Questor: this rare top-quality tech stock without a sky-high share price is worth a look

“So many tech investors get it wrong. They fixate on sales growth and forget that a business that makes no profits is worthless.” So says William de Gale, who insists that any company in his BlueBox Global Technology fund has to make profits.

And not just any old profits either.

“The problem with even some apparently profitable tech firms is that the money they make doesn’t end up in the pockets of outside shareholders. One of the biggest reasons is the options they grant, which can represent an enormous transfer of money from the business to its employees,” de Gale adds.

“Fortunately, there is a way to spot the companies that do reward their actual owners: they are the ones that report decent ‘GAAP’ [generally accepted accounting principles] profits – other measures such as ‘adjusted earnings’ or ‘Ebitda’ can simply disguise how much money ends up in insiders’ pockets.”

De Gale’s rule for inclusion in his fund is simple: he wants firms that grow their GAAP profits each year by a percentage in the high teens. “The US tech index achieves mid-teens, so if I can do this I will outperform,” he says.

“Most of my holdings are not famous names – they are unexciting companies that provide products or services their customers simply must have.” Asked for an example, he does indeed pick a stock previously unknown to this column: Lam Research, which makes specialist equipment used in the manufacture of computer chips.

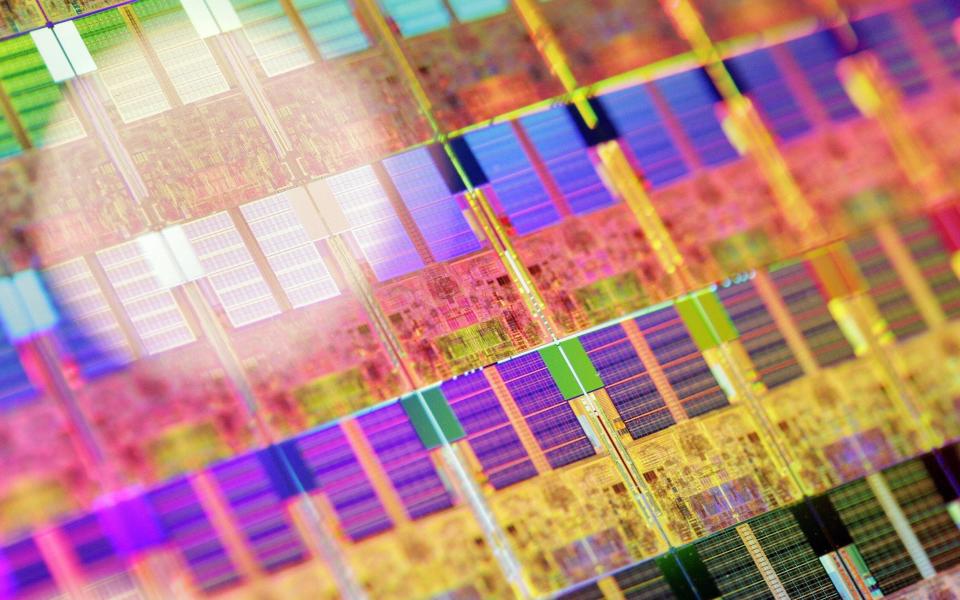

To see what makes it enduringly profitable we need to understand a little about the process of making these chips. “There are many stages and each requires its own extremely precise equipment,” de Gale says.

“The equipment needed for each stage tends to be supplied by just a handful of companies and typically one will have 60pc of the market, the next 30pc and the others a tiny amount each. The one that has 60pc will be enormously profitable, the one that has 30pc will roughly break even when research and development costs are included, and the others will lose money.”

Lam Research is in the 60pc club in several categories of semiconductor “etch and deposition”: putting certain chemicals where they need to go on the chips to enable the “printing” of the right electronic components and removing any excess chemical afterwards. It has a 30pc share of other categories.

Thanks to its high market share in each of these niches the company makes very high returns on capital of 35pc. Questor has often tipped such “quality” companies and one thing they almost always share is a high valuation. But not Lam: its price-to-earnings ratio is about 19, roughly the same as its earnings growth rate, which makes its “Peg” ratio about 1 – a good sign of a cheap stock.

Why is Lam not as expensively valued as other quality stocks? “You can divide the semiconductor market into three: the ‘logic’ devices such as CPUs; memory chips; and ‘analogue’ chips, which are not digital and do not need such advanced, expensive machines to make them,” de Gale says. “Lam has never done much business with Intel, a giant in the ‘logic’ segment, and as a result its business is skewed towards memory makers.

“Now making memory chips is a terrible business – unless you are Samsung, the technological leader, you will make next to no returns. Investors know this but they make the mistake of tarring Lam with the same brush – even though it is a supplier to memory companies, which is completely different.

“To be a supplier to memory makers is a great place to be: making cutting-edge memory chips requires enormous amounts of capital – this is why the makers’ returns are so bad – and that capital goes to the equipment firms such as Lam. And the memory firms have to spend it, or they risk being hopelessly off the pace technologically and out of the game.”

This combination of high quality and low valuation is rare indeed. Buy.

Questor says: buy

Ticker: Nasdaq: LRCX

Share price at 6pm: $708.71

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 5am.

Read Questor’s rules of investment before you follow our tips.

Yahoo Finance

Yahoo Finance