We Ran A Stock Scan For Earnings Growth And Bel Fuse (NASDAQ:BELF.A) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Bel Fuse (NASDAQ:BELF.A). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Bel Fuse

How Fast Is Bel Fuse Growing Its Earnings Per Share?

In the last three years Bel Fuse's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Bel Fuse's EPS skyrocketed from US$4.20 to US$5.79, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 38%.

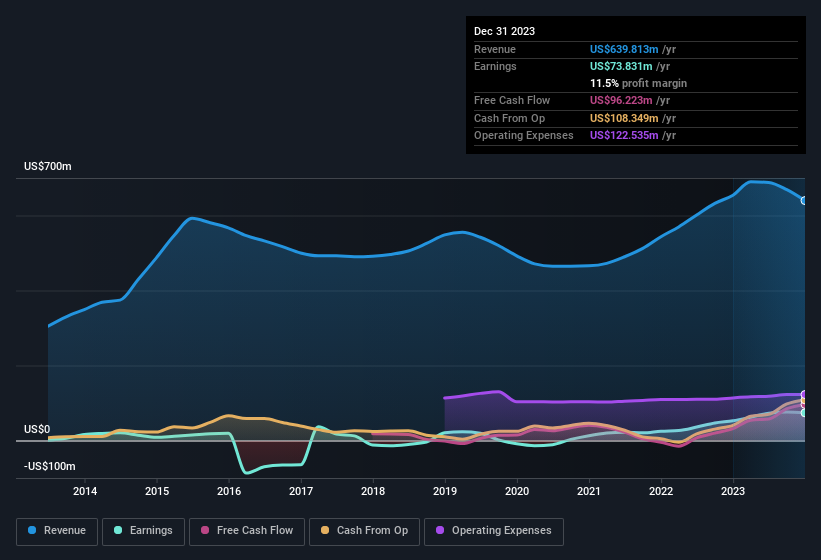

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Unfortunately, Bel Fuse's revenue dropped 2.2% last year, but the silver lining is that EBIT margins improved from 11% to 15%. While not disastrous, these figures could be better.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Bel Fuse's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Bel Fuse Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Bel Fuse shares, in the last year. With that in mind, it's heartening that Farouq Tuweiq, the CFO, Principal Financial Officer & Treasurer of the company, paid US$37k for shares at around US$53.48 each. It seems that at least one insider is prepared to show the market there is potential within Bel Fuse.

Along with the insider buying, another encouraging sign for Bel Fuse is that insiders, as a group, have a considerable shareholding. Holding US$53m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This should keep them focused on creating long term value for shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Daniel Bernstein, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Bel Fuse with market caps between US$400m and US$1.6b is about US$3.3m.

Bel Fuse's CEO took home a total compensation package of US$1.5m in the year prior to December 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Bel Fuse To Your Watchlist?

For growth investors, Bel Fuse's raw rate of earnings growth is a beacon in the night. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. Astute investors will want to keep this stock on watch. Now, you could try to make up your mind on Bel Fuse by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Bel Fuse, you'll probably love this curated collection of companies in the US that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance