Radiation-Hardened Electronics for Space Application Market Analysis Report 2021-2032: Opportunities in the Adoption of New Materials to Manufacture Space Electronics

Radiation-Hardened Electronics for Space Application Market

Dublin, June 15, 2022 (GLOBE NEWSWIRE) -- The "Radiation-Hardened Electronics for Space Application Market - A Global and Regional Analysis: Focus on Platform, Manufacturing Technique, Material Type, Component, and Country - Analysis and Forecast, 2022-2032" report has been added to ResearchAndMarkets.com's offering.

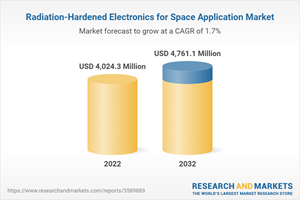

The global radiation-hardened electronics for space applications market is estimated to reach $4,761.1 million in 2032 from $2,348.0 million in 2021, at a growth rate of 1.70% during the forecast period.

The growth in the global radiation-hardened electronics for space applications market is expected to be driven by increasing demand for communication and Earth observation satellites.

Market Lifecycle Stage

Over the past few years, there has been a drastic shift toward adopting small satellites over conventional ones. Moreover, the market has been witnessing a drift in the trend from using small satellites for one-time stints toward their regular use in satellite constellations. With the rapid growth in small satellite constellations for various applications such as Earth observation, remote sensing, and space-based broadband services, the demand for radiation-hardened electronic components has also significantly increased.

Several projects are currently in progress to produce advanced radiation-hardened electronics with enhanced capability to shield space perturbations at low cost, which are expected to increase with the launch of upcoming mega-constellations as well as with the rising interest of companies in satellite components that can sustain in the harsh space environment for longer period of time.

Various radiation-hardened electronics that are currently used are onboard computers, microprocessors and microcontrollers, power sources, memory (solid-state recorder), field-programmable gate array, transmitter, and receiver (antennas), application-specific integrated circuit, and sensors. Space is a huge market with unlimited opportunities, and radiation-hardened components are required across all platforms to function. As a result, the market for radiation-hardened electronics for space applications is well-established.

The increasing number of satellites in low Earth orbit (LEO) with the upcoming mega-constellation has placed a high demand for the production of space-based radiation-hardened components that are capable of withstanding high radiation effects caused due to solar flares.

Furthermore, rising interest among space agencies for long-term missions has resulted in the need for radiation-hardened components that can survive severe environments while also being compressed or miniaturized to support complex missions for significantly longer periods.

Market Segmentation

Platform (Satellite, Launch Vehicle, Deep Space Probe)

Based on platforms, the global radiation-hardened electronics for space applications market in the platform segment is expected to be dominated by the satellite platform.

Manufacturing Technique (Rad-Hard by Design, Rad-Hard by Process, Rad-Hard by Software)

Based on manufacturing techniques, the global radiation-hardened electronics for space applications market is slightly more dominated by the rad-hard by design segment. Rad-hard by design manufacturing technique is expensive to manufacture, but the components provide extremely robust solutions and the highest radiation hardness rating that can be used for extreme space applications such as deep space missions and satellites.

Material Type (Silicon, Gallium Nitride, Silicon Carbide, Others)

The majority of the radiation-hardened components is made out of silicon because it helps in reducing the size and weight and improves the computation performance from medium to high speed.

Component (Onboard Computer, Microprocessor, and Controller, Power Source, Memory (Solid-State Recorder), Field-Programmable Gate Array, Transmitter and Receiver (Antennas), Application-Specific Integrated Circuit, Sensor)

Due to technological advancements, onboard computers, microprocessors, and controllers are expected to be used for new applications requiring increased efficiency, robust, and capable microprocessor technology, resulting in the deployment of highly sophisticated, demanding applications in smaller spaces.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysis of the company's coverage, product portfolio, and market penetration.

The top segment players that lead the market include established players providing radiation-hardened electronics for space applications and constitute 80% of the presence in the market. Other players include start-up entities that account for approximately 20% of the presence in the market.

Recent Developments in Global Radiation-Hardened Electronics for Space Applications Market

In June 2020, GSI Technology partnered with NSF Center for space to build cost-effective radiation-hardened and modular computer systems for space-related efforts, from ground-based high-performance computing data centers to deep space missions.

In March 2021, Mercury systems signed a contract with NASA's Jet Propulsion Laboratory to provide solid-state data recorders for the science mission. The device would be installed in an Earth-imaging spectrometer instrument, which is scheduled to launch in 2022.

In August 2021, STMicroelectronics collaborated with Xilinx, Inc. to build a power solution for Xilinx radiation-tolerant field-programmable gate arrays (FPGA) with QML-V qualified voltage regulator.

In April 2021, Exxelia launched a high-performance space-graded resistor that meets the requirements of weapons platforms, modern electronic warfare, and a wide range of space applications.

Some of the prominent names established in this market are:

3D Plus

Analog Devices, Inc.

Apogee Semiconductor

Cobham Plc

Data Device Corporation

Exxelia

General Dynamics

GSI Technology, Inc.

Infineon Technologies

Mercury Systems, Inc.

Microchip Technology, Inc.

Micropac Industries

Renesas Electronics Corporation

Solid State Devices, Inc.

STMicroelectronics N.V.

Teledyne Technologies

Texas Instruments

Vorago Technologies

Xilinx, Inc.

Other Key Players

ON Semiconductor

TE Connectivity

Key Topics Covered:

1 Markets

1.1 Industry Outlook

1.1.1 Radiation-Hardened Electronics for Space Applications Market: Overview

1.1.1.1 New Space: An Emerging Business Opportunity from LEO-Focused Small Satellites and Deep Space Missions

1.1.2 Comparison of Radiation-Hardened Products Standard Requirements (by End User)

1.1.3 Ongoing Radiation Hardening Efforts in the Space Industry

1.1.3.1 Davinci+

1.1.3.2 Lunar Ice Cubes

1.1.3.3 Psyche

1.1.3.4 Jupiter Icy Moons Explorer (JUICE)

1.1.3.5 Peregrine Mission 1

1.1.4 Current and Futuristic Trends

1.1.4.1 Machine Learning in Space-Graded FPGA

1.1.4.2 Single Board Computer for Space Missions

1.1.4.3 Artificial Intelligence-Based ARM Quad-Core Processor

1.1.4.4 Radiation-Hardened Plastic Package Integrated Circuits

1.1.4.5 Complementary Metal Oxide Semiconductor Image Sensor

1.1.5 Radiation-Hardened Electronics Manufacturers and Certifications

1.1.6 Supply Chain Analysis

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Rising Demand for Radiation-Hardened Electronics Components in the Communication Satellite Segment

1.2.1.2 Technological Advancements in Microprocessors and FPGAs

1.2.2 Business Challenges

1.2.2.1 High-Cost Development and Designing Associated with Radiation-Hardened Electronic Components

1.2.2.2 Impact of Electronics Components Shortage on the Global Space Industry

1.2.3 Business Strategies

1.2.3.1 New Product Launch

1.2.4 Corporate Strategies

1.2.4.1 Partnerships, Collaborations, Agreements, and Contracts

1.2.4.2 Mergers and Acquisitions

1.2.4.3 Others

1.2.5 Business Opportunities

1.2.5.1 Adoption of New Materials to Manufacture Space Electronics

2 Application

2.1 Global Radiation-Hardened Electronics for Space Applications Market - by Platform

2.1.1 Market Overview

2.1.1.1 Demand Analysis of Radiation-Hardened Electronics for Space Applications Market (by Platform)

2.1.2 Satellite

2.1.2.1 Small Satellites (0-500Kg)

2.1.2.2 Medium Satellites (501-1,000Kg)

2.1.2.3 Large Satellites (1,001Kg and Above)

2.1.2.3.1 Demand Analysis of Satellite Market

2.1.3 Launch Vehicle

2.1.3.1 Small and Medium-Lift Launch Vehicle

2.1.3.2 Heavy-Lift Launch Vehicles

2.1.3.2.1 Demand Analysis of Launch Vehicle Market

2.1.4 Deep Space Probe

2.1.4.1 Lander

2.1.4.2 Rover

2.1.4.3 Orbiter

3 Products

3.1 Global Radiation-Hardened Electronics for Space Applications Market - by Manufacturing Technique

3.1.1 Market Overview

3.1.1.1 Demand Analysis of Radiation-Hardened Electronics for Space Applications Market (by Manufacturing Technique)

3.1.2 Rad-Hard by Design

3.1.2.1 Total Ionization Dose

3.1.2.2 Single Event Effect

3.1.3 Rad-Hard by Process

3.1.3.1 Silicon on Insulator

3.1.3.2 Silicon on Sapphire

3.1.4 Rad-Hard by Software

3.2 Global Radiation-Hardened Electronics for Space Applications Market - by Material Type

3.2.1 Market Overview

3.2.1.1 Demand Analysis of Radiation-Hardened Electronics for Space Applications Market (by Material Type)

3.2.2 Silicon

3.2.3 Gallium Nitride

3.2.4 Silicon Carbide

3.2.5 Others

3.3 Global Radiation-Hardened Electronics for Space Applications Market - by Component

3.3.1 Market Overview

3.3.1.1 Demand Analysis of Radiation-Hardened Electronics for Space Applications Market (by Component)

3.3.2 Onboard Computer, Microprocessor, and Controller

3.3.3 Power Source (Power Management Device, Solar Panel, Batteries, Convertors)

3.3.4 Memory (Solid State Recorder)

3.3.5 Field-Programmable Gate Array (FPGA)

3.3.6 Transmitter and Receiver (Antennas)

3.3.7 Application-Specific Integrated Circuit

3.3.8 Sensor

4 Region

4.1 Global Radiation-Hardened Electronics for Space Applications Market (by Region)

5 Market - Market Share Analysis & Company Profiles

5.1 Market Share Analysis

5.2 Company Overview

5.2.1 Role in the Radiation-Hardened Electronics for Space Applications Market

5.2.2 Product Portfolio

5.3 Business Strategies

5.3.1 New Product Launch

6 Growth Opportunities and Recommendations

6.1 Growth Opportunities

6.2 Recommendations

7 Research Methodology

For more information about this report visit https://www.researchandmarkets.com/r/96t8yp

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance