REITs Gearing Up for Q2 Earnings on Aug 7: VTR and KIM

We are in the final leg of the current reporting cycle and the real estate investment trust (REIT) space is still buzzing with activity, with a number of earnings releases lined up for Aug 7. Among others, Ventas Inc. VTR and Kimco Realty Corp. KIM will release their quarterly numbers on Friday.

REITs invest in all types of properties, from residential, industrial, offices, malls to hospitals, hotels and data centers and several others. And underlying asset categories as well as location of properties play a crucial role in determining their performance. Therefore, though the coronavirus mayhem disrupted the economy and the job market during the June-end quarter, affecting several industries and corresponding asset categories, there were a few which were resilient and benefited during this period.

Therefore, not all companies in the sector have suffered a setback during the period under discussion. Hence, delving into the asset fundamentals and markets of each REIT becomes all the more important.

Particularly, the industrial real estate asset category showed resilience during the second quarter amid the coronavirus crisis on low vacancy rates, high-asking rents, positive net absorptions and robust rent collections.

Also, given the higher investments in pharmaceutical research and development, critical monetary support from the government and urgent hiring by tenants, lab-office assets are anticipated to have been in high demand during the quarter under review. Apart from this, increasing levels of patient traffic and activity have buoyed performance of medical office buildings.

Nevertheless, seniors housing occupancy shrunk 280 basis points (bps) sequentially to 84.9%, per the National Investment Center for Seniors Housing & Care (NIC) data. Moreover, the annual absorption rate was -0.5% during the quarter, as against 3.1% growth registered in the first quarter. Annual rent growth for the June-end quarter was 2.1%, down from 2.4% observed in the March-end quarter.

In addition, the retail real estate market had already been bearing the brunt of declining traffic, store closures and retailer bankruptcies, and now the pandemic has only added to its woes with rent collections and deferrals. Per a report from CBRE Group CBRE, the overall retail availability rate in second-quarter 2020 expanded 3 basis points to 6.4%, while retail properties witnessed their first quarterly decline in net absorption since early 2011. Neighborhood, community & strip centers resulted in majority of the decrease in net absorption.

Let’s analyze the factors that are likely to have played a key role in the above-mentioned REITs’ quarterly performance.

Ventas, Inc. is scheduled to release second-quarter results before the bell. Our proven model does not conclusively predict a positive surprise in terms of funds from operations (FFO) per share for this healthcare REIT this season.

The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a FFO beat. But that’s not the case here as Ventas currently carries a Zacks Rank of 3 and has an Earnings ESP of -3.05%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Over the preceding four quarters, Ventas outpaced estimates on all occasions, the average beat being 3.94%.

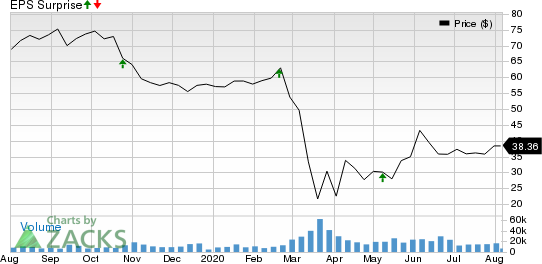

Ventas, Inc. Price and EPS Surprise

Ventas, Inc. price-eps-surprise | Ventas, Inc. Quote

The Zacks Consensus Estimate for quarterly revenues is currently pegged at $974.8 million, suggesting a 2.5% increase from the prior-year period. However, the Zacks Consensus Estimate for the quarterly FFO per share of 72 cents calls for a decline of 25.8% year over year.

The pandemic’s crippling impact on the seniors housing industry has resulted in occupancy and rental rate erosions. Ventas’ seniors housing operating portfolio (SHOP) and triple-net lease segment too are not immune to the industry setbacks. Further, rise in monthly average operating expenses, along with unfavorable revenue trends, might have dampened net operating income growth.

Nevertheless, outpatient medical facilities are likely to have reopened for elective procedures during the to-be-reported quarter, supporting revenues from medical office portfolio. (Read more: Here's How Ventas Looks Just Ahead of Q2 Earnings)

You can see the complete list of today’s Zacks #1 Rank stocks here.

Kimco Realty Corporation is set to report quarterly numbers before market open. Our proven model does not conclusively predict a positive surprise in terms of FFO per share for this retail REIT in the quarter to be reported, as Kimco currently carries a Zacks Rank #4 (Sell) and has an Earnings ESP of +5.69%.

Kimco beat the Zacks Consensus Estimate in three of the trailing four quarters and met in the other, the average beat being 2.09%.

Kimco Realty Corporation Price and EPS Surprise

Kimco Realty Corporation price-eps-surprise | Kimco Realty Corporation Quote

The Zacks Consensus Estimate for quarterly revenues is currently pinned at $250 million, indicating a 12.2% decline from the prior-year quarter reported figure. Also, the Zacks Consensus Estimate of 23 cents for quarterly FFO per share calls for a plunge of 36.1%, year over year.

The company enjoys ownership of high-quality assets, concentrated in the top 20 major metro markets, which offer several growth levers. Further, in these uncertain times, having a grocery component has been saving the grace of retail REITs, and for Kimco more than 77% of its annual base rent comes from grocery-anchored centers.

However, the choppy retail real estate environment is likely to have curbed its growth momentum in the to-be-reported quarter, as secular industry headwinds keep dampening industry fundamentals. Furthermore, rent relief and deferral requests from its tenants are likely to impede revenue growth. (Read more: What's in the Offing for Kimco This Earnings Season?)

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

\

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Ventas, Inc. (VTR) : Free Stock Analysis Report

CBRE Group, Inc. (CBRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance