Reasons to Retain AmerisourceBergen (ABC) in Your Portfolio

AmerisourceBergen Corporation ABC is well-poised for growth on the back of its robust U.S. Healthcare Solutions business and product launches. Intense competition though remains a concern.

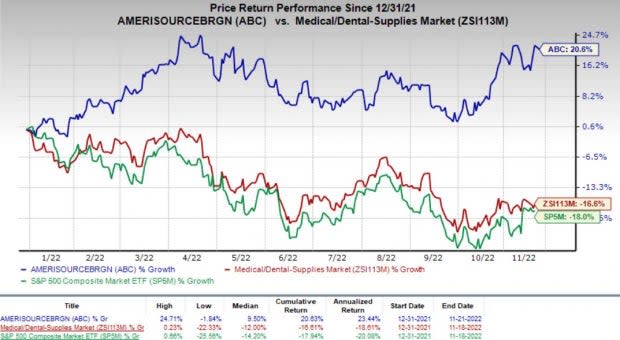

Shares of this currently Zacks Rank #3 (Hold) player have gained 20.6% against the industry’s decline of 16.6% so far this year. The S&P 500 Index has fallen 18% in the same time frame.

With a market capitalization of $33.32 billion, AmerisourceBergen is one of the world’s largest pharmaceutical services companies, focused on providing drug distribution and related services to reduce healthcare costs and improve patient outcomes. ABC’s earnings are anticipated to improve 8.2% over the next five years. It beat on earnings in three of the trailing four quarters and missed the mark once, the average surprise being 2.51%.

Image Source: Zacks Investment Research

What’s Driving Growth?

It is worth mentioning that AmerisourceBergen made a strategic evaluation of its reporting structure to represent its expanded international presence following the June 2021 buyout of Alliance Healthcare. As a result, starting the first quarter of fiscal 2022, ABC realigned its reporting structure under two reportable segments, namely U.S. Healthcare Solutions and International Healthcare Solutions.

Per the segment realignment, U.S. Healthcare Solutions consists of the legacy Pharmaceutical Distribution Services reportable segment (excluding Proforma), MWI Animal Health, Xcenda, Lash Group and ICS 3PL. The segment benefits from increasing volume and an expanding customer base. Strong organic growth rates in the U.S. pharmaceutical market, improving patient access to medical care, enhanced economic conditions and population demographics are likely to favor the segment in the coming quarters.

In fourth-quarter fiscal 2022, revenues at this segment totaled $54.8 billion, reflecting a rise of 4.7% on a year-over-year basis on the back of higher specialty product sales and overall market growth. However, lower revenues from commercial COVID-19 treatments partially offset this upside. Segmental operating income was $578.4 million, up 14% year over year. Higher gross profit (which included fees earned from the distribution of government-owned COVID-19 treatments and a gross profit on sales from specialty physician practices) contributed to the upside.

In September, AmerisourceBergen signed a definitive agreement to acquire Germany-based PharmaLex Holding GmbH for €1.28 billion ($1.3 billion) in cash. PharmaLex is a leading provider of specialized services for the life sciences industry owned by funds advised by AUCTUS Capital Partners AG. It has a global reach, with a significant footprint in Europe and the United States and a growing presence in other parts of the world. The acquisition of this Germany-based company will enhance ABC’s global portfolio of solutions to support manufacturer partners across the pharmaceutical development and commercialization journey.

In January, ABC collaborated with TrakCel, the leading innovator of cellular orchestration solutions, to launch an integrated technology platform for accelerating patient access to prescribed cell and gene therapies and providing complete visibility throughout the treatment process.

The acquisition of Alliance Healthcare strongly drove AmerisourceBergen’s international segment revenues in fiscal 2022.

Adjusted EPS is estimated to be $11.30-$11.60 for fiscal 2023, reflecting 2-5% growth from the fiscal 2022-level. ABC estimates revenue growth of 5-7% for fiscal 2023.

What’s Hurting the Stock?

AmerisourceBergen operates in a highly competitive pharmaceutical distribution and related healthcare services market. The generic industry is facing consolidation of customers and manufacturers, globalization and regulatory challenges. ABC encounters additional competition from manufacturers, chain drugstores, specialty distributors, and packaging and healthcare technology companies. Increased competition will affect its business.

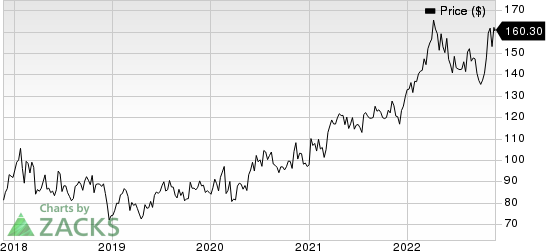

AmerisourceBergen Corporation Price

AmerisourceBergen Corporation price | AmerisourceBergen Corporation Quote

Estimate Trend

AmerisourceBergen has been witnessing an upward estimate revision trend for fiscal 2023. In the past 60 days, the Zacks Consensus Estimate for earnings has moved north to $11.50 from $11.48.

The Zacks Consensus Estimate for first-quarter fiscal 2023 revenues is pegged at $61.44 billion, suggesting growth of 3% from the year-ago fiscal quarter’s reported number.

Stocks to Consider

Some better-ranked stocks in the broader medical space are AMN Healthcare Services AMN, McKesson MCK and Lantheus LNTH, all currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for AMN Healthcare Services have improved from earnings of $11.26 to $11.43 for 2022 and $8.30 to $8.39 for 2023 in the past 60 days. The AMN stock has dipped 1.2% so far this year.

AMN Healthcare Services delivered an earnings surprise of 10.96%, on average, in the last four quarters.

McKesson’s earnings per share estimates increased from $24.42 to $24.76 for fiscal 2023 and $26.04 to $26.34 for fiscal 2024 in the past 60 days. MCK has gained 48.4% so far this year.

McKesson delivered an earnings surprise of 4.79%, on average, in the last four quarters.

Estimates for Lantheus’ earningsper share increased from $3.57 to $3.82 for 2022 and $4.01 to $4.21 for 2023 in the past 60 days. LNTH has gained 98.7% so far this year.

Lantheus has an earnings yield of 6.6% against a negative yield for the industry.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance