Reflecting on Wilmington's (LON:WIL) Share Price Returns Over The Last Five Years

Wilmington plc (LON:WIL) shareholders should be happy to see the share price up 13% in the last quarter. But if you look at the last five years the returns have not been good. After all, the share price is down 31% in that time, significantly under-performing the market.

View our latest analysis for Wilmington

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

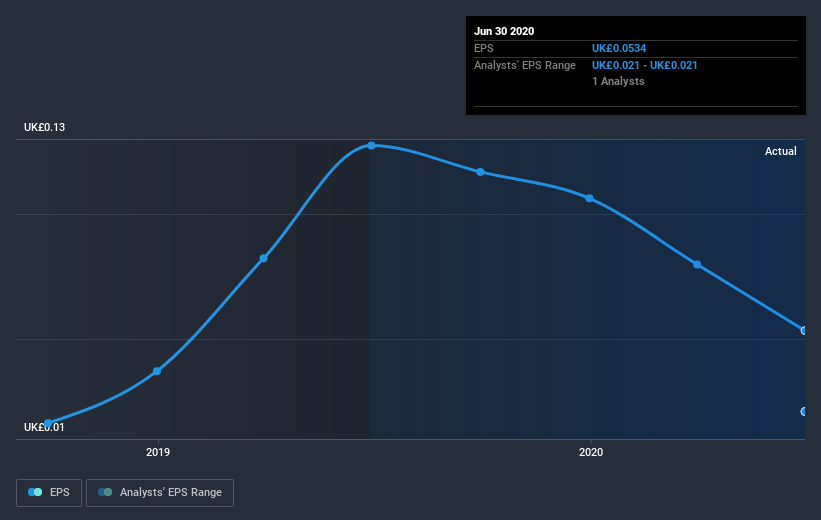

Looking back five years, both Wilmington's share price and EPS declined; the latter at a rate of 9.8% per year. This fall in the EPS is worse than the 7% compound annual share price fall. So the market may previously have expected a drop, or else it expects the situation will improve.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Wilmington's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Wilmington's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Wilmington shareholders, and that cash payout explains why its total shareholder loss of 20%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While the broader market lost about 5.4% in the twelve months, Wilmington shareholders did even worse, losing 28%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Wilmington that you should be aware of before investing here.

Wilmington is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance