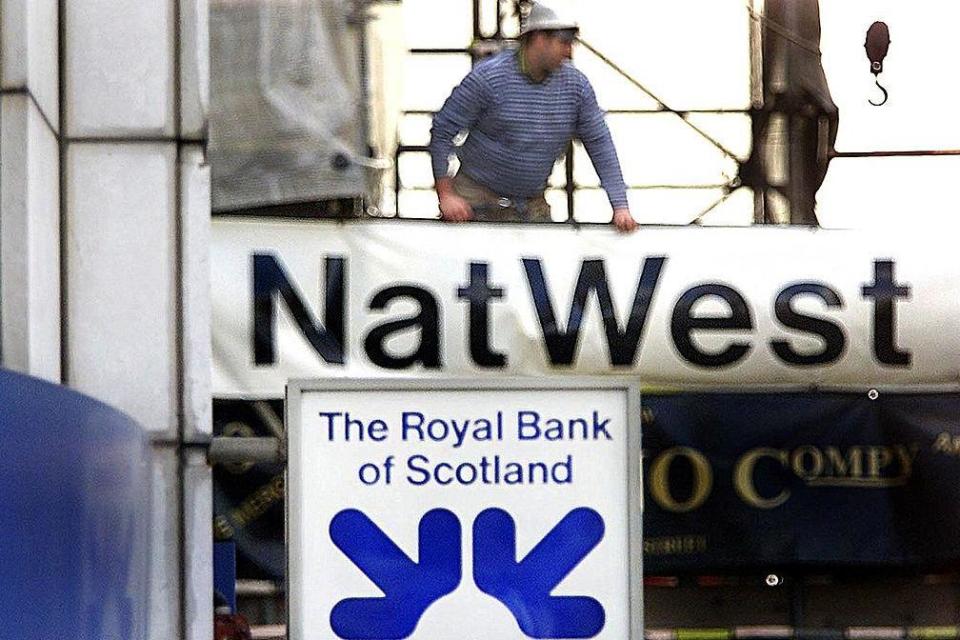

RBS: Royal Bank of Scotland to change name to NatWest in major shake-up

Royal Bank of Scotland is to change its name to NatWest plc in a major shake up, the company has announced.

The Edinburgh-based bank, which owns RBS, NatWest and Ulster Bank, said the move was because 80 per cent of customers bank with the NatWest brand, rather than through RBS branches

The name-change will come into effect later this year and will not impact on customers or staff, the bank said.

In a statement on the lender’s website, CEO Alison Rose said: “Today marks the start of a new era for our bank as we announce our new purpose - to champion potential, helping people, families and businesses to thrive.

“The way people live their lives has changed. And their expectations of companies are changing too; looking for us to deliver not only financial performance but a positive contribution to society; benefitting customers and communities as well as shareholders. The future of this bank depends on us successfully delivering on both.

“I am hugely excited about the opportunities that lie ahead of us.”

She added in a video message: “We’re building a bank that is fit for the future and there to support our customers right the way through their lives.”

It comes as the bank also announced plans to hand over £600 million to the government – which owns 62 per cent of the bank – in dividend payments, as it hit a pretax profit of £4.23 billion last year.

The payment will be made as part of a normal 3p dividend and a special dividend of 5p per share, as bosses said its preferred measure – return on tangible equity – hit 9.4 per cent.

The next step, according to Ms Rose, is to create a “purpose-led” bank, aligning executive pay with a range of targets linked to long-term bonuses.

The targets include creating 50,000 new businesses by 2023, helping to create 500,000 jobs.

RBS added that this would include 75 per cent jobs outside London, 60 per cent women, 20 per cent BAME and 10 per cent“social purpose”.

Bosses also said they want to teach customers how to save and have a “climate positive” operation by 2025, with a halving the climate impact of financing activity.

RBS also wants to ensure 50 per cent of its mortgage book is comprised of properties with an energy efficiency rating of at least C by 2030.

On the decision to change its name, chairman Howard Davies said: “The board has decided that it is the right time to align the parent name with the brand under which the great majority of our business is delivered.”

RBS remains keen to shake off its past, and this is the latest cosmetic change made by bosses to remove the stigma attached to the bank nearly collapsing during the financial crisis.

Eight years ago it also recalibrated the shares to make them look more impressive – jumping from 20p to 200p overnight, although the value of the shares remained the same.

Yahoo Finance

Yahoo Finance