Remitly Global Inc (RELY) Q1 2024 Earnings: Revenue Surges, Narrowing Losses

Active customers: Increased by 36% year-over-year to 6.2 million.

Send volume: Rose by 34% year-over-year to $11.5 billion.

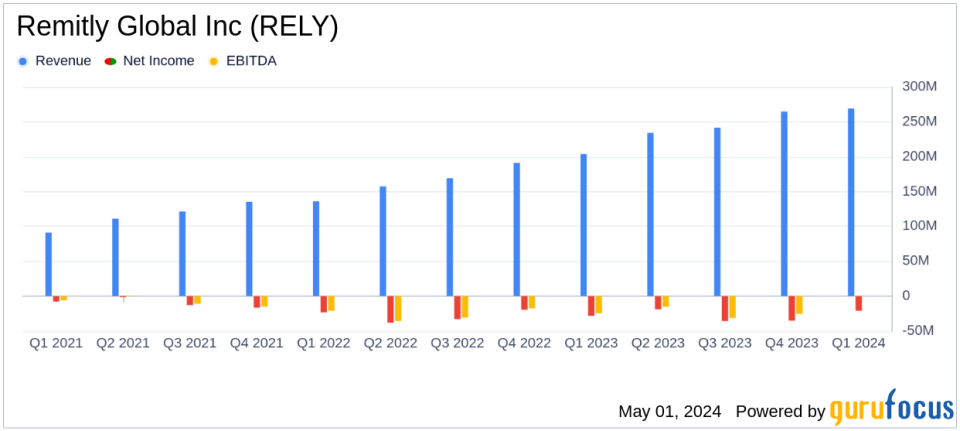

Revenue: Grew by 32% year-over-year to $269.1 million, falling slightly short of the estimated $273.97 million.

Net loss: Improved to $21.1 million from a previous $28.3 million, falling slightly short of the estimated loss of $24.46 million.

Adjusted EBITDA: Increased significantly to $19.3 million from $5.4 million in the previous year.

2024 Financial Outlook: Revenue expected to be between $1,225 million and $1,250 million, with Adjusted EBITDA forecasted between $85 million and $95 million.

On May 1, 2024, Remitly Global Inc (NASDAQ:RELY), a leading provider of digital financial services for immigrants, unveiled its first quarter results for 2024, demonstrating significant growth and operational improvements. The company's detailed financial performance is accessible through its 8-K filing. Remitly reported a 32% year-over-year increase in revenue, reaching $269.1 million, surpassing the estimated $273.97 million. Despite a net loss, the figure improved to $21.1 million from a previous $28.3 million, showcasing effective cost management and operational efficiency.

Company Overview

Remitly Global Inc is at the forefront of transforming the money transfer sector by providing immigrant communities with fast, reliable, and cost-effective financial services. The company's platform facilitates cross-border payments, leveraging digital channels to enhance customer experience and accessibility.

Quarterly Performance Highlights

The first quarter saw a robust increase in active customers to 6.2 million, up 36% from the previous year, and a 34% increase in send volume, indicating strong customer engagement and market expansion. This customer growth is a testament to Remitly's compelling service offerings and its strategic market positioning. Adjusted EBITDA also saw a significant boost, reaching $19.3 million, a substantial rise from $5.4 million in the prior year, reflecting improved profitability and operational leverage.

Financial Health and Future Outlook

Remitly's balance sheet remains solid with $285.9 million in cash and cash equivalents. Looking ahead, the company has raised its 2024 revenue forecast to between $1,225 million and $1,250 million, and adjusted EBITDA expectations to between $85 million and $95 million, signaling confidence in continued growth and profitability.

Analysis of Earnings

Despite the net loss, Remitly's reduced loss per share to $0.11 from $0.16 year-over-year illustrates an improving trajectory towards profitability. The company's ability to exceed revenue forecasts while effectively managing expenses highlights its operational efficiency and the scalability of its business model.

Strategic Initiatives and Market Expansion

CEO Matt Oppenheimer commented on the results, stating,

We are pleased with our strong start to the year that reflects our resilient customer base and superior customer experience."

This statement underscores the strategic initiatives undertaken by Remitly to enhance user engagement and expand its market reach.

Conclusion

Remitly's first quarter results for 2024 reflect a dynamic business capable of sustaining growth and improving its financial health. With strategic expansions and a focus on operational efficiency, Remitly is well-positioned to build on its current momentum and continue delivering value to its customers and investors.

For more detailed information and analysis, investors and stakeholders are encouraged to view the full earnings report and tune into the upcoming webcast detailed on Remitlys investor relations page.

Explore the complete 8-K earnings release (here) from Remitly Global Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance