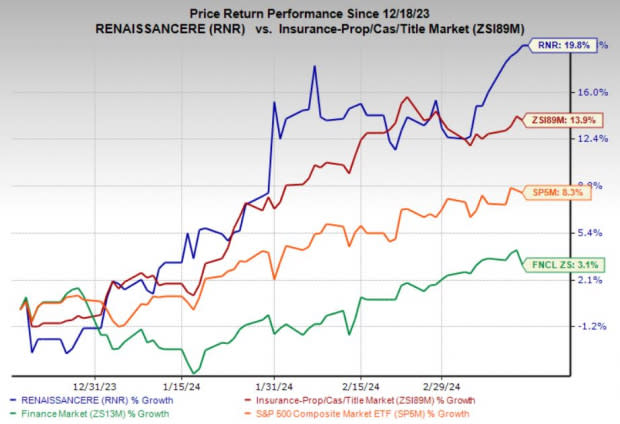

RenaissanceRe (RNR) Rises 19.8% in 3 Months: More Growth Ahead?

Shares of RenaissanceRe Holdings Ltd. RNR have jumped 19.8% in the past three months, outperforming the industry’s 13.9% increase. Based in Pembroke, Bermuda, RenaissanceRe offers reinsurance and insurance products in the domestic, as well as international markets. Solid contributions from the Casualty and Specialty business are aiding the company. RNR has a market cap of $12.5 billion.

In the past three months, the company’s shares also outperformed the 3.1% and 8.3% growth in the Finance sector and the S&P 500 Index, respectively. Growing premiums, net investment income and improvements in underwriting results are aiding its performance. It gains from the active inorganic growth strategy as the demand for property and casualty reinsurance services keeps rising. These factors are collectively contributing to this Zacks Rank #3 (Hold) company's notable price appreciation.

Image Source: Zacks Investment Research

Can RNR Retain Momentum?

The ingredients are there, and now let’s get into the details and show you how its estimates for the coming days stand.

The Zacks Consensus Estimate for RenaissanceRe’s 2024 full-year earnings is pegged at $34.35 per share, which increased by 2.8% in the past 60 days. It has witnessed five upward estimate revisions during this time against no movement in the opposite direction. The company beat earnings estimates in each of the last four quarters, with an average surprise of 24.8%.

The consensus mark for full-year 2024 revenues stands at nearly $11.1 billion, which suggests a 27.7% rise from the prior-year reported number. Our model indicates significant increases in premiums earned and investment income, which are likely to support top-line growth.

Our model suggests that net premiums earned and net investment income are expected to grow around 21% and 23% year over year, respectively, in 2024. Its prudent acquisition activities are expected to further enhance its capabilities. RenaissanceRe's acquisition of Validus Re, AlphaCat and the Talbot Treaty reinsurance business from AIG will likely boost the scale of its global property and casualty reinsurance business as well as boost profitability.

Thanks to its robust operations, the company consistently generates substantial cash from operations, enabling it to pursue strategic investments and return capital to shareholders. In 2023, net cash from operations amounted to $1.9 billion, marking a notable 19.2% increase from 2022. Moreover, the company's commitment to shareholder returns is evident in its recent dividend hike of 2.6%, marking the 29th consecutive year of dividend increases.

Risks

Despite the upside potential, there are a few factors that investors should keep an eye on.

Increasing operating costs and a substantial debt burden, resulting in rising interest expenses, pose challenges for the company. We expect total expenses to surge by nearly 29% year-over-year in the current year, which may exert pressure on its bottom line. Additionally, the company experienced a considerable rise in debt levels, soaring from $1.2 billion at the end of 2022 to nearly $2 billion as of Dec 31, 2023. Nevertheless, we believe that a systematic and strategic plan of action will drive its long-term growth.

Key Picks

Some better-ranked stocks in the broader Finance space are Ryan Specialty Holdings, Inc. RYAN, Root, Inc. ROOT and Brown & Brown, Inc. BRO, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ryan Specialty’s 2024 full-year earnings indicates a 28.3% year-over-year increase. It beat earnings estimates in two of the past four quarters and met twice, with an average surprise of 5.1%. Also, the consensus mark for RYAN’s 2024 full-year revenues suggests 19.5% year-over-year growth.

The consensus mark for Root’s 2024 full-year earnings indicates a 23.1% year-over-year improvement. The earnings estimate has witnessed three upward estimate revisions in the past month against no movement in the opposite direction. Furthermore, the consensus estimate for ROOT’s 2024 full-year revenues suggests 101.8% year-over-year growth.

The Zacks Consensus Estimate for Brown & Brown’s 2024 full-year earnings is pegged at $3.29 per share, which indicates 17.1% year-over-year growth. The estimate jumped by 9 cents over the past week. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 11.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RenaissanceRe Holdings Ltd. (RNR) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Root, Inc. (ROOT) : Free Stock Analysis Report

Ryan Specialty Holdings Inc. (RYAN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance