Reasons to Retain TransUnion (TRU) Stock in Your Portfolio

TransUnion TRU is currently benefiting from a strong sales performance and ongoing innovations.

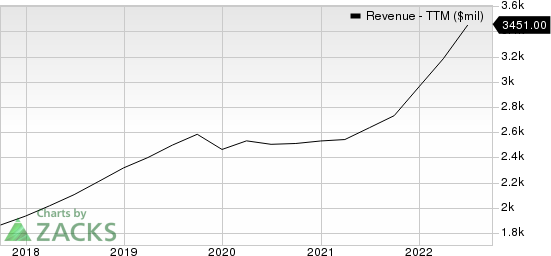

The company’s revenues for 2022 and 2023 are expected to improve 21.7% and 8.2%, respectively, year over year. Earnings are expected to increase 9.3% and 10.6% year over year, respectively, in 2022 and 2023.

Factors That Bode Well

TransUnion’s addressable market includes the burgeoning Big Data and analytics market, which is expanding at a rapidly accelerating pace as companies understand the advantages of building an analytical enterprise where decisions are derived from data and insights. To capitalize on the immense growth potential in this market, TransUnion has leveraged its next-generation technology to strengthen its analytics capabilities and further expanded its database.

TransUnion Revenue (TTM)

TransUnion revenue-ttm | TransUnion Quote

TransUnion’s gigantic treasure trove of data is its most distinguishing asset and also perhaps the biggest barrier to entry for competitors. Acquiring or building such data involves huge costs, making it extremely difficult for a new company to acquire the contacts and data that TransUnion already has. This fortifies TRU's ability to sustain its competitive advantage and protect its market share.

The company has made significant investments to modernize its infrastructure and facilitate the seamless transition to the latest Big Data and analytics technologies. These enable TransUnion to expand its business and improve its cost structure.

Some Risks

TransUnion's current ratio at the end of the second quarter of 2022 was 1.63, lower than the current ratio of 1.79 reported at the end of the first quarter. A decline in the current ratio is not desirable as it indicates that the company may have problems meeting its short-term debt obligations.

The stock lost 24.6% in the past three months compared with a 5.4% decline of the industry it belongs to.

Zacks Rank and Stocks to Consider

TRU currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Avis Budget Group, Inc. CAR, Automatic Data Processing, Inc. ADP and CRA International, Inc. CRAI.

Avis Budget sports a Zacks Rank #1 (Strong Buy) at present. CAR has an earnings growth rate of 108.4% for 2022. You can see the complete list of today’s Zacks #1 Rank stocks here.

Avis Budget delivered a trailing four-quarter earnings surprise of 69.5%, on average.

Automatic Data Processing carries a Zacks Rank #2 (Buy) at present. ADP has a long-term earnings growth expectation of 12%.

ADP delivered a trailing four-quarter earnings surprise of 5%, on average.

CRA International carries a Zacks Rank of 2, currently. CRAI has a long-term earnings growth expectation of 14.3%.

CRAI delivered a trailing four-quarter earnings surprise of 26%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Charles River Associates (CRAI) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

TransUnion (TRU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance