RBA August Rate Hike Remains in Play, Minutes Show

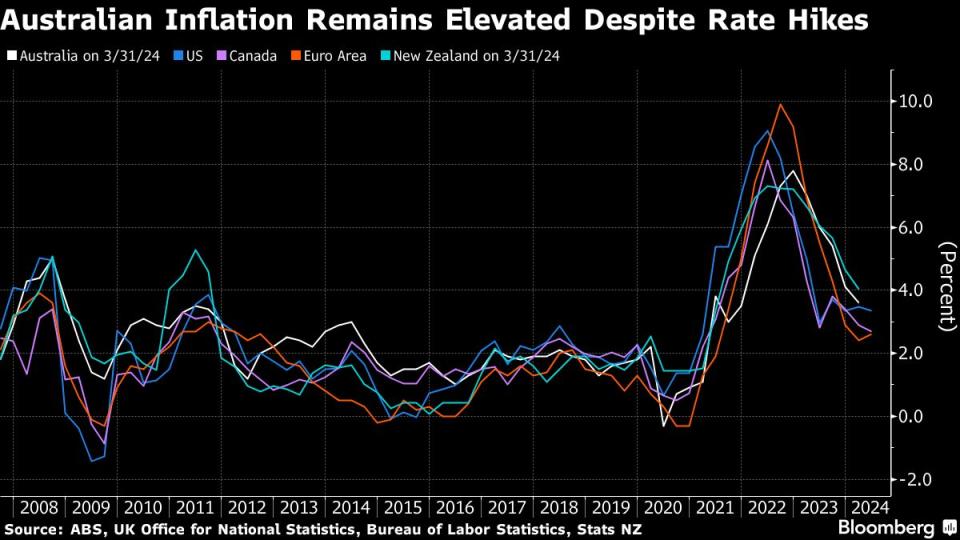

(Bloomberg) -- Australia’s central bank saw the need to remain “vigilant” to upside price risks, even as it left interest rates at a 12-year high last month because recent data hadn’t been sufficient to derail its inflation outlook.

Most Read from Bloomberg

Democrats Weigh Mid-July Vote to Formally Tap Biden as Nominee

Trump Immunity Ruling Means Any Trial Before Election Unlikely

Beryl Becomes Earliest Ever Category 5 Hurricane in Atlantic

‘Upflation’ Is the Latest Retail Trend Driving Up Prices for US Consumers

Minutes of the Reserve Bank’s June 17-18 meeting released Tuesday showed that the board discussed further tightening but decided that the case to leave the key rate at 4.35% was the “stronger one.”

The RBA also reiterated it will do what’s necessary to return inflation to its 2%-3% target and that it was “difficult either to rule in or rule out” future policy moves.

The minutes shine a spotlight into the board’s thinking as fears the RBA could resume tightening policy at its Aug. 5-6 meeting gained momentum after a partial gauge of consumer prices showed inflation accelerated to 4% in May, well above the central bank’s 2-3% target. A detailed quarterly report will be released on July 31.

“The minutes confirm the RBA’s angst around upside risks,” to inflation, said Su-Lin Ong, chief economist at Royal Bank of Canada. She pointed to a new discussion in the minutes about whether monetary policy is ‘sufficiently restrictive.’

Read: RBA’s Hauser Says Bad Mistake to Set Rates on One CPI Figure

“The word ‘sufficient’ is key in our view and will be at the heart of the debate at the August meeting,” she said. “Excess demand in both goods and labor markets suggests policy settings are not restrictive enough and we would argue that the prudent approach would be to hike further in August.”

Financial market pricing implies a 65% chance of a rate hike to 4.6% this year, though a Bloomberg News survey from June 28 to July 1 showed that majority of economists expect the RBA to keep the cash rate steady in August and throughout 2024.

The Australian dollar was a touch weaker at 66.41 U.S cents on Tuesday, staying in a narrow 65.80-67 cents range since early May. Yields on policy sensitive three-year bonds were slightly higher at 4.15%.

Globally, prospects are dwindling for a swift removal of the unprecedented, post-pandemic tightening. Central bankers worried about lingering price pressures are seen adopting a gentler downward trajectory for rates than they did on the way up.

In discussing the case to hike further, RBA board members noted that domestic demand was holding up better-than-expected, according to the minutes. An improvement in global outlook is also likely to support Australia’s export-heavy economy, while recent data did imply “some upside risk” to the RBA’s latest forecasts.

The RBA’s goal to preserve recent labor market gains together with mixed economic data were key reasons why the board left rates unchanged.

Ahead of its August meeting, the RBA will also receive two retail sales reports, employment figures for June and business surveys to help gauge the health of the economy.

Recent data indicated that Australia’s economy is slowing, and even contracting on a per-person basis, while tepid retail sales reflect downbeat consumer sentiment. The RBA expects weakness in household spending to continue this year, noting that there was “clear evidence that many households were experiencing financial stress.”

At the same time, the labor market remains resilient, giving policymakers optimism that they can engineer a soft landing — bringing down inflation while holding onto the enormous job gains of recent years.

“The runway is shortening for our central scenario of a November easing,” said Belinda Allen, senior economist at Commonwealth Bank of Australia. “We too are watching upcoming data.”

--With assistance from Garfield Reynolds.

(Adds economist comment in fourth paragraph, updates market pricing.)

Most Read from Bloomberg Businessweek

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

The FBI’s Star Cooperator May Have Been Running New Scams All Along

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance