RA International Group PLC (LON:RAI) Might Not Be As Mispriced As It Looks

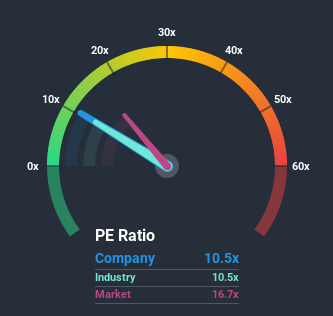

When close to half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 17x, you may consider RA International Group PLC (LON:RAI) as an attractive investment with its 10.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for RA International Group as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for RA International Group

Want the full picture on analyst estimates for the company? Then our free report on RA International Group will help you uncover what's on the horizon.

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like RA International Group's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 19% last year. The strong recent performance means it was also able to grow EPS by 106% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings growth will be highly resilient over the next year growing by 17%. Meanwhile, the broader market is forecast to contract by 3.0%, which would indicate the company is doing very well.

With this information, we find it very odd that RA International Group is trading at a P/E lower than the market. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader market.

What We Can Learn From RA International Group's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that RA International Group currently trades on a much lower than expected P/E its growth forecasts are potentially beating a struggling market. When we see a superior earnings outlook with some actual growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. So, the risk of a price drop looks to be subdued, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for RA International Group (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

You might be able to find a better investment than RA International Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance