Reasons to Hold on to Inari Medical (NARI) Stock For Now

Inari Medical, Inc. NARI is well poised for growth in the coming quarters, backed by its focus on understanding the venous system. A solid performance in the second quarter of 2021 and its commitment toward patient care also buoy optimism on the stock. However, dependency on broad adoption of products and limited commercial sales expertise are major downsides.

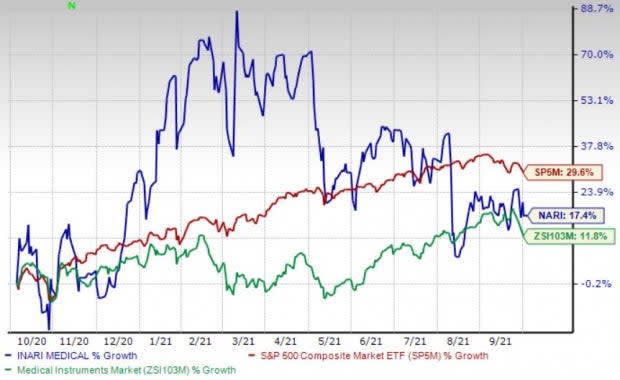

Over the past year, this Zacks Rank #3 (Hold) stock has gained 17.4% compared with 11.8% growth of the industry and 29.6% rise of the S&P 500.

The renowned commercial-stage medical device company has a market capitalization of $3.93 billion. The company projects 51.5% growth for 2022 and expects to witness continued improvements in its business. Inari Medical’s earnings surpassed the Zacks Consensus Estimates in three of the trailing four quarters and missed the same in one, delivering an earnings surprise of 281.95%, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Focus on Understanding the Venous System: Inari Medical is spearheading the creation and commercialization of devices that are purposefully built keeping in the mind the specific characteristics of the venous system, thus raising our optimism. Inari Medical’s commitment toward understanding the venous system and its in-depth knowledge of its target market has allowed the company to figure out the unmet needs of its patients and physicians. This, in turn, has enabled the company to quickly innovate and improve its products while informing its clinical and educational programs. On its second-quarter 2021 earnings call, management informed that the company continues to make noteworthy progress in its FLAME and FLASH registries.

Commitment Toward Patient Care: We are upbeat about Inari Medical’s primary objective to cater to their venous thromboembolism (“VTE”) patients (under-treated, and mostly ignored and not properly understood by industry participants) and enhance their quality of life. Per the company, removal of the clot can have a huge impact on the lives of VTE patients over both the short and long term. It is the company’s responsibility to make sure that most of its patients are treated safely, effectively and seamlessly. The company has deployed hiring and recruiting systems to carefully select professionals whose beliefs and goals align with its. Inari Medical continues to pursue its main purpose with a team of people who are committed both to a cause and to each other.

Strong Q2 Results: Inari Medical’s better-than-expected revenues in second-quarter 2021 instill confidence on the stock. In the second quarter, the company treated a record number of patients, which boosted quarterly revenues, thereby significantly expanding its commercial footprint. Inari Medical announced the FDA clearance of FlowSaver during its second-quarter earnings call, which will aid in bloodless thrombectomy by utilizing Triever Catheters. The company presented interim results of the CLOUT DVT registry at New Cardiovascular Horizons, which confirmed best-in-class safety, clot removal and clinical results with respect to patients treated with ClotTriever. The expansion of gross margin bodes well. A raised revenue outlook for 2021 is encouraging.

Downsides

Dependency on Broad Adoption of Products: A majority of Inari Medical’s product sales and revenues have come from a limited number of hospitals, to date. The company’s future growth and profitability mainly depend on its capability to boost physician and patient awareness of its products, and how keen physicians and hospitals are to adopt its products and perform catheter-based thrombectomy procedures for the treatment of VTE.

Limited Commercial Sales Expertise: Inari Medical started to commercialize its products in the United States in 2017 and hence does not have a long trajectory of being operational as a commercial company. Limited physician awareness and experience with the company’s products — ClotTriever and FlowTriever — have resulted in restricted product and brand recognition within the medical industry for the treatment of VTE.

Estimate Trend

Inari Medical has been witnessing a downward estimate revision trend for 2021. Over the past 90 days, the Zacks Consensus Estimate for its earnings per share has moved 15.4% south to 33 cents.

The Zacks Consensus Estimate for third-quarter 2021 revenues is pegged at $62.2 million, suggesting a 60.5% rise from the year-ago reported number.

Key Picks

Some better-ranked stocks from the broader medical space are Henry Schein, Inc. HSIC, Omnicell, Inc. OMCL and West Pharmaceutical Services, Inc. WST.

Henry Schein’s long-term earnings growth rate is estimated at 13.9%. The company presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Omnicell’s long-term earnings growth rate is estimated at 16%. It currently has a Zacks Rank #2.

West Pharmaceutical’s long-term earnings growth rate is estimated at 27.3%. It currently carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicell, Inc. (OMCL) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Inari Medical, Inc. (NARI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance