RedHill (RDHL) Up on Orphan Drug Tag for NTM Disease Drug

RedHill Biopharma RDHL announced that the European Commission (EC) has granted orphan-drug designation to RHB-204 for the treatment of pulmonary nontuberculous mycobacteria (NTM) disease.

NTM disease is a pulmonary lung infection caused by Mycobacterium avium complex (MAC), a species of NTM bacteria, accounting for almost 80% of the NTM lung disease cases in the United States.

The Orphan Drug designation is granted by the European Medicines Agency (EMA) to a drug or biologic intended to treat a rare disease or condition, which must not affect more than five in 10,000 individuals in the European Union. With the EU Orphan Drug designation, RHB-204 has now gained eligibility for 10 years of European market exclusivity post EU approval.

The designation also includes incentives, including protocol assistance from the EMA, financial aid depending on the sponsor status and required service in the event of regulatory approval.

RHB-204 has been granted orphan-drug status after a positive recommendation from the EMA’s Committee for Orphan Medicinal Products (COMP).

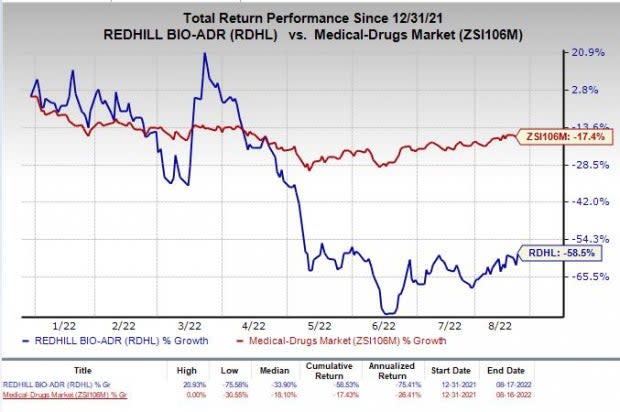

Shares of RedHill Biopharma were up 9.2% during market hours on Aug 17, after the announcement of the news. However, the stock has declined 58.5% year to date compared with the industry’s fall of 17.4%.

Image Source: Zacks Investment Research

The company is currently conducting a phase III study for RHB-204 in the United States, evaluating the safety and efficacy of the candidate in adults with NTM disease.

NTM infections are extremely difficult to treat, and there are no approved stand-alone therapies for the same in the world. RedHill is thus developing RHB-204 as the first stand-alone first line therapy for the NTM disease as a standard of care.

RHB-204 was granted Fast Track designation for the aforementioned indication, by the FDA, In January 2021. This, in turn, extends the U.S market exclusivity for the candidate for potentially 12 years, upon FDA approval. The candidate also enjoys Qualified Infectious Disease Product (QIDP) designation and Orphan Drug designation in the United States.

Additionally, RHB-204 is covered by U.S patents, which extends RHB-204’s patent protection until 2029. A U.S. patent protection application is pending, which if approved, will extend RHB-204’s patent protection till 2041.

The company is also pursuing potential partners to fund RHB-204 across multiple territories.

Apart from RHB-204, RedHill is evaluating oral drug candidate opaganib as a potential treatment for patients hospitalized with COVID-19, advanced cholangiocarcinoma and prostate cancer in separate clinical studies.

It is also evaluating RHB-107 in a phase III study for non-hospitalized symptomatic COVID-19 and multiple other cancer and inflammatory gastrointestinal diseases.

Redhill Biopharma Ltd. Price

Redhill Biopharma Ltd. price | Redhill Biopharma Ltd. Quote

Zacks Rank and Stocks to Consider

RedHill Biopharma currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector includeAquestive Therapeutics AQST,Jazz Pharmaceuticals JAZZ and Soleno Therapeutics SLNO,each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Aquestive Therapeutics’ loss per share estimates for 2022 have narrowed from $1.34 to $1.25 in the past 30 days. The same for 2023 has narrowed from 74 cents to 67 cents in the same time frame.

Earnings of Aquestive beat estimates in three of the trailing four quarters and missed the same on the remaining one occasion. The average earnings surprise for AQST is 11.47%.

Jazz Pharmaceuticals’ earnings estimates for 2022 have improved to $17.35 from $17.06 in the past 30 days. The loss estimates for 2023 has improved from $18.15 per share to $18.63 per share in the same time frame.

JAZZ surpassed earnings in three of the trailing four quarters, missing the same in one. The average earnings surprise for Inozyme is 10.94%.

Soleno Therapeutics’ loss per share estimates for 2022 have narrowed from 28 cents to 27 cents in the past 30 days. The same for 2023 has narrowed from 20 cents to 14 cents in the same time frame.

Earnings of Soleno missed estimates in three of the trailing four quarters and were in line with the estimate in the remaining occasion. The average earnings surprise for SLNO is 11.40%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Redhill Biopharma Ltd. (RDHL) : Free Stock Analysis Report

Soleno Therapeutics, Inc. (SLNO) : Free Stock Analysis Report

Aquestive Therapeutics, Inc. (AQST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance