Reflecting on Manolete Partners' (LON:MANO) Share Price Returns Over The Last Year

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the Manolete Partners Plc (LON:MANO) share price slid 13% over twelve months. That contrasts poorly with the market decline of 7.0%. We wouldn't rush to judgement on Manolete Partners because we don't have a long term history to look at. It's down 32% in about a quarter.

Check out our latest analysis for Manolete Partners

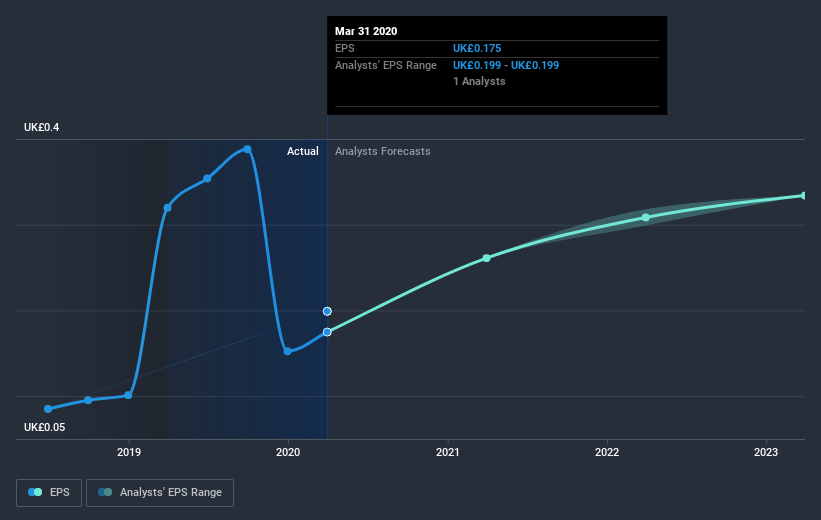

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Manolete Partners reported an EPS drop of 45% for the last year. This fall in the EPS is significantly worse than the 13% the share price fall. It may have been that the weak EPS was not as bad as some had feared.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Manolete Partners' earnings, revenue and cash flow.

A Different Perspective

Manolete Partners shareholders are down 13% for the year (even including dividends), even worse than the market loss of 7.0%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's worth noting that the last three months did the real damage, with a 32% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Manolete Partners (of which 1 is potentially serious!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance