Reasons to Add IDACORP (IDA) to Your Portfolio Right Now

IDACORP Inc.’s IDA continuous capital investments are likely to strengthen its infrastructure that would help enhance the performance of the company. Cost-management strategies and the shift to producing electricity from clean sources will boost its performance even further.

Currently, the company carries a Zacks Rank #2 (Buy). Let’s look at the factors that are driving the stock.

Growth Projections

The Zacks Consensus Estimate for IDA’s 2024 and 2025 earnings per share has increased 0.8% and 1.4% in the past 60 days to $5.36 and

$5.75.

Customer Additions

IDACORP’s regulated electric operations in Idaho generate a relatively stable and growing income. The customer base has improved 2.5% year on year. Moody’s is expecting GDP growth in the company’s service area in the next two years, which will likely create more economic improvement in the region and increase the demand for IDACORP’s services, thereby leading to more customer growth.

Surprise History & Dividend Details

IDACORP has a positive earnings surprise history. Its trailing four-quarter earnings surprise is 6.8%, on average.

The company has a dividend yield of 3.63%, which is higher than the Zacks S&P 500 composite’s average of 1.6%.

Liquidity

IDACORP’s current ratio is 1.54, better than the industry average of 0.78. The current ratio, being greater than one indicates the company has enough short-term assets to meet its short-term obligations.

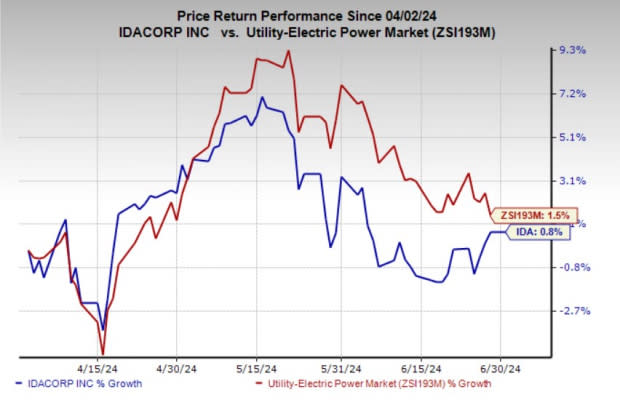

Price Performance

Shares of IDACORP have gained 0.8% in the past three months compared with the industry’s 1.5% growth.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the Zacks Utilities sector are Atmos Energy ATO, California Water Service Group CWT, and PG&E PCG. California Water Service Group currently sports a Zacks Rank #1 (Strong Buy) while Atmos Energy and PG&E hold a Zacks Rank #2. You can see the complete list of Zacks Rank #1 stocks here.

Atmos Energy, California Water Service Group, and PG&E delivered an earnings surprise of 8.8%, 476.2%, and 5.71%, respectively, in the last quarter.

Shares of Atmos Energy, California Water Service Group, and PG&E have returned 1%, -2.2%, and -4.3%, respectively, over the last month.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pacific Gas & Electric Co. (PCG) : Free Stock Analysis Report

IDACORP, Inc. (IDA) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

California Water Service Group (CWT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance