Reflecting On Apparel, Accessories and Luxury Goods Stocks’ Q1 Earnings: Guess (NYSE:GES)

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the apparel, accessories and luxury goods stocks, including Guess (NYSE:GES) and its peers.

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel, accessories and luxury goods stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 0.5%. while next quarter's revenue guidance was 2.2% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and apparel, accessories and luxury goods stocks have held roughly steady amidst all this, with share prices up 4.1% on average since the previous earnings results.

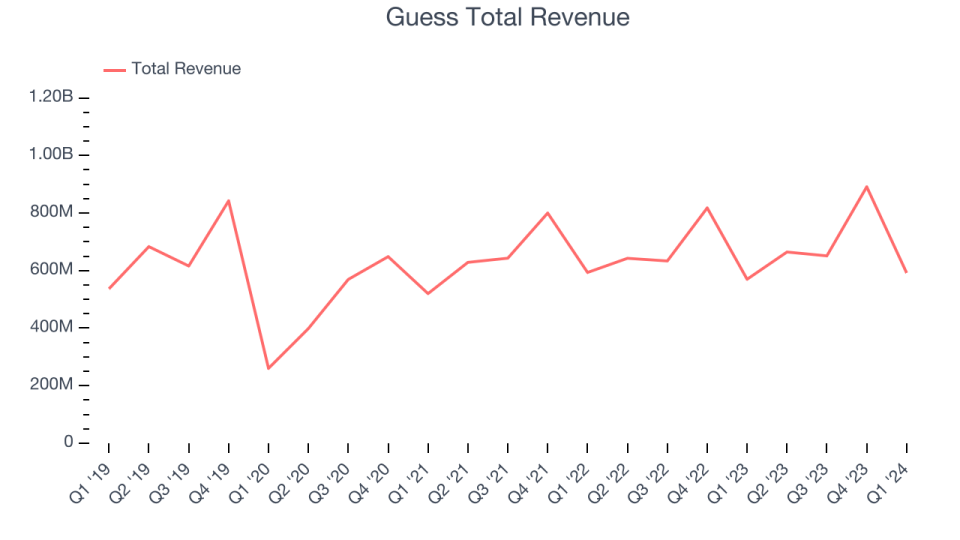

Guess (NYSE:GES)

Flexing the iconic upside-down triangle logo with a question mark, Guess (NYSE:GES) is a global fashion brand known for its trendy clothing, accessories, and denim wear.

Guess reported revenues of $591.9 million, up 3.9% year on year, topping analysts' expectations by 3%. It was a mixed quarter for the company, with an impressive beat of analysts' earnings estimates but a miss of analysts' operating margin estimates.

Carlos Alberini, Chief Executive Officer, commented, “We are very pleased with our first quarter results, which exceeded our expectations for revenues and earnings per share. We delivered revenue growth of 4% in US dollars and 7% in constant currency, driven by a remarkable performance of our Licensing and Americas wholesale businesses and strong results in Europe and Asia. Revenues in our Americas retail business finished flat for the quarter, as we continued to experience softness in certain of our businesses in the region due to slower customer traffic. I believe our strong results this quarter once again highlight the power of our diversified business model and the strength of our brand and our global distribution.”

The stock is down 9.9% since the results and currently trades at $21.06.

Read our full report on Guess here, it's free.

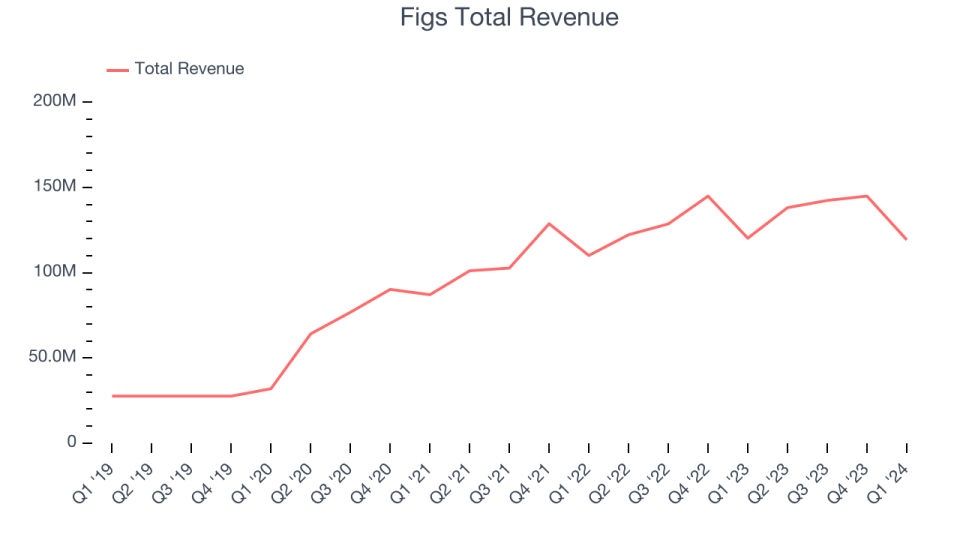

Best Q1: Figs (NYSE:FIGS)

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Figs reported revenues of $119.3 million, down 0.8% year on year, outperforming analysts' expectations by 1.6%. It was a, very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is down 13.1% since the results and currently trades at $4.89.

Is now the time to buy Figs? Access our full analysis of the earnings results here, it's free.

ThredUp (NASDAQ:TDUP)

Founded to revolutionize thrifting, ThredUp (NASDAQ:TDUP) is a leading online fashion resale marketplace that offers a wide selection of gently-used clothing and accessories.

ThredUp reported revenues of $79.59 million, up 4.8% year on year, falling short of analysts' expectations by 0.9%. It was a weak quarter for the company, with a miss of analysts' operating margin and earnings estimates.

ThredUp achieved the fastest revenue growth but had the weakest full-year guidance update in the group. The stock is down 1.6% since the results and currently trades at $1.84.

Read our full analysis of ThredUp's results here.

Oxford Industries (NYSE:OXM)

The parent company of Tommy Bahama, Oxford Industries (NYSE:OXM) is a lifestyle fashion conglomerate with brands that embody outdoor happiness.

Oxford Industries reported revenues of $398.2 million, down 5.2% year on year, falling short of analysts' expectations by 1.6%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year and a miss of analysts' operating margin estimates.

The stock is up 0.8% since the results and currently trades at $101.83.

Read our full, actionable report on Oxford Industries here, it's free.

Hanesbrands (NYSE:HBI)

A classic American staple founded in 1901, Hanesbrands (NYSE: HBI) is a clothing company known for its array of basic apparel including innerwear and activewear.

Hanesbrands reported revenues of $1.16 billion, down 16.8% year on year, falling short of analysts' expectations by 1.6%. It was a solid quarter for the company, with an impressive beat of analysts' earnings estimates and optimistic earnings guidance for the full year.

Hanesbrands had the slowest revenue growth among its peers. The stock is up 12.1% since the results and currently trades at $4.99.

Read our full, actionable report on Hanesbrands here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance