Rajesh Exports Leads Trio Of Indian Exchange Stocks Priced Below Estimated Value

The Indian stock market has shown robust growth, climbing 2.0% over the past week and an impressive 46% increase over the past twelve months, with earnings expected to grow by 16% annually. In such a thriving market, identifying stocks priced below their estimated value could present opportunities for investors looking for potential growth at a reasonable price.

Top 10 Undervalued Stocks Based On Cash Flows In India

Name | Current Price | Fair Value (Est) | Discount (Est) |

HEG (NSEI:HEG) | ₹2160.40 | ₹3304.12 | 34.6% |

IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹421.30 | ₹636.71 | 33.8% |

Updater Services (NSEI:UDS) | ₹304.25 | ₹538.38 | 43.5% |

Vedanta (NSEI:VEDL) | ₹456.70 | ₹745.05 | 38.7% |

Rajesh Exports (NSEI:RAJESHEXPO) | ₹315.35 | ₹507.36 | 37.8% |

Strides Pharma Science (NSEI:STAR) | ₹937.75 | ₹1664.05 | 43.6% |

Mahindra Logistics (NSEI:MAHLOG) | ₹525.10 | ₹911.05 | 42.4% |

Delhivery (NSEI:DELHIVERY) | ₹387.85 | ₹747.47 | 48.1% |

PVR INOX (NSEI:PVRINOX) | ₹1449.85 | ₹2544.93 | 43% |

Godrej Properties (NSEI:GODREJPROP) | ₹3313.90 | ₹5719.79 | 42.1% |

Underneath we present a selection of stocks filtered out by our screen.

Rajesh Exports

Overview: Rajesh Exports Limited operates in India, engaging in the refining, manufacturing, wholesale, and retail of gold and diamond jewelry and various gold products, with a market capitalization of approximately ₹93.11 billion.

Operations: The company generates revenue primarily from gold products, totaling approximately ₹28.09 billion.

Estimated Discount To Fair Value: 37.8%

Rajesh Exports, priced at ₹315.35, appears undervalued with a fair value estimate of ₹507.36, suggesting significant underpricing. Despite low return on equity projections (8.2% in three years) and marginal net profit margin improvements (0.1% from 0.4% last year), the company is poised for robust earnings growth at 31.68% annually, outpacing the Indian market's forecasted 15.8%. This financial trajectory coupled with its competitive pricing relative to peers underscores its potential as an undervalued stock based on cash flows.

RITES

Overview: RITES Limited offers consultancy, engineering, and project management services across various sectors including railways, highways, and renewable energy, with a market capitalization of approximately ₹175.34 billion.

Operations: RITES Limited generates revenue through several segments including domestic consultancy at ₹11.94 billion, domestic turnkey construction projects at ₹9.03 billion, domestic leasing at ₹1.38 billion, export sales at ₹1.03 billion, and consultancy abroad at ₹0.95 billion.

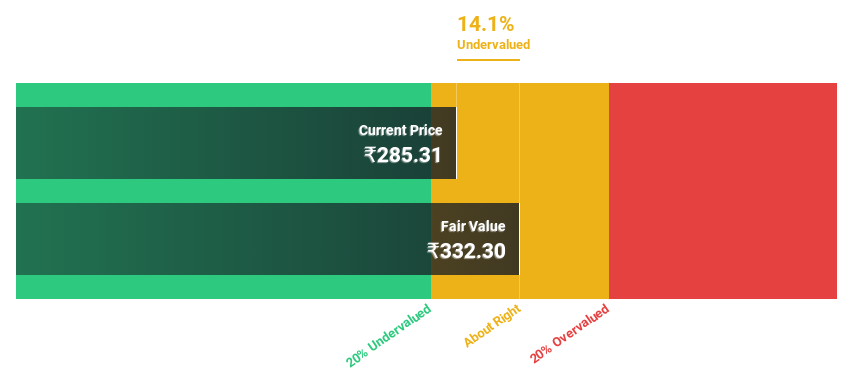

Estimated Discount To Fair Value: 22.1%

RITES, currently priced at ₹729.65, is assessed to be undervalued with a fair value estimate of ₹936.11, reflecting a substantial discount. The company's revenue and earnings are expected to grow annually at 13.4% and 18.54% respectively, outperforming the broader Indian market projections of 9.6% for revenue and 15.8% for earnings growth. However, its dividend coverage is weak as dividends are not well supported by earnings or free cash flows, indicating potential challenges in sustainable payouts despite recent strategic partnerships and contracts enhancing its business scope.

Our earnings growth report unveils the potential for significant increases in RITES' future results.

Click to explore a detailed breakdown of our findings in RITES' balance sheet health report.

Texmaco Rail & Engineering

Overview: Texmaco Rail & Engineering Limited is an engineering and infrastructure company operating both in India and internationally, with a market capitalization of approximately ₹109.72 billion.

Operations: The company generates revenue through three primary segments: the Freight Car Division, which contributes approximately ₹27.50 billion, and two infrastructure segments—Electrical and Rail & Green Energy—bringing in about ₹2.26 billion and ₹5.27 billion, respectively.

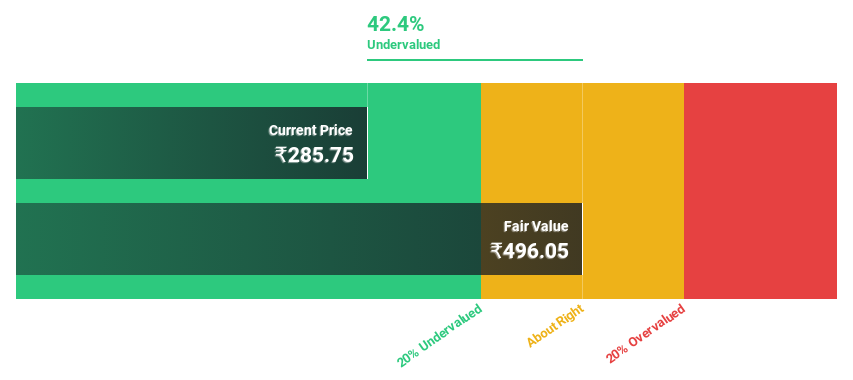

Estimated Discount To Fair Value: 17.1%

Texmaco Rail & Engineering, trading at ₹274.67, is positioned below the estimated fair value of ₹331.36, suggesting a modest undervaluation. The company's earnings have surged by 335% over the past year and are projected to continue growing at 28.9% annually over the next three years, outpacing the Indian market's forecast of 15.8%. However, its share price has been highly volatile recently and shareholder dilution occurred in the past year, posing potential risks for investors considering cash flow-based valuations.

Seize The Opportunity

Discover the full array of 21 Undervalued Indian Stocks Based On Cash Flows right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:RAJESHEXPO NSEI:RITES and NSEI:TEXRAIL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com