Raytheon Technologies' (RTX) Q1 Earnings Beat, Sales Up Y/Y

Raytheon Technologies Corporation’s RTX first-quarter 2023 adjusted earnings per share (EPS) of $1.22 beat the Zacks Consensus Estimate of $1.11 by 9.9%. The bottom line also improved 6% from the year-ago quarter’s adjusted earnings of $1.15 per share.

Including one-time items, the company reported GAAP earnings of 97 cents per share compared with 74 cents recorded in the prior-year quarter.

Operational Performance

Raytheon Technologies’ first-quarter sales of $17,214 million beat the Zacks Consensus Estimate of $16,857 million by 2.1%. The sales figure also rose 9.5% from $15,716 million recorded in the year-ago quarter.

Total costs and expenses increased 6.7% year over year to $15,650 million. The company generated an operating profit of $1,652 million compared with $1,080 million in the prior-year quarter.

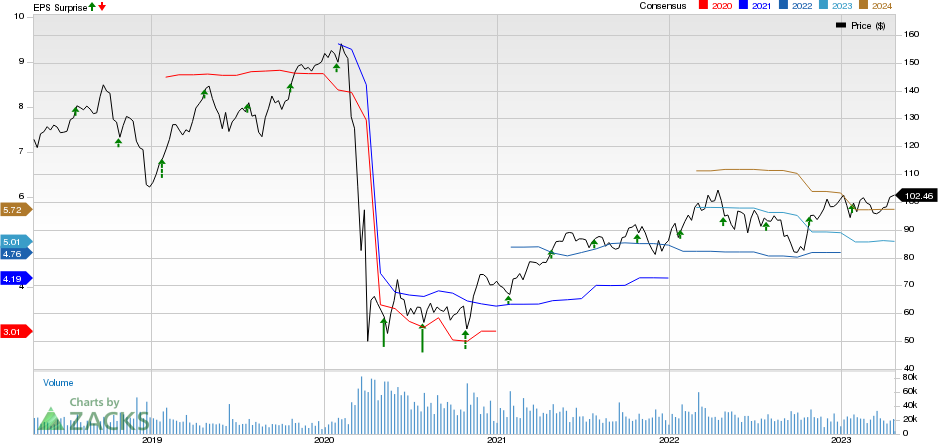

Raytheon Technologies Corporation Price, Consensus and EPS Surprise

Raytheon Technologies Corporation price-consensus-eps-surprise-chart | Raytheon Technologies Corporation Quote

Segmental Performance

Collins Aerospace: Sales at this segment improved 16% year over year to $5,581 million. This improvement can be attributed to higher commercial aftermarket and commercial OEM sales, backed by continued recovery of air traffic. Also, an increase in military sales boosted this segment’s top line.

Its adjusted operating income came in at $800 million, compared with the year-ago quarter’s level of $584 million. This was driven by higher commercial aftermarket volume and a favorable mix.

Pratt & Whitney: This segment’s sales rose 15% year over year to $5,230 million. The improvement was due to growth in the commercial aftermarket and commercial OEM businesses, backed by continued recovery and higher volume across both Large Commercial Engines and Pratt & Whitney Canada. Higher F135 sustainment volume and higher military sales on account of F135 production contract award also boosted the segment’s revenues.

Adjusted operating profit was $434 million compared with the year-ago quarter’s level of $308 million. This was driven by drop through on higher commercial aftermarket sales, a favorable contract matter and higher military sales.

Raytheon Intelligence & Space: This segment recorded first-quarter sales of $3,565 million, almost flat year over year, as lower volumes from Command, Control and Communications programs got offset by higher volumes from Cyber and Services programs.

Its adjusted operating profit was $330 million, which declined 13% on account of lower net program efficiencies.

Raytheon Missiles & Defense: The unit recorded sales of $3,671 million, up 4% year over year. This was driven by higher sales in Advanced Technology and Air Power programs.

The segment recorded an adjusted operating profit of $335 million, down 13% from that reported in the year-ago period.

Financial Update

Raytheon Technologies had cash and cash equivalents of $5,893 million as of Mar 31, 2023, compared with $6,220 million as of Dec 31, 2022.

Long-term debt was $32,717 million as of Mar 31, 2023, up from $30,694 million as of Dec 31, 2022.

Net cash outflow from operating activities amounted to $863 million as of Mar 31, 2023, compared with $476 million at the end of first-quarter 2022.

Its free cash outflow was $1,383 million at the end of first-quarter 2023, against free cash inflow of $37 million at the end of first-quarter 2022.

Guidance

Raytheon Technologies has reiterated its financial guidance for 2023.

The company still projects adjusted EPS in the range of $4.90-$5.05. The Zacks Consensus Estimate for Raytheon’s 2023 EPS, pegged at $5.01, lies above the midpoint of the company’s guided range.

Raytheon Technologies also continues to expect revenues in the range of $72.00-$73.00 million. The Zacks Consensus Estimate for revenues is pegged at $72.20 billion, which lies below the mid-point of the company’s guidance.

RTX still expects to generate free cash flow of $4.8 billion.

Zacks Rank

Raytheon currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Q1 Defense Earnings

Lockheed Martin Corporation LMT reported first-quarter 2023 adjusted earnings of $6.43 per share, which surpassed the Zacks Consensus Estimate of $6.07 by 5.9%. The bottom line, however, came in line with the year-ago quarter’s tally.

Net sales amounted to $15.13 billion in the reported quarter, which surpassed the Zacks Consensus Estimate of $14.87 billion by 1.9%. The top line rose 1.1% from $14.96 billion in the year-ago quarter.

Upcoming Q1 Defense Earnings

Textron Inc. TXT is scheduled to report first-quarter 2023 results on Apr 27, before market open. The Zacks Consensus Estimate for first-quarter revenues is pegged at $3.08 billion, indicating a 2.6% increase from the year-ago quarter’s reported figure.

The same for earnings is pegged at 95 cents per share, indicating an 8% improvement from that reported in the prior-year period.

The Boeing Company BA is set to release first-quarter 2023 results on Apr 26, before the opening bell. The Zacks Consensus Estimate for Boeing’s total revenues stands at $17.36 billion, indicating a 24.1% increase from the year-ago quarter’s reported number.

The bottom-line estimate for BA is pegged at a loss of 98 cents per share, indicating a significant improvement from the year-ago quarter’s loss of $2.75 per share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance