Reflecting On Perishable Food Stocks’ Q1 Earnings: Tyson Foods (NYSE:TSN)

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Tyson Foods (NYSE:TSN) and the best and worst performers in the perishable food industry.

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

The 11 perishable food stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 4.5%. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and perishable food stocks have held roughly steady amidst all this, with share prices up 0.8% on average since the previous earnings results.

Tyson Foods (NYSE:TSN)

Started as a simple trucking business, Tyson Foods (NYSE:TSN) today is one of the world’s largest producers of chicken, beef, and pork.

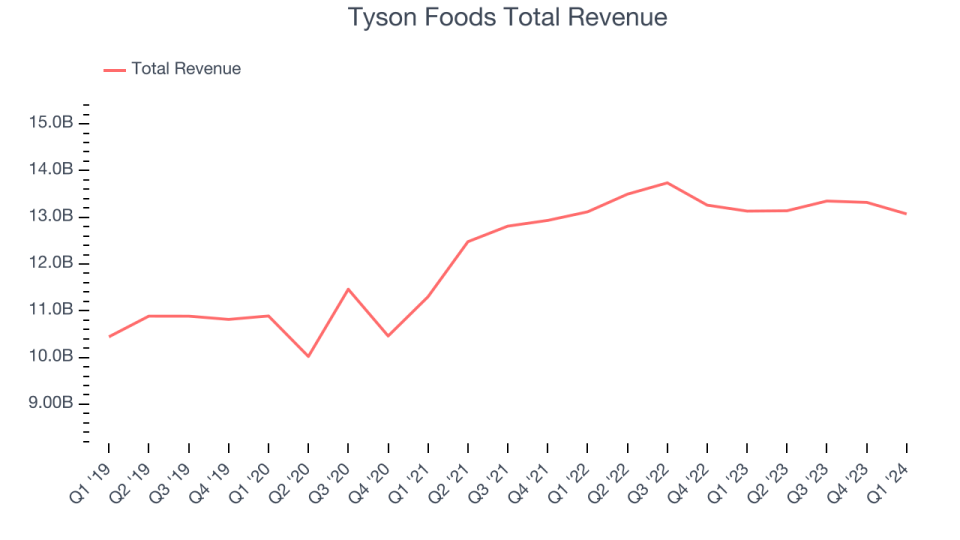

Tyson Foods reported revenues of $13.07 billion, flat year on year, in line with analysts' expectations. Overall, it was a very strong quarter for the company with an impressive beat of analysts' earnings and gross margin estimates.

The stock is down 7.3% since reporting and currently trades at $57.42.

Is now the time to buy Tyson Foods? Access our full analysis of the earnings results here, it's free.

Best Q1: Mission Produce (NASDAQ:AVO)

Founded in 1983 in California, Mission Produce (NASDAQ:AVO) grows, packages, and distributes avocados.

Mission Produce reported revenues of $297.6 million, up 34.6% year on year, outperforming analysts' expectations by 31.4%. It was an incredible quarter for the company with an impressive beat of analysts' earnings and gross margin estimates.

Mission Produce delivered the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a great quarter compared its peers, the market seems unhappy with the results as the stock is down 10.7% since reporting. It currently trades at $10.20.

Is now the time to buy Mission Produce? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Fresh Del Monte Produce (NYSE:FDP)

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE:FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

Fresh Del Monte Produce reported revenues of $1.11 billion, down 1.8% year on year, falling short of analysts' expectations by 3.8%. It was a weak quarter for the company with a miss of analysts' gross margin and earnings estimates.

Fresh Del Monte Produce had the weakest performance against analyst estimates in the group. As expected, the stock is down 14.7% since the results and currently trades at $22.21.

Read our full analysis of Fresh Del Monte Produce's results here.

Cal-Maine (NASDAQ:CALM)

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

Cal-Maine reported revenues of $703.1 million, down 29.5% year on year, surpassing analysts' expectations by 1.5%. Overall, it was a weaker quarter for the company with a miss of analysts' gross margin estimates.

Cal-Maine had the slowest revenue growth among its peers. The stock is up 6.9% since reporting and currently trades at $63.

Read our full, actionable report on Cal-Maine here, it's free.

Dole (NYSE:DOLE)

Cherished for its delicious, world-famous pineapples and Hawaiian roots, Dole (NYSE:DOLE) is a global agricultural company specializing in fresh fruits and vegetables.

Dole reported revenues of $2.12 billion, up 6.6% year on year, in line with analysts' expectations. More broadly, it was a solid quarter for the company with an impressive beat of analysts' earnings estimates.

The stock is up 4.5% since reporting and currently trades at $12.81.

Read our full, actionable report on Dole here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.