Rambus Shares Are Under Heavy Demand

Rambus Shares Attract Big Money

So, what’s Big Money? Said simply, that’s when a stock pushes higher alongside chunky volumes. It’s indicative of institutions betting on the shares.

Smart money managers are always looking for the next up-trending stock. And RMBS has many fundamental qualities that are attractive.

But how the shares have been trading points to strong investor appetite. As I’ll show you, the Big Money has been consistent in the shares.

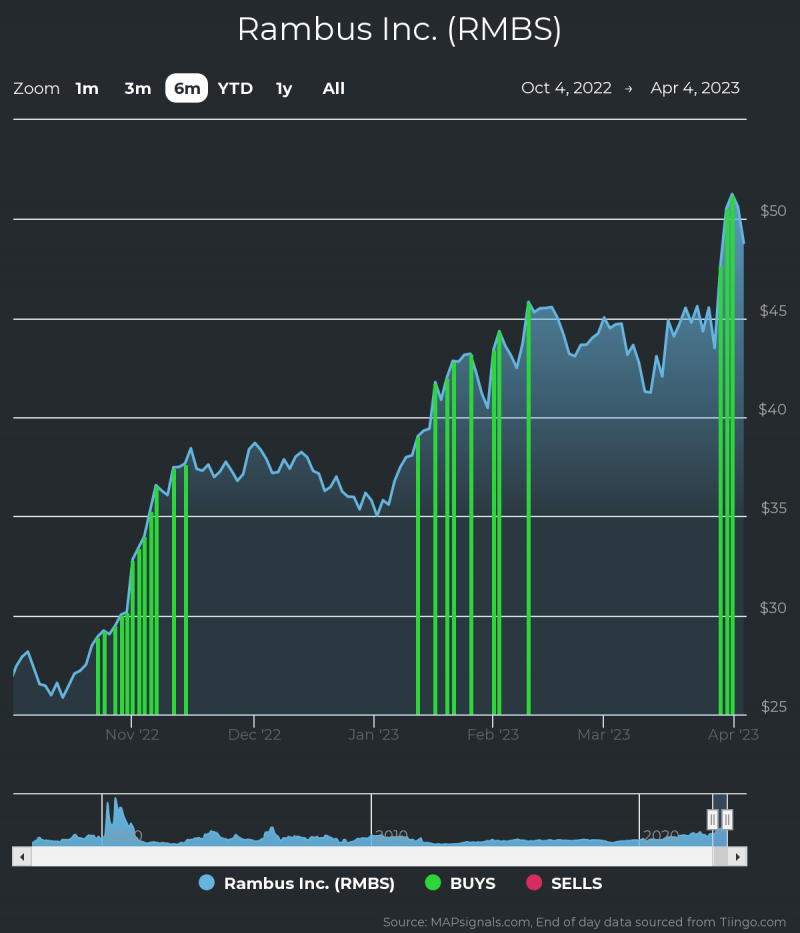

Each green bar signals big trading volumes as the stock ramped in price:

Since October alone the shares attracted 23 unusual inflow signals. Demand for the stock has been high. Those repeated green bars could mean more upside is ahead.

Now, let’s check out the fundamental action grabbing my attention:

Rambus Fundamental Analysis

Next, it’s a good idea to check under the hood. Meaning, I want to make sure the fundamental story is supportive too. As you can see, RMBS grew sales double digits on a 1-year basis. The firm is expected to grow EPS at a healthy clip too. Take a look:

1-year sales growth rate (+38.5%)

1-year estimated EPS growth rate (+15.8%)

Source: FactSet

Marrying strong fundamentals with technically superior stocks is a winning recipe over the long-term.

In fact, RMBS has been a top-rated stock multiple times at my research firm, MAPsignals. That means the stock has buy pressure and healthy fundamentals. We have a ranking process that showcases stocks like this on a weekly basis.

Follow the Big Money.

Rambus Price Prediction

The Rambus rally could have further to go. Healthy buying in the shares is signaling to take notice. Shares could be positioned for further upside.

Disclosure: the author holds no position in RMBS at the time of publication.

Learn more about the MAPsignals process here.

Contact

https://mapsignals.com/contact/

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance