The Reata Pharmaceuticals (NASDAQ:RETA) Share Price Has Soared 359%, Delighting Many Shareholders

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It hasn't been the best quarter for Reata Pharmaceuticals, Inc. (NASDAQ:RETA) shareholders, since the share price has fallen 12% in that time. But that doesn't change the fact that the returns over the last three years have been spectacular. Indeed, the share price is up a whopping 359% in that time. So the recent fall doesn't do much to dampen our respect for the business. The thing to consider is whether there is still too much elation around the company's prospects.

See our latest analysis for Reata Pharmaceuticals

Reata Pharmaceuticals isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Reata Pharmaceuticals saw its revenue shrink by 1.5% per year. So it's pretty amazing to see the stock price has zoomed up 66% per year in that time. This clear lack of correlation between revenue and share price is surprising to see in a money losing company. So there is a serious possibility that some holders are counting their chickens before they hatch.

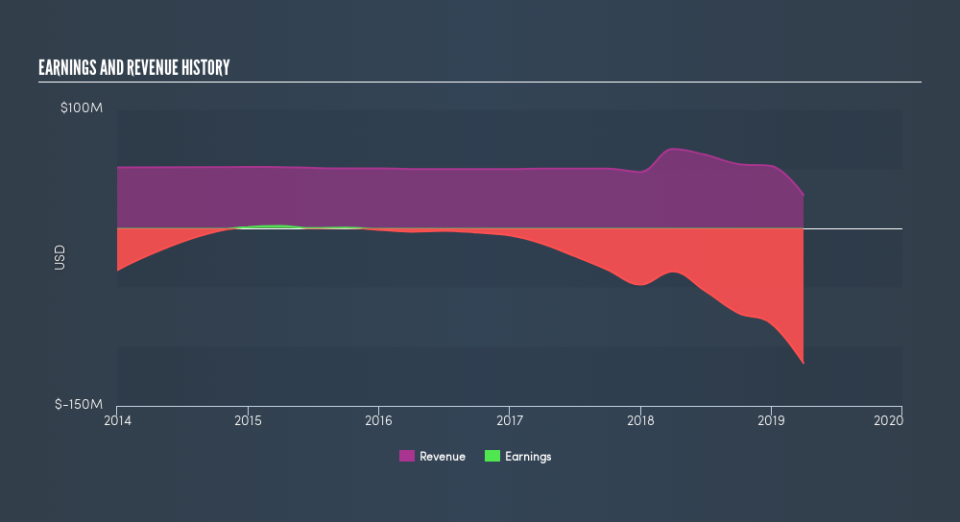

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Pleasingly, Reata Pharmaceuticals's total shareholder return last year was 113%. So this year's TSR was actually better than the three-year TSR (annualized) of 66%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Reata Pharmaceuticals by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance