Radius Health (RDUS) to Disappoint Investors in Q4 Earnings?

Radius Health, Inc. RDUS is scheduled to report fourth-quarter 2017 results on Mar 1.

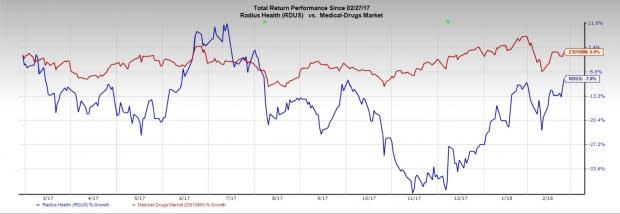

Radius Health’s shares have lost 7.9% over a year compared with the industry’s 0.9 % slip.

Radius Health has a disappointing track record. The company has reported wider-than-expected loss in the trailing four trailing quarters with an average negative earnings surprise of 8.37%.

Let’s see how things are shaping up for this quarter.

Radius Health, Inc. Price and Consensus

Radius Health, Inc. Price and Consensus | Radius Health, Inc. Quote

Factors at Play

Radius Health develops therapeutics for the treatment of osteoporosis, oncology and endocrine diseases.

The company’s lead drug, Tymlos, was approved in the United States in April 2017. The drug was approved for treating postmenopausal women with osteoporosis at high risk for fracture, defined as history of osteoporotic fracture and multiple risk factors for fracture. The drug can also be used for patients who have failed or are intolerant to other available osteoporosis therapies.

The company reported sales of Tymlos (abaloparatide) of $3.5 million in third-quarter 2017.

Hence, we expect investors to focus on the uptake of the drug during the upcoming earnings call.

Although the osteoporosis market in the United States has great potential as approximately 1.4 million postmenopausal women experience osteoporotic fractures each year, Tymlos is expected to face significant competition from Eli Lilly &Co's LLY Forteo and Amgen’s AMGN Prolia.

Meanwhile, the company’s Marketing Authorisation Application for Eladynos (abaloparatide-SC) in Europe for the treatment of postmenopausal women with osteoporosis was under review. However, in December 2017, Radius Health announced that the Committee for Medicinal Products for Human Use (“CHMP”) will issue a third Day-180 List of Outstanding Issues in its regulatory review of abaloparatide-SC. The CHMP informed the company that it will refer the marketing authorisation application to a scientific advisory group for additional advice as part of its ongoing risk-benefit assessment. Hence, the CHMP expects to give an opinion on the same during the first half of 2018. In July 2017, the CHMP provided a second Day-180 List of Outstanding Issues and requested additional data analyses related to the safety and efficacy of abaloparatide-SC for their ongoing regulatory review. The delay in approval in Europe is disappointing given the potential the market holds.

Meanwhile, the FDA granted Fast Track designation to pipeline candidate elacestrant, an experimental selective estrogen receptor down-regulator/degrader for the treatment of women with ER+ and HER2- advanced or metastatic breast cancer. The elacestrant clinical development program is currently ongoing with two phase I studies in patients with ER+, HER2- advanced or metastatic breast cancer who have been heavily pre-treated (median of three prior lines of therapy) and have evaluable disease. In December 2017, Radius Health provided encouraging data from the phase I 005 clinical study of elacestrant (RAD1901) in patients with estrogen receptor positive (ER+) breast cancer at the 2017 San Antonio Breast Cancer Symposium.

Approximately 40 patients were treated at the 400 mg dose in the elacestrant phase I dose escalation and expansion cohorts. Of the enrolled patients, 22 patients met the RECIST measurable disease criteria at baseline and there were six confirmed partial responses in this group. Elacestrant was well tolerated with the most common adverse events being low grade nausea, dyspepsia and vomiting. Consequently, Radius Health plans to initiate a phase II study of elacestrant monotherapy, a potentially pivotal study, for women suffering from advanced or metastatic ER+/HER2- breast cancer early in 2018. Hence, we expect the management to throw light on pipeline progress.

Earnings Whispers

Our proven model does not conclusively show that Radius Health is likely to beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here, as you will see below.

Zacks ESP: Earnings ESP for Radius Health is currently pegged at -1.22%. This is because both the Most Accurate estimate is pegged at a loss of $1.50 while the Zacks Consensus Estimate stands at a loss of $1.48. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Radius Health has a Zacks Rank #3. Although the rank is favorable, the company’s negative ESP makes surprise prediction difficult. Note that we caution against Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stock to Consider

Here is a pharma company that you may consider, as our model shows that it has the right combination of elements to deliver an earnings beat this quarter.

Gemphire Therapeutics GEMP is expected to release fourth-quarter results on Mar 21. The company has an Earnings ESP of +8.01% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Gemphire Therapeutics Inc. (GEMP) : Free Stock Analysis Report

Radius Health, Inc. (RDUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance