RBS' Monzo rival Bó officially launches

Royal Bank of Scotland’s (RBS.L) new consumer-focused digital bank Bó on Wednesday officially launched to the public, going head-to-head with digital challengers like Monzo, Starling, and Revolut.

RBS said Wednesday that the Bó app was now live on both the Apple App Store and Google’s Play store. People can apply for current accounts through the app.

“We are launching Bó to help people build the habits and routines that will allow them do money better day-by-day and week after week so they can fund their lives and lifestyles in a more sustainable way,” Bó chief executive Mark Bailie said in a statement.

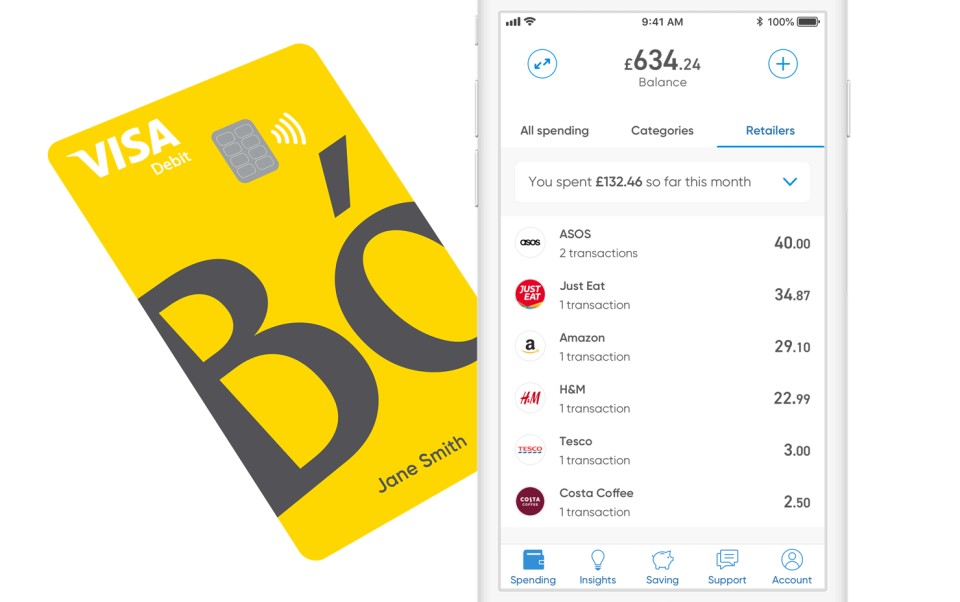

The new Bó app includes many features that will look familiar to users of other challenger banks like Monzo and Starling, such as a timeline of transactions, ‘Piggy Bank’ saving pots, and budgeting tools. The account come with an eye-catching yellow card, keeping with the trend among digital banks to offer unusual cards.

News that RBS was working on Bó first emerged last September. It is one of two digital challenger brands launched by the bank this month, alongside small business-focused bank Mettle. Bó will sit under RBS’ NatWest brand but will have no branches, instead offering all its services through the app.

The new launches are part of a fight-back by major banks against a wave of popular app-only digital challenger banks launched in the last few years.

Figures from the Current Account Switching Service show RBS had a net loss of just over 10,000 customers in the third quarter of 2019, while startups like Monzo and Starling made net gains. Kantar said in September that big banks including RBS had lost £1.6bn in brand value over the last 12 months, with buzzy startup banks to blame.

The Telegraph reported last month that RBS considered buying Monzo in 2017 but decided it would be cheaper to build its own challenger brand instead. Questions may be asked about RBS’ ability to successfully build a tech-only bank. The Bó’s launch comes on the same day that consumer group Which? named RBS as the joint-worst bank for tech outages over the last year.

“As we’re part of NatWest, people can rely on Bó to keep their money safe,” Bailie said. “But as a digital bank, built entirely on a separate cloud-based technology, Bó is also able to harness new technology and develop rapidly in line with our customers’ needs and expectations.”

Read more on the banking app battles:

Yahoo Finance

Yahoo Finance