Regions (RF) Q1 Earnings Miss, Provisions Up on Coronavirus Woes

Regions Financial Corporation RF reported first-quarter 2020 adjusted earnings of 15 cents per share, missing the Zacks Consensus Estimate of 19 cents. The figure plummeted 59.5%, year over year.

Net income available to common shareholders was $139 million compared with the $378 million reported in the year-ago period.

Results were negatively impacted by lower revenues resulting from a reduction in net interest income on lower rates and a deteriorating fee income. Additionally, elevated provisions were an undermining factor. Yet, lower non-interest expenses were the driving factor. Moreover, rise in loans and deposits reflect a strong capital position.

Revenues Down, Costs Drop

Adjusted total revenues (net of interest expense) came in at $1.41 billion in the reported quarter, lagging the Zacks Consensus Estimate of $1.45 billion. The revenue figure also decreased 2.6% from the year-ago quarter’s reported tally.

Regions Financial recorded adjusted pre-tax pre-provision income from continuing operations of $587 million, down 1.7% year over year.

On a fully-taxable equivalent (FTE) basis, net interest income was $940 million, down 2.2%, year over year. Also, net interest margin (on an FTE basis) contracted 7 basis points (bps) year over year to 3.44% in the first quarter. These declines mainly resulted from lower market-interest rates, partly offset by lower funding costs.

Non-interest income slipped 3.4% to $485 million. This decline mainly resulted from lower card & ATM fees, capital markets income, bank-owned life insurance and other income. Higher mortgage income, service charges on deposit account and wealth management income provided some relief.

Non-interest expense dropped 2.8% year over year to $836 million, mainly due to fall in salaries and employee benefits, net occupancy, professional, legal and regulatory expenses, FDIC insurance assessments, credit card and other expenses. On an adjusted basis, non-interest expenses were down 3.3% year over year to $824 million.

Adjusted efficiency ratio came in at 57.9% compared with the prior-year quarter’s 58.3%. A lower ratio indicates a rise in profitability.

Balance-Sheet Strength

As of Mar 31, 2020, adjusted total loans escalated 6.6% sequentially to $86.5 billion. Further, total deposits came in at $100 billion, up 2.6%.

As of Mar 31, 2020, low-cost deposits, as a percentage of average deposits, were 91%, in line with the prior-year quarter. In addition, deposit costs came in at 35 bps in the March-end quarter.

Credit Quality: A Concern?

Credit metrics deteriorated during the quarter. Non-performing assets, as a percentage of loans, foreclosed properties and non-performing loans held for sale, advanced 8 bps from the prior-year quarter to 0.96%. Also, non-accrual loans, excluding loans held for sale, as a percentage of loans, came in at 0.72%, expanding 10 bps year over year.

Allowance for loan losses as a percentage of loans, net of unearned income was 1.77%, up 76 bps from the year-earlier quarter. The company’s total business services criticized loans climbed 18.9% year over year.

Furthermore, adjusted net charge-offs, as a percentage of average loans, came in at 0.59%, advancing 21 bps. Provision for loan losses was $373 million, up from the prior-year quarter figure of $91 million.

Strong Capital Position

Regions Financial’s estimated ratios remained well above the regulatory requirements under the Basel III capital rules. As of Mar 31, 2020, Basel III Common Equity Tier 1 ratio (fully phased-in) and Tier 1 capital ratio were estimated at 9.4% and 10.6%, respectively, compared with the 9.8% and 10.6% recorded in the year-earlier quarter.

During the January-March period, Regions did not repurchase shares, though announced $149 million in dividends to common shareholders. Notably, the company has temporarily suspended share buybacks through the second quarter of 2020, following the “unprecedented challenge” from the coronavirus pandemic.

Our Viewpoint

Regions Financial put up a disappointing performance in the first quarter on lower revenues. Apart from this, margin pressure on low rates is expected to prevail. Though rise in provisions on the coronavirus scare was a headwind, expense reduction acted as a tailwind.

The company’s favorable funding mix, attractive core business and revenue-diversification strategies will likely yield stellar earnings in the upcoming period. Though decline in net interest and fee income are concerns, we remain optimistic on the company's branch-consolidation plan and expense-reduction moves.

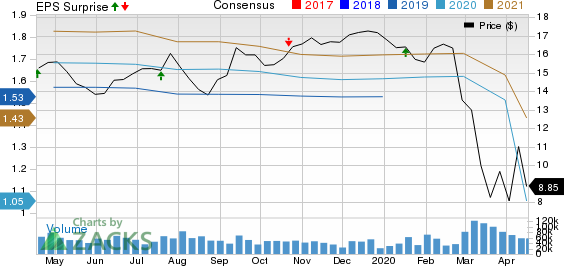

Regions Financial Corporation Price, Consensus and EPS Surprise

Regions Financial Corporation price-consensus-eps-surprise-chart | Regions Financial Corporation Quote

Currently, Regions Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other banks

JPMorgan’s JPM first-quarter 2020 earnings came in at 78 cents per share, which missed the Zacks Consensus Estimate of $1.70, thanks to a substantial rise in provisions due to the coronavirus-related concerns. The dismal results resulted from provision builds due to deterioration in the macro-economic backdrop, losses related to funding spread widening on derivatives and bridge book markdowns. Excluding these, earnings per share amounted to $2.89.

PNC Financial PNC reported first-quarter earnings per share of $1.95, surpassing the Zacks Consensus Estimate of $1.38 amid coronavirus concerns. The bottom line, however, reflected a 25.3% decline from the prior-year quarter reported figure. Higher revenues, driven by higher net interest income and escalating fee income, aided the company’s results. Further, expenses declined. However, rise in provisions was a headwind. Moreover, lower net interest margin was another concern.

Citigroup C delivered a positive earnings surprise of 19.1% in the March-end quarter on revenue strength. Its adjusted earnings per share of $1.06 for the quarter handily outpaced the Zacks Consensus Estimate of 89 cents. However, it came in lower than the year-ago quarter figure of $1.87 per share. Citigroup recorded higher revenues, riding on strong performance in the Institutional Clients Group segment. Increase in client activity due to a rise in volatility led to higher revenues from equity markets (up 39%). Also, strength in rates and commodities boosted fixed-income revenues (up 39%) during the reported quarter.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Regions Financial Corporation (RF) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance