Rapid UK house price growth threatens financial stability as hard Brexit looms, warns OECD

Rapid house price growth in countries such as the UK risks triggering a fresh economic downturn if prices fall, according to a top think tank, as it warned that Britain was on course for a hard Brexit.

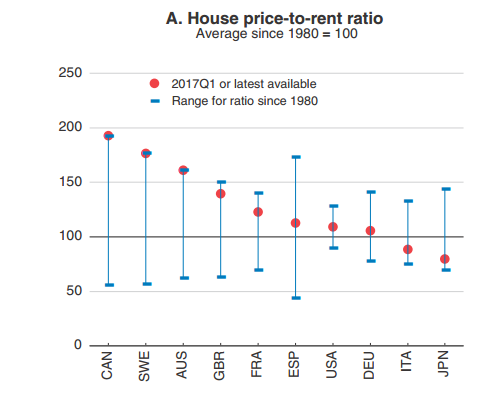

The Organisation for Economic Co-operation and Development (OECD) said "buoyant" house prices in countries such as the UK, Norway, Canada and Sweden "raised concerns about financial stability".

The Paris-based think tank said house prices in these economies were elevated relative to rents, suggesting prices were overvalued.

As past experience has shown, rapid house price gains can be a precursor of an economic downturn

OECD

Recent data suggest the UK property market is cooling. Halifax data on Wednesday showed house price growth was flat ahead of the general election.

The OECD said low interest rates across the advanced world had "led to vulnerabilities associated with rising debt levels" as it warned that there were signs of another housing "bubble" in Ireland.

"As past experience has shown, rapid house price gains can be a precursor of an economic downturn, especially when they occur simultaneously in a large number of economies," the OECD said in its latest global economic outlook.

The think tank said UK policymakers should also be poised to clamp down on lending on credit cards and personal loans if the "vibrant" pace of growth continued.

On the eve of the UK general election, the OECD warned policymakers to take steps to boost investment, build more houses, raise educational standards and foster "lifelong learning" in order to support jobs and growth over the medium term.

The OECD expects the UK economy to expand by 1.6pc in 2017. This is unchanged from its previous forecast in March and slightly below last year's growth rate of 1.8pc.

It said growth was likely to slow to 1pc in 2018 as unemployment creeps up and investment shrinks, which is also unchanged from its previous projection.

The OECD said it continued to assume a hard Brexit in 2019, with the UK falling back on World Trade Organisation trade rules from April of that year.

"The uncertainty, and the assumed outcome, is projected to undermine spending, in particular investment," it said.

It urged policymakers on both sides of the English Channel to focus on striking a quick, comprehensive trade deal that "retains strong trade linkages with the European Union".

It said this would lead to higher growth than currently projected in its forecasts.

Credit growth 'vibrant'

The Bank of England has been monitoring the pace of consumer credit growth in the UK and regulators are currently examining whether lending standards need to be tightened.

The OECD said regulators should consider "taking targeted steps" if credit growth continues to grow rapidly, including calibrating measures launched by the Bank of England last August to stimulate the economy in the wake of the Brexit vote.

It suggested policymakers could phase out consumer loans from the Bank's so-called Term Funding Scheme, which provides funding for commercial banks at close to Bank Rate - or 0.25pc.

This would be similar to the exclusion of household loans from the Funding for Lending Scheme in 2014, the OECD said.

The findings by the Prudential Regulation Authority and Financial Conduct Authority will be published in the coming months.

Life after Brexit

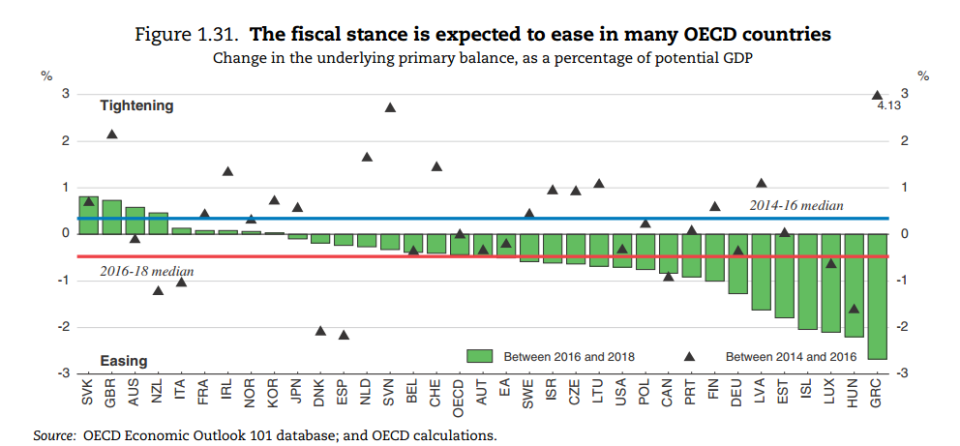

While austerity is expected to ease in many rich nations over the next couple of years, the OECD noted that fiscal tightening in the UK was still projected to be one of the biggest in the OECD club of rich economies.

Slower consumer spending growth was expected to weigh on overall output, even though this would be partially offset by higher exports, the OECD said.

The think tank expects public borrowing to remain broadly unchanged over the next year - at around 2.5pc of gross domestic product (GDP).

The OECD said the UK had the longest maturity of public debt in the OECD, which it said would help policymakers to create "substantial fiscal space".

"Further fiscal initiatives to increase public investment should be considered to support demand in the near term and boost supply in the longer term," the OECD added.

With employment expected to fall next year, the OECD said further increases in the minimum wage should "continue to be adjusted depending on labour market conditions and productivity developments to avoid pricing low-skilled workers out of employment".

Global backdrop brighter - but risks remain

Catherine Mann, the OECD's chief economist, said the outlook for the global economy had "brightened" over the past year, boosting trade, manufacturing and employment.

The global economic outlook is better, but not good enough to sustainably improve citizens’ well-being

Catherine Mann, OECD

The OECD predicts the global economy will expand by 3.5pc this year, up from 3pc in 2016.

However, Ms Mann warned that the "modest" upturn was not yet enough to raise living standards or "reduce persistent inequalities" as she warned that the global economy remained vulnerable to shocks.

The OECD noted that growth per head in the OECD remained 0.5 percentage points weaker than the two decades before the financial crisis.

"In sum, the global economic outlook is better, but not good enough to sustainably improve citizens’ well-being," said Ms Mann.

She added: "The global cyclical upturn is not yet assured; nor are the higher productivity, greater inclusiveness, and non-discriminatory international system that are needed to improve well being for all. Policymakers cannot be complacent."

Yahoo Finance

Yahoo Finance