RBS customers in store for £40m payout over foreign currency rigging

The Royal Bank of Scotland is to pay £40m in compensation to 730,000 customers after it uncovered a group of rogue staff “skimming” cash on foreign money transfers over four years.

Workers on the lender's foreign exchange desk manipulated the rates applied to overseas transactions between 2010 and 2014 - earning Natwest owner RBS tens of millions of pounds in extra profits.

One customer, believed to be a large business, is to receive £70,000 in redress.

The case is the first of its kind and is likely to force other large banks to check their own systems for evidence of similar wrongdoing. A string of lenders including RBS have previously been fined millions of pounds for cheating on currency markets.

The employees responsible changed computer systems, which meant 0.06pc was added to the rate applied to more than 10 million foreign exchange payments.

That put on an extra 60p for every £1,000 sent abroad via bank transfer. Debit and credit card payments were unaffected.

The bank - which is 62pc-owned by taxpayers following a £46bn bailout during the financial crisis a decade ago - uncovered the issue in 2014, but is only now paying compensation because of the scale of the problem.

More than 730,000 customers, mainly individuals but also small businesses using RBS, NatWest and NatWest Markets, will receive an average of £53 each.

A spokesman confirmed the bank made the discovery in the wake of another foreign exchange rigging scandal in which RBS and four other banks received record fines from the City watchdog.

In 2014, RBS was ordered to pay £217m for its traders’ part in collusion with staff at other banks to manipulate “spot” currency rates, ripping off their clients and distorting the broader market.

The bank said customers would have been unaware they had lost out because they received the rates quoted to them, but that these were not set at the level the bank intended.

RBS made the decision to offer payouts itself, without being ordered to do so by regulators.

The employees responsible, who numbered fewer than 10, had all left the company before their actions were discovered.

The group did not profit from the skimmed cash directly, but would have benefited from bonuses to linked the performance of their department.

Affected customers are being written to and will receive a refund for the extra rate they paid, plus 8pc simple interest, paid automatically into their accounts.

Mike Warburton, a Telegraph’s columnist and former director at accountancy Grant Thornton, was handed £122 in compensation.

He said: “My initial reaction to the letter from my bank saying that they had made an error and were sending me a refund was positive.

“They were admitting their mistake and it is welcome news shortly before Christmas. What I did not know, until the Telegraph exposed it, was that this was not a minor computer error but a consequence of a major and sophisticated skimming exercise by the bank’s own employees.

“I regularly make payments in SA Rand to my brother who lives in Cape Town. As an accountant I would expect to notice that something was amiss.

“The key to a scam of this nature, however, is that with the large number of transactions involved it only needed a very small amount to be diverted on each transaction – far too small to be noticed.”

RBS said the Financial Conduct Authority watchdog was alerted at the time, but the staff were not reported to the police as the bank did not believe any crime had been committed.

A spokesman for the bank said: “We are proactively refunding the difference, with interest, for incorrect foreign exchange rates that were applied to some international payments for certain customers between 2010 and 2014.

"We identified and addressed the source of the incorrect exchange rates in 2014, and put in place additional checks and controls to prevent this happening again. We apologise to those customers impacted.”

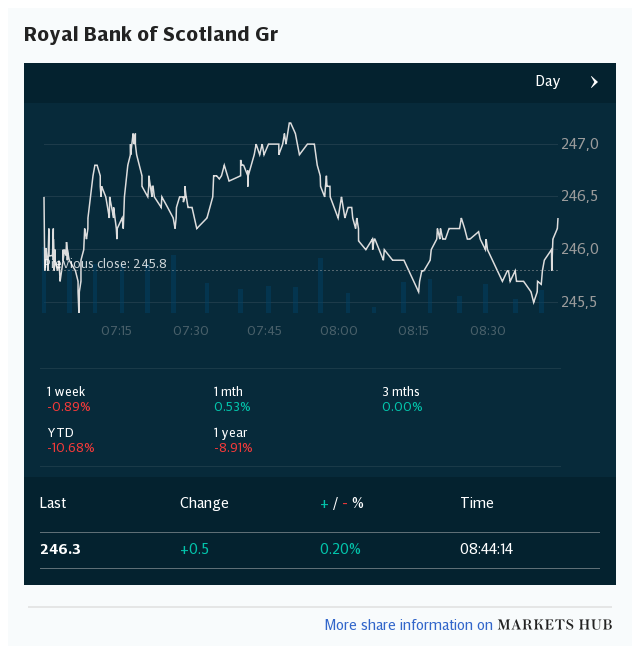

Yahoo Finance

Yahoo Finance