Questor: RIT offers most of the stock market’s thrills but thankfully less of the spills

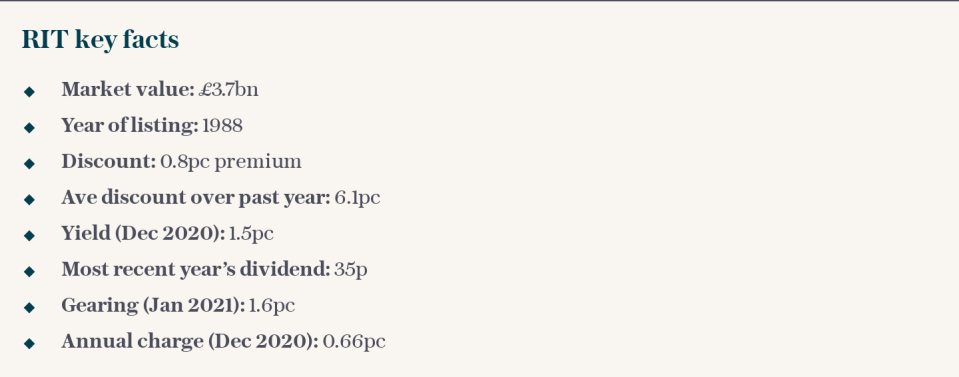

An investment that offers the highs of the stock market without the lows is one that no investor would pass up. Unfortunately no such prospect exists, although it is the aim of RIT Capital Partners, the £3.7bn investment trust founded by Lord Rothschild, to go some way towards it.

RIT claims to have delivered 73pc of the market’s rises since its listing in 1988 but only 38pc of the falls. That sort of record normally comes at a premium and so it has in RIT Capital’s case – until last year.

Shares in the trust have spent the bulk of the past five years trading above the value of its assets. But after they tumbled to a discount last March as stock markets plunged at the onset of the pandemic, they have struggled to regain that rating.

A 28pc fall in the shares at the height of last year’s sell-off appears to have shaken investors’ belief in the wealth preservation credentials of the trust, set up to manage some of the Rothschild family’s wealth.

Yet the fall in the trust’s assets, of 9.5pc over the same period, was creditable against the backdrop of a London stock market that had lost a third of its value and in line with RIT’s claim to shield investors from the worst of market falls.

Sign up to our Business Briefing newsletter for a snapshot of the day's biggest business stories

Read Questor’s rules of investment before you follow our tips

The trust delivers on this pledge by investing in a mix of quoted shares, private companies, hedge funds, property, gold and currencies. It said £10,000 invested when the trust listed in 1988 would have grown to £366,000 by the end of last year, versus £99,000 from global stocks, having grown investors’ money by 11.7pc a year.

Returns have outstripped those of other trusts with similar capital preservation aims, such as Personal Assets and Capital Gearing, although RIT doesn’t offer as much protection as those funds when markets turn south.

Nor is it the sort of trust that, like Ruffer or BH Global, both tipped by this column, is able to rise when stock markets are tumbling. For investors willing to take on a little more risk in the hope of a greater reward, however, RIT Capital has value.

The merits of the trust’s multi-pronged investment approach were highlighted last week by the blockbuster flotation of Coupang, the South Korean ecommerce business.

RIT invested in the firm three years ago and its £38.5m stake then is now worth £440m, according to estimates from Numis, the stockbroker, as the shares surged on their debut on the New York Stock Exchange last Thursday.

That’s a sizeable gain even in the context of a £3.7bn investment trust and has yet to be reflected in its net asset value, published monthly. Last week, the trust announced a NAV per share of £23.16 for the end of February, although it added that Coupang’s surge on flotation would add 195p, or 8.4pc, based on Thursday’s share price.

RIT’s shares have responded in kind: they have risen by 5pc over the past week. Technically, they have now regained the premium they lost last year, although only on the basis of the now-outdated NAV. Factor in that 195p per share from Coupang’s flotation and the shares trade at a 7pc discount.

That’s too cheap, according to analysts at Numis, who rate RIT as a core global trust pick. “We believe this offers an attractive buying opportunity,” they said. “RIT has an exceptional long-term track record through an unconstrained investment approach seeking to deliver long-term capital growth while preserving shareholders’ capital.”

Questor agrees and sees RIT as an ideal replacement for investors who follow this column out of BH Global (see below).

Questor says: buy

Ticker: RCP

Share price at close: £23.35

Update: BH Global

Questor has been waiting for an update from BH Global’s board on an exit plan for shareholders who have balked at the demand from the management company, Brevan Howard, for a doubling of its fees. It arrived on Friday, offering investors an exit at 98pc of NAV should shareholders vote through the demands.

This column advises investors to take the board up on that offer, which has already narrowed the discount. Should the discount near the 2pc mark, as it did earlier this week, shareholders should use that opportunity to sell the shares in the market. Investors are already paying enough for Brevan Howard’s management.

Questor says: sell

Ticker: BHGG

Share price at close: £19

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 5am.

Yahoo Finance

Yahoo Finance