Rapid7 Inc (RPD) Q1 2024 Earnings: Surpasses Revenue Expectations with Strong Operational ...

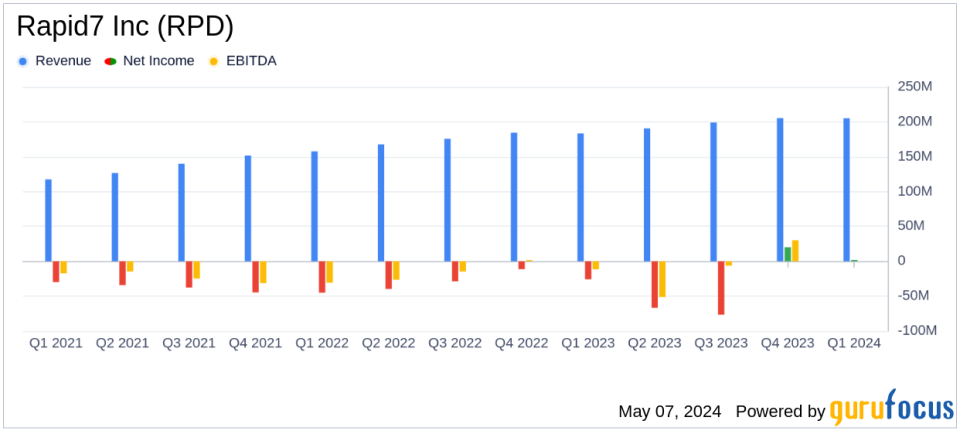

Total Revenue: $205.1 million, up 12% year-over-year, slightly exceeding estimates of $204.03 million.

Net Income: Non-GAAP net income of $39.39 million, not surpassing the estimated $39.88 million.

Earnings Per Share: Non-GAAP diluted EPS of $0.55, exceeding the estimated $0.54.

Free Cash Flow: $27.53 million, demonstrating significant improvement from a negative free cash flow in the previous year.

Annualized Recurring Revenue (ARR): $807 million, marking an 11% increase year-over-year.

Operating Income: Non-GAAP operating income of $40.28 million, a substantial increase from $10.99 million in the previous year.

Customer Growth: Number of customers grew to 11,462, a 4% increase from the previous year.

Rapid7 Inc (NASDAQ:RPD) disclosed its first-quarter financial results on May 7, 2024, revealing a notable increase in revenue and operational efficiency. The company's detailed financial performance can be accessed through its recent 8-K filing. Rapid7, established in 2000 and headquartered in Boston, has evolved from a vulnerability management provider to a comprehensive cybersecurity solutions firm, offering a range of services from threat detection to cloud security.

Quarterly Financial Highlights

Rapid7 reported a total revenue of $205 million for the first quarter of 2024, marking a 12% increase from the previous year and slightly above the analyst's expectation of $204.03 million. The growth was primarily driven by a 13% increase in product subscriptions revenue, which totaled $197 million. The company's Annualized Recurring Revenue (ARR) also saw an 11% year-over-year increase, reaching $807 million.

Despite challenges in transitioning its VM base to the integrated Cloud Risk Complete offering, which impacted ARR expectations, CEO Corey Thomas emphasized the long-term growth potential from this strategic shift. The company's operational income stood at $11 million on a GAAP basis and $40 million non-GAAP, reflecting significant improvements in profitability.

Operational and Cash Flow Analysis

Rapid7's operational efficiency was evident in its improved margins, with GAAP and non-GAAP gross margins reaching 70% and 74%, respectively. The company also demonstrated strong cash generation capabilities, with net cash provided by operating activities at $31 million and free cash flow at $28 million. This financial health supports the company's optimistic free cash flow outlook of at least $160 million for the full year.

Strategic Initiatives and Market Positioning

The company's focus on integrating cloud security and risk management is a strategic response to the evolving cybersecurity landscape. This transition, although gradual, positions Rapid7 to capitalize on the growing demand for comprehensive, consolidated security solutions that address complex risk environments.

Future Financial Outlook

Looking ahead to the second quarter and full year of 2024, Rapid7 anticipates continued revenue growth with projections suggesting a year-over-year increase of 7% to 8%. The company expects full-year revenue to be between $830 million and $836 million, aligning closely with market expectations. Non-GAAP income from operations is forecasted to be between $150 million and $158 million for the year.

Investor and Analyst Perspectives

Investors and analysts might view Rapid7s latest financial results as a strong indicator of the company's robust operational framework and its ability to adapt to market needs. The successful management of operational income and cash flows, in particular, underscores Rapid7's strategic execution capabilities amidst a period of transition.

Rapid7 continues to demonstrate its commitment to innovation and market expansion, reinforcing its position as a key player in the cybersecurity industry. For detailed financial figures and future projections, stakeholders are encouraged to review the full 8-K filing.

For further information and updates, please visit Rapid7's investor relations page or contact their corporate communications for more insights into their strategic initiatives and market performance.

Explore the complete 8-K earnings release (here) from Rapid7 Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance