Read This Before Buying Supermarket Income REIT plc (LON:SUPR) For Its Dividend

Dividend paying stocks like Supermarket Income REIT plc (LON:SUPR) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

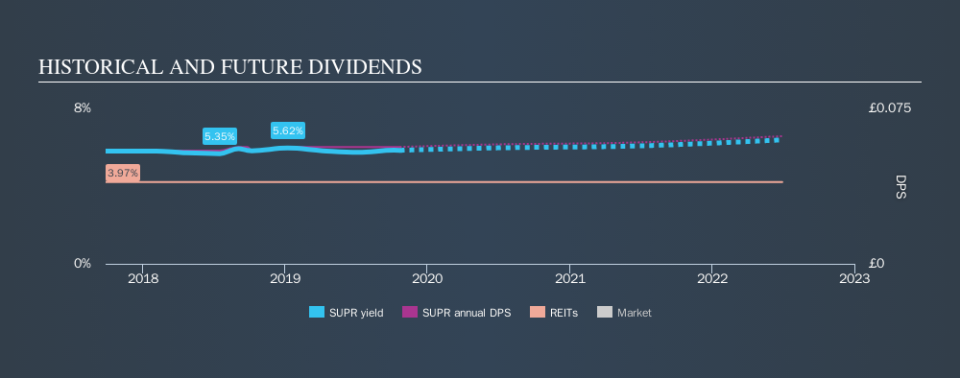

In this case, Supermarket Income REIT pays a decent-sized 5.5% dividend yield, and has been distributing cash to shareholders for the past two years. A high yield probably looks enticing, but investors are likely wondering about the short payment history. Some simple analysis can reduce the risk of holding Supermarket Income REIT for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Supermarket Income REIT!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Supermarket Income REIT paid out 78% of its profit as dividends, over the trailing twelve month period. It's paying out most of its earnings, which limits the amount that can be reinvested in the business. This may indicate limited need for further capital within the business, or highlight a commitment to paying a dividend.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Supermarket Income REIT paid out 78% of its cash flow last year. This may be sustainable but it does not leave much of a buffer for unexpected circumstances. It's positive to see that Supermarket Income REIT's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Supermarket Income REIT is a REIT, which is an investment structure that often has different payout rules compared to other companies. It is not uncommon for REITs to pay out 100% of their earnings each year.

We update our data on Supermarket Income REIT every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. The dividend has not fluctuated much, but with a relatively short payment history, we can't be sure this is sustainable across a full market cycle. During the past two-year period, the first annual payment was UK£0.055 in 2017, compared to UK£0.057 last year. This works out to be a compound annual growth rate (CAGR) of approximately 1.6% a year over that time.

Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Supermarket Income REIT has grown its earnings per share at 63% per annum over the past five years. The company pays out most of its earnings as dividends, although with such rapid EPS growth, its possible the dividend is better covered than it looks. Still, we'd be cautious about extrapolating high growth too far out into the future.

We'd also point out that Supermarket Income REIT issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

To summarise, shareholders should always check that Supermarket Income REIT's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Supermarket Income REIT's is paying out more than half its income as dividends, but at least the dividend is covered by both reported earnings and cashflow. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Supermarket Income REIT out there.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Supermarket Income REIT stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance