QuidelOrtho's (QDEL) Myocardial Infarction Test Cleared in Canada

QuidelOrtho Corporation QDEL recently announced that its TriageTrue High-Sensitivity Troponin I (hsTnl) Test on the Quidel Triage MeterPro had been approved for use in Canada by Health Canada. Per the company, the innovative test will likely achieve high sensitivity and precision when used with the Quidel Triage MeterPro platform.

However, it is worth mentioning that the Quidel Triage MeterPro is a high-performance, comprehensive testing platform with the currently smallest footprint analyzer, which can aid in the diagnosis of myocardial infarction.

The latest regulatory approval is likely to significantly boost QuidelOrtho’s immunoassay business.

Significance of the Approval

The Quidel TriageTrue hsTnl Test is expected to effectively and safely offer a quick turnaround time with a result within a few minutes for fast decision-making for treatment. The Quidel TriageTrue hsTnl Test, a fluorescence immunoassay that runs on the Quidel Triage MeterPro platform, provides a quantitative determination of troponin I in EDTA anticoagulated whole blood and plasma specimens for use as an aid in the diagnosis of myocardial infarction. Other probable benefits associated with the availability of test results in a few minutes include faster patient disposition and reduced length of stay, among others.

Per management, the new Quidel TriageTrue hsTnl Test will likely enable clinicians to identify the earliest signals for heart attacks, which is the release of troponin as the body’s emergency alert system. This, in turn, is expected to quickly and confidently determine the appropriate treatments. Management feels that since the test is the first high-sensitivity troponin assay on the smallest analyzer platform in Canada, the new assay is expected to reduce the time to diagnosis, besides saving lives and costs for both families and the healthcare system.

Industry Prospects

Per a report by MarketsandMarkets, the global immunoassay market is anticipated to reach $49.6 billion by 2027 from $40.2 billion in 2022 at a CAGR of 4.3%. Factors like the increase in chronic and infectious diseases and the rise in the elderly population are likely to drive the market.

Given the market potential, the latest regulatory approval will likely provide a significant impetus to QuidelOrtho’s business.

Recent Developments

This month, QuidelOrtho announced that its subsidiary, Ortho Clinical Diagnostics Trading (China) Co., Ltd., had inked a definitive agreement with Shanghai Medconn Biotechnology Co., Ltd., a subsidiary of Shanghai Runda Medical Technology Co., Ltd. The joint venture is aimed at developing and manufacturing assays in China for QuidelOrtho’s VITROS platform.

Last month, QuidelOrtho reported its third-quarter 2022 results, wherein it saw a robust overall top-line performance driven by POC and Donor Screening product lines. The company recorded strong revenues in the majority of its geographies at a constant exchange rate, excluding COVID-19 revenues. The continued strength in QuidelOrtho’s comprehensive product portfolio and expanded global commercial footprint also raised optimism about the stock.

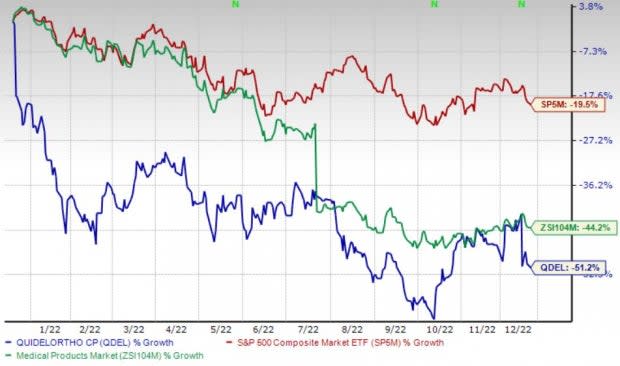

Price Performance

Shares of the company have lost 51.2% in the past year compared with the industry’s 44.2% decline and the S&P 500's 19.5% fall.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Currently, QuidelOrtho carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical space are Exact Sciences Corporation EXAS, ShockWave Medical, Inc. SWAV and Merit Medical Systems, Inc. MMSI.

Exact Sciences, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 27.5%. EXAS’ earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in one, the average beat being 0.6%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Exact Sciences has lost 39.3% compared with the industry’s 24.4% decline in the past year.

ShockWave Medical, carrying a Zacks Rank #2 at present, has an estimated growth rate of 21.2% for 2023. SWAV’s earnings surpassed estimates in all the trailing four quarters, the average beat being 146.1%.

ShockWave Medical has gained 21.5% against the industry’s 28.4% decline over the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 15.7% against the industry’s 11.1% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

QuidelOrtho Corporation (QDEL) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance