QuinStreet Inc (QNST) Reports Mixed Fiscal Q3 2024 Results: Misses Revenue Estimates, Posts ...

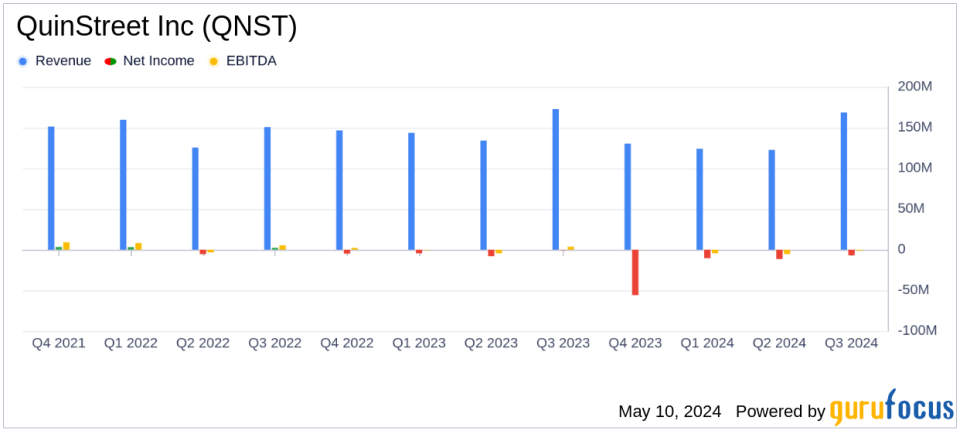

Revenue: Reported at $168.6 million for the fiscal third quarter, falling short of the estimated $187.88 million.

Net Income: Reported a GAAP net loss of $7.0 million, significantly below the estimated net income of $5.48 million.

Earnings Per Share (EPS): Adjusted EPS was $0.06, falling short of the estimated $0.10.

Adjusted EBITDA: Reached $7.9 million, indicating operational profitability despite the net loss.

Cash Position: Ended the quarter with $39.6 million in cash and cash equivalents, maintaining a strong liquidity position with no bank debt.

Future Outlook: Expects revenue between $180 million and $190 million for fiscal Q4, setting a potential quarterly revenue record and projecting significant year-over-year growth.

Auto Insurance Vertical: Noted a significant re-ramp in spending, with strong revenue growth expected to continue in upcoming quarters.

On May 8, 2024, QuinStreet Inc (NASDAQ:QNST), a leader in performance marketplaces and technologies for the financial services and home services industries, released its 8-K filing detailing the fiscal third quarter results ended March 31, 2024. The company reported a revenue of $168.6 million, falling short of the analyst estimates of $187.88 million. However, it achieved an adjusted net income of $3.4 million, or $0.06 per diluted share, aligning with expectations.

Company Overview

QuinStreet Inc focuses on delivering measurable online marketing results to clients in large, information-intensive industries. The company has developed a range of Internet marketing tools and is known for its performance marketing products, including Clicks, Inquiries, Calls, Applications, and Full Customer Acquisitions.

Financial Highlights and Challenges

The reported quarter saw a significant re-ramp in Auto Insurance carrier spending, which contributed to a sequential revenue growth of approximately 40%. Despite this growth, the company experienced a GAAP net loss of $7.0 million, or $0.13 per diluted share, primarily due to increased costs and operating expenses. Adjusted EBITDA stood at $7.9 million, reflecting an improvement from previous quarters.

QuinStreet closed the quarter with $39.6 million in cash and cash equivalents, maintaining a strong balance sheet with no bank debt. This financial stability is crucial as the company anticipates further revenue growth and margin expansion in the upcoming quarters.

Future Outlook

Looking ahead to fiscal Q4, QuinStreet expects record quarterly revenue between $180 million and $190 million, which would represent a year-over-year growth of over 40% at the midpoint. The company also forecasts adjusted EBITDA to be between $10 million and $11 million, indicating a significant increase from the current quarter.

The optimism for fiscal year 2025 is palpable, with expected strong growth and margin expansion starting July 1, 2024. The annual run rate of fiscal Q4 already suggests a growth of 20% or more over the full fiscal year 2024.

Analysis of Financial Statements

The income statement reveals a net loss, primarily driven by higher operating expenses, including significant costs related to product development and general administrative expenses. However, the balance sheet remains robust with a healthy cash position and no significant long-term debt, positioning the company well for future investments and growth.

The cash flow statement showed a positive turn in operations, generating $4.1 million in cash from operating activities, a significant improvement from the previous year. This indicates better management of working capital and operational efficiency.

Investor and Analyst Perspectives

While the revenue miss might concern some investors, the strong guidance for the coming quarters and the strategic focus on expanding high-margin verticals like Auto Insurance may build confidence in the company's growth trajectory. Analysts might focus on the company's ability to sustain its cost management while scaling operations to meet growing demand.

QuinStreet's performance this quarter paints a mixed picture, but its strategic initiatives and robust outlook suggest potential for significant growth and profitability enhancements. As the company continues to execute its strategic plans, it will be crucial to monitor its ability to manage expenses and drive revenue growth across its key business segments.

Explore the complete 8-K earnings release (here) from QuinStreet Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance