Risk firm: 'American is most at risk' of coronavirus default among US airlines

The worldwide coronavirus crisis has decimated air travel and endangered the solvency of major air carriers — of which American Airlines (AAL) is the most vulnerable, a new study revealed on Wednesday.

According to a new assessment from risk assessment firm RapidRatings, the largest U.S. airline is most in danger of going bankrupt, even after being thrown a lifeline by the Treasury.

“American is the most at risk and that's it in every way you look at it. American stands out as the weakest of this cohort,” RapidRatings CEO James Gellert told Yahoo Finance.

His firm, which has done similar work for McDonald’s (MCD) and Unilever (UL), looks at whether a company can withstand shocks like the COVID-19 crisis, which has devastated the global economy.

RapidRatings recently conducted comprehensive stress tests on the other major U.S. airlines, including Delta (DAL) United (UAL) and Southwest (LUV), using dozens of variables including debt loads, cash flow analysis and a loss of at least 15% of revenue. Yet over the last three months, the major carriers have sustained much deeper losses, with passenger volumes and revenue plummeting by over 90%.

RapidRatings used the tests to produce a short term financial health rating (FHR) and long term core health score (CHS). The FHR measures a company’s short-term resiliency and default risk while the CHS analyzes risk and company efficiency over a three year period.

A score below 40 places a firm at risk of failing. Gellert said RapidRatings has more than a decade of proven results, “Over 90% of companies that failed have been rated 40 and below on our scales.”

And on that score, the firm found American was the weakest U.S. airline going into the COVID-19 pandemic — and now faces the biggest risk to emerging unscathed. According to RapidRatings data, American had a pre-shock (FHR) of 59 and pre-shock (CHS) of 66.

After the coronavirus shock, both ratings fell below 40 to a post-shock (FHR) 29 and post-shock (CHS) of 27.

Last week Boeing (BA) CEO Dave Calhoun alluded to the industry’s trouble when he told NBC’s Today Show that he expected a major U.S. airline to go out of business, but didn’t identify which one. Gellert speculated that Calhoun was referring to American.

With the carrier fighting to stay airborne, Gellert told Yahoo Finance that “I would be quite certain that is the airline in the crosshairs of the Boeing comment.”

In response to the RapidRatings data, American told Yahoo Finance in a statement that it was “focused on rightsizing the airline for the current environment, and plan to reduce our 2020 operating and capital expenditures by more than $12 billion.”

Up in the air

American, Delta and United each generated more than $40 billion last year in revenue — a large portion of it during the summer travel season which normally kicks off Memorial Day weekend. But with many coronavirus lockdowns in effect and few fliers taking to the skies, this year is all but certain to be different.

“This is where they make their money from May to September and I mean not all of it but a lot of it,” Cowen equity research analyst Helane Becker told Yahoo Finance.

Looking ahead, Becker doesn’t expect airline finances to improve dramatically, even as people start flying again. Cowen expects capacity to stay depressed.

“You can't employ 750,000 people at half capacity flying,” Becker said.

Recently, the airlines have accessed $25 billion dollars — mostly in grants — from the U.S. Treasury which require them to keep paying employees through September 30th without layoffs. The companies have also applied for an additional $25 billion in loans from the Treasury but none, so far, have taken that money. Each airline has until September 30th to determine if they will.

“American's liquidity position is dependent on government aid, bucking the trends we've seen from other airlines. The company is receiving a total of $10.6 billion ... [and] we expect another capital raise” in the 3rd quarter, Becker recently wrote.

Savanthi Syth, an equity analyst at Raymond James, also agrees American will need a lifeline. “I mean, if you look at the cash on hand that's definitely the case,” Syth said.

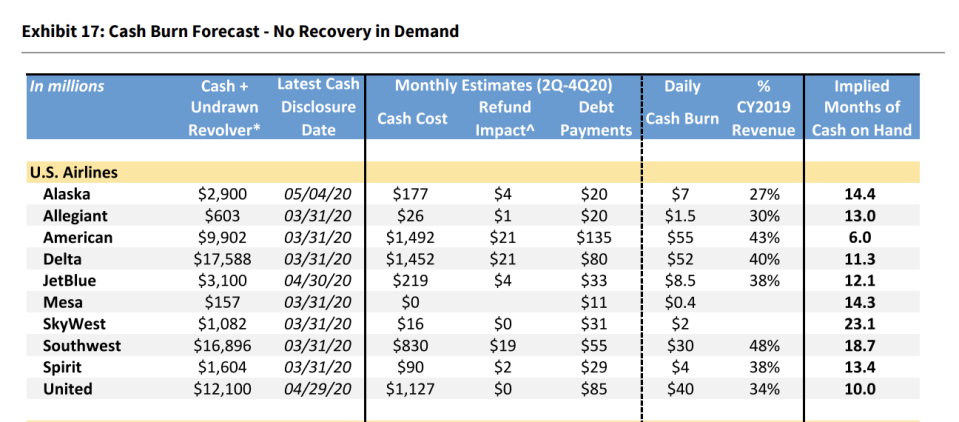

According to Raymond James, American has six months of cash on hand. Meanwhile, United — which sits on 10 months worth, Delta at 12, and Southwest at almost 19 — all have more liquidity to get through the crisis.

“Travel demand, as measured by TSA throughput, continues to improve, albeit still at very depressed levels,” Syth said in a note to clients this week. According to the TSA passenger traffic as of May 15th was off 91% year over year — and that was an improvement form the prior weeks 96% year over year decline.

Southwest and United both recently reported modest increases in domestic bookings and Syth expects American will benefit from a return of domestic flyers. “They have greater domestic exposure than United so I mean, if you look at it last year, 75% of American’s revenue came from the domestic market.”

But at $38.5 billion, American also has the largest debt load of the major carriers, followed by Delta’s $30.7 billion, United’s $25.1 billion and Southwest’s $13 billion. Staying afloat will require American to take on more debt even if passengers start to return, Cowen’s Becker said.

For its part, American said it expects to end Q2 with around $11 billion in liquidity, and insisted it has “significant unencumbered assets – valued at more than $10 billion excluding the AAdvantage program – at our disposal.”

However, it’s not all bad news, according to Becker. She pointed out that low interest rates on American’s debt may help it navigate the crisis, along with a young and fuel-efficient fleet. “In fact, they're in a very good position relative to Delta and United which were just starting their re-fleeting program,” she said.

According to Syth at Raymond James, American will have to grow its way out of trouble and that hinges on passengers returning.

“I don't think bankruptcy is a foregone conclusion,” she said. However, “it's just going to take longer for American to kind of dig themselves out of this kind of debt burden, and therefore equity could be challenged in the near term.”

Adam Shapiro is co-anchor of Yahoo Finance’s On the Move.

Southwest warns that revenue could drop as much as 95% in May

Delta shores up liquidity as coronavirus pummels demand, warns of smaller airline

JetBlue Chairman: 'Everybody's working on survival' as coronavirus decimates airlines

Ted Cruz: 'We are going to see human lives lost' if coronavirus shutdowns last for months

J&J eyes 'imminent' coronavirus vaccine production, aims for a billion doses worldwide

Gary Cohn: Restarting the economy after coronavirus is 'not going to be an overnight big bang'

J&J's Chief Scientific Officer predicts vaccinations against coronavirus within 12 months

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit

Yahoo Finance

Yahoo Finance