Reasons to Hold Broadridge (BR) Stock in Your Portfolio

Broadridge Financial Solutions, Inc. BR has an impressive Growth Score of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth. The company’s revenues for fiscal 2023 and 2024 are expected to improve 9.4% and 8.7%, respectively, year over year.

Factors Favoring BR

Broadridge’s business is currently benefiting from positive trends such as strong growth in equity and fund records, transformation and digitization of the financial services industry, governance innovation through multiple product launches and an increase in omnichannel customer communication wins.

The company’s recurring fee revenues have witnessed a CAGR of 7.5% in five years (2018-2022) and constitute the bulk of its top line. The company currently has a large recurring revenue backlog of around $440 million, which provides good visibility on its organic revenues in the near to mid-term.

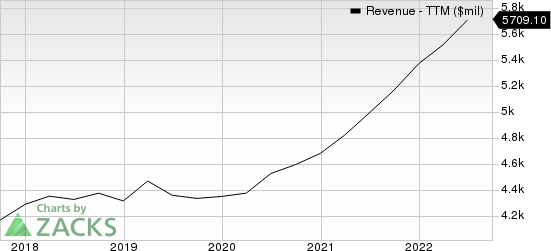

Broadridge Financial Solutions, Inc. Revenue (TTM)

Broadridge Financial Solutions, Inc. revenue-ttm | Broadridge Financial Solutions, Inc. Quote

The company’s Global Technology and Operations business looks well poised to be driven by the Itiviti acquisition. Itiviti is an effective strategic fit for Broadridge’s capital market franchise and contributes significantly to the company’s international revenue growth.

The company’s capital market business is likely to grow as markets continue to globalize and regulatory changes continue to occur. The wealth and investment management business is benefiting from increased scrutiny of money movements. Furthermore, the growing demand for transparency in corporate governance should drive the governance business.

Some Risks

Broadridge's current ratio at the end of the June quarter was 1.01, lower than the 1.27 reported at the end of the prior quarter. A decline in the current ratio is not desirable as it indicates that the company may have problems meeting its short-term obligations.

Zacks Rank and Stocks to Consider

Broadridge currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Avis Budget Group, Inc. CAR, Automatic Data Processing, Inc. ADP and CRA International, Inc. CRAI.

Avis Budget sports a Zacks Rank #1 (Strong Buy), at present. CAR has an earnings growth rate of 109.1% for 2022. You can see the complete list of today’s Zacks #1 Rank stocks here.

Avis Budget delivered a trailing four-quarter earnings surprise of 69.5%, on average.

Automatic Data Processing currently carries a Zacks Rank #2 (Buy). ADP has a long-term earnings growth expectation of 12%.

ADP delivered a trailing four-quarter earnings surprise of 5%, on average.

CRA International carries a Zacks Rank of 2, currently. CRAI has a long-term earnings growth expectation of 14.3%.

CRAI delivered a trailing four-quarter earnings surprise of 26%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Charles River Associates (CRAI) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance