullish as the stock market rises.

As ever, the trust’s relatively high share price volatility due in part to gearing of 9pc is of little concern to this column.

In fact, debt is welcome given the upbeat long-term prospects for the trust, since it magnifies returns. And with its rise in net asset value outperforming the wider index by 0.7 percentage points per annum over the past decade, the company has a solid track record.

Its list of major holdings, meanwhile, still contains several stocks that this column has previously tipped.

To raise capital for the additional purchase, our holding in TwentyFour Income will be removed from the portfolio. The fund, which invests in asset-backed securities, has produced a 14pc total return since being added in August 2021.

In the short run, the Schroder UK Mid Cap Fund faces a period of uncertainty that could mean its share price volatility is elevated.

But on a long-term view, its wide discount to net asset value, alongside dirt-cheap valuations within the FTSE 250 index, mean further capital growth is ahead.

Questor says: buy

Ticker: SCP

Share price at close: 620p

Read the latest Questor column on telegraph.co.uk every Sunday, Monday, Tuesday, Wednesday and Thursday from 8pm.

Read Questor’s rules of investment before you follow our tips.

Yahoo Finance

Yahoo Finance