Reasons to Add Northwest Natural (NWN) to Your Portfolio Now

Northwest Natural Holding Company NWN — through its subsidiaries — provides natural gas, water and wastewater services to customers in the United States. NWN purchases natural gas from multiple sources, which protect it against regional supply disruptions and help it take advantage of price differentials.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Growth Projections

The Zacks Consensus Estimate for 2021 and 2022 earnings per share is pegged at $2.58 and $2.68, respectively. The 2021 and 2022 estimates indicate year-over-year growth of 12.2% and 3.8%, respectively. Estimates for 2021 has remained unchanged but the same for 2022 has increased 0.4% in the past 60 days.

The Zacks Consensus Estimate for 2021 and 2022 revenues is pegged at $828.4 million and $857.1 million, indicating year-over-year growth of 7.1% and 3.5%, respectively.

Dividend Yield

Currently, Northwest Natural has a dividend yield of 4.2%, higher than the industry’s 2.99%. NWN has increased its annual dividend rate for 65 consecutive years.

Long-Term EPS Growth & Surprise History

Northwest Natural’s trailing four-quarter earnings surprise is 24.7%, on average. NWN’s long-term (three to five years) earnings growth is currently projected at 5.03%.

Regular Investments & Steady Customer Growth

Northwest Natural makes consistent investments to upgrade and maintain the existing infrastructure as well as expand operations. NWN anticipates investing in the range of $280-$300 million in 2021 and $1-$1.2 billion during the 2021-2025 time period in natural gas operations. These investments will increase the reliability of gas services and enable it to serve an increasing customer base effectively. NWN expects this systematic investment to drive 4-6% rate base growth over the long term.

Northwest Natural has been registering a consistent increase in gas utility customer volumes over the past 14 years. At the end of 2020, NWN’s customer volumes increased 1.5% year over year and it expects to register gas customer growth of more than 1.4% annually over the long term.

Focus on Net Zero

One of the primary objectives of NWN is to attain carbon neutrality by 2050. Northwest Natural plans to achieve this target through extensive usage of renewable sources that do not contribute new carbon to the atmosphere, and partnerships with cleaner electric systems to create seasonal and peak energy storage.

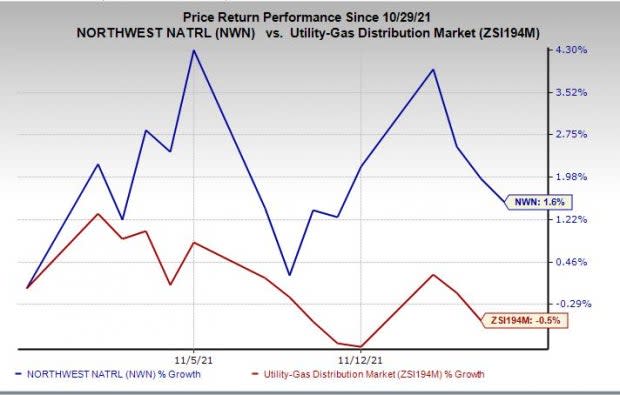

Price Performance

Shares of Northwest Natural have gained 1.6% in the month-to-date period against the industry’s 0.5% decline.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the same sector include MYR Group MYRG, California Water Service Group CWT and Chesapeake Utilities Corporation CPK, each currently holding a Zacks Rank #2.

MYR Group, California Water Service Group, and Chesapeake Utilities delivered an average earnings surprise of 41.1%, 10.8%, and 12.6%, respectively.

The Zacks Consensus Estimate for 2021 earnings for MYR Group, California Water Service Group, and Chesapeake Utilities has moved up 9.2%, 7.6%, and 3.5%, respectively, in the past 60 days.

MYR Group, California Water Service Group, and Chesapeake Utilities shares have returned 40.9%, 17.3%, and 11.3%, respectively, in the past six months compared with the sector’s decline of 2.1%

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chesapeake Utilities Corporation (CPK) : Free Stock Analysis Report

MYR Group, Inc. (MYRG) : Free Stock Analysis Report

Northwest Natural Gas Company (NWN) : Free Stock Analysis Report

California Water Service Group (CWT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance