Questor: don't confuse the reliability of CVS's earnings with the safety of its share price

It has been a wild ride since this column first assessed CVS four years ago but the veterinary services group has come good, as its shares have galloped to a fresh record high.

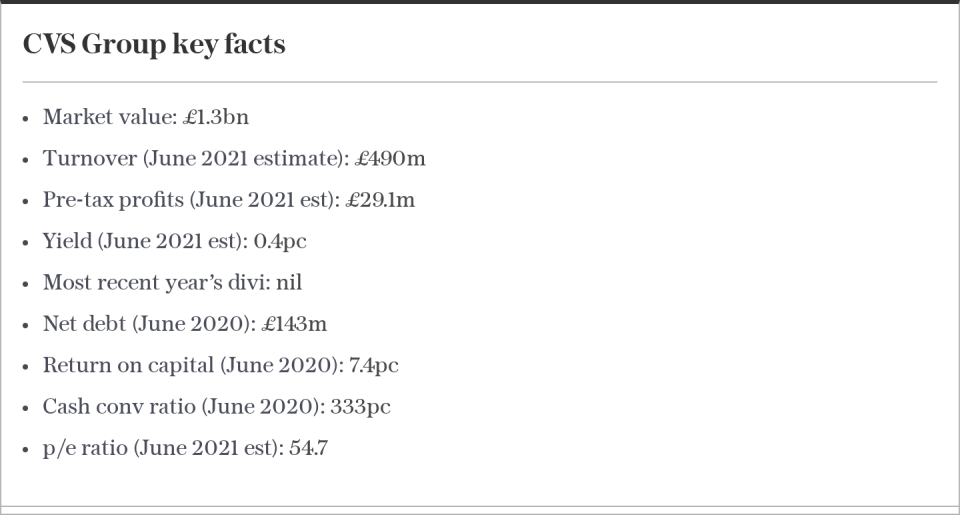

However, a pleasing capital gain of almost 70pc means the shares now trade on more than 50 times consensus earnings forecasts for the current year.

Even allowing for the strength of the business model, the health of the balance sheet and the long-term prospects of the pet care market, such a rating feels lofty and as a result it may be time to book a gain and move on, albeit reluctantly.

CVS’s interim results last month showed that the firm was back on track after the combination of acquisitions, staff shortages and debt got it into a tangle a couple of years ago and forced a sequence of profit warnings.

A £60m share sale in February 2018 helped to straighten out the Aim-quoted concern’s finances, new management came aboard in late 2019 and the pace of purchases slowed so that the company could focus on the day job.

Sign up to our Business Briefing newsletter for a snapshot of the day’s biggest business stories

Read Questor’s rules of investment before you follow our tips

In the six months to December, customer registrations and Healthy Pet Club scheme memberships rose nicely and average spending per customer rose, while the vet vacancy rate came down slightly to an average of 7.5pc. As a result, revenues and profits advanced smartly, the operating margin recovered to 7.5pc and debt came rattling down.

CVS has practices in Britain, Ireland and the Netherlands and those nations’ love affair with their pets, perhaps stronger now than ever after the thick end of a year in lockdown, shows no sign of abating. Spending on the care of companion animals is surely going to remain a priority for loyal owners, whatever the economy does.

All of that forms the basis for a solid investment case but investors must be careful not to mistake reliability of earnings for safety of share price. This column committed such a blunder when it first assessed CVS in a positive way when the shares traded north of £10, only to see them collapse to barely 400p.

Thankfully, we did not lose our nerve but very high multiples of forecast earnings suggest that sentiment has swung from rank pessimism to optimism once more and that leaves much less margin for any unexpected error or disappointment.

CVS is a good company in a good market but the rating now looks very full. Time to move on.

Questor says: sell

Ticker: CVSG

Share price at close: £18.06

Update: AG Barr

This column has had its share of howlers over the past four and a half years, including giving up on Dignity, Xaar and the now delisted Avesoro Resources at precisely the wrong time, and while there have been exceptions – Smiths News, or Connect as it was then, for example – waiting has generally brought its reward. CVS is one example where patience paid off and there is yet time for Scotland’s AG Barr to become another.

Admittedly, last week’s full-year results from the maker of the iconic Irn-Bru fizzy drink fell pretty flat. Quite understandably, in view of the effects of the pandemic and multiple lockdowns, sales fell by 11pc and earnings per share (excluding exceptional items) slid by 16pc as increased home consumption of Irn-Bru, Rubicon and Funkin drinks was not enough to offset the loss of business from pubs, bars and restaurants.

Equally logically, the chief executive, Roger White, was pretty guarded about the near-term outlook. Analysts continue to trim their profit forecasts, especially as AG Barr is still investing in streamlining its business processes, products and brands.

The shares may continue to drift as a result, but the long-term benefits of this investment should more than compensate. AG Barr’s strong cash flow and net cash on the balance sheet mean it can afford to take these steps and for good measure management hopes for a return to the dividend list in the coming year.

It’s worth sticking with the company even if the shares look a bit marooned right now.

Questor says: hold

Ticker: BAG

Share price at close: 495p

Russ Mould is investment director at AJ Bell, the stockbroker

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 5am.

Yahoo Finance

Yahoo Finance