Rent-to-own loan cap could save vulnerable consumers £62 million in repayments

Tens of thousands of vulnerable people could save more than £62 million if a cap was introduced on rent-to-own deals, a leading charity has said.

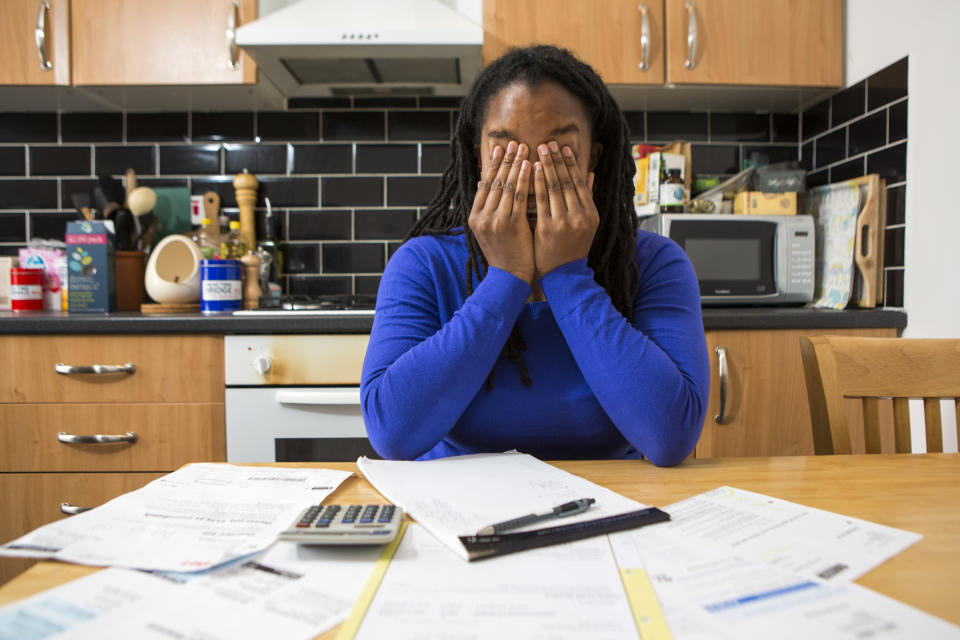

Citizens Advice says high-interest rates, late payment fees and expensive add-ons are leaving rent-to-own consumers struggling to pay for goods that they often end up having to return.

The charity believes if a cap similar to that imposed by the Financial Conduct Authority on payday loans was introduced, consumers could be protected from paying up to £62 million in repayments on 245,000 hire purchase products.

MORE: Rent-to-own firm PerfectHome to repay millions to 37,000 customers

Its call comes after the FCA watchdog secured a £2.1m redress deal for 37,000 customers with rent-to-own firm PerfectHome, many of whom had been given loans they could not afford.

Rent-to-own customers can secure hire purchase-style deals to buy a TV or sofa or washing machine over a period of time, usually for a substantially higher cost.

Citizens Advice also revealed the case of one woman referred to the charity who owed more than £9,000 to a rent-to-own provider through 12 hire purchase agreements.

She was unable to work due to her long-term health conditions and was struggling to meet other bills such as rent, council tax and food.

About 400,000 people have rent-to-own debt in the UK. Loans can have annual percentage rates (APRs) as high as 99.9% over the course of three years, as well as punitive late payment fees that add to the original cost.

MORE: Provident Financial to repay £170m to customers in new mis-selling scandal

Gillian Guy, chief executive of Citizens Advice, said: “Our latest research, along with the FCA’s intervention in the rent-to-own market last week, make it clear that there are significant problems in the sector that need to be addressed.

“The FCA needs to put in place measures to protect people from expensive borrowing and spiralling debts.

“The evidence is clear – the cap on the payday lending market secured a much better deal for consumers. The FCA should use its upcoming high-cost credit review to build on the success of the payday loan cap and extend the same protections to rent-to-own customers.”

The charity is asking the FCA to introduce rules for high-cost short-term credit providers to give clarity about what these checks should include, for example proof of income, to prevent people from being lent money they cannot afford to repay.

MORE: Poorest UK households spend over £1 in every £4 repaying debts

Evidence provided by rent-to-own firm Brighthouse last month as part of the Treasury select committee’s household finances inquiry also revealed about half of those customers with signed up to its rent-to-own agreements never actually get to own the TV, dishwasher, washing machine or other products they have been paying for.

Last year, Citizens Advice helped more than 5,000 people with problems relating to their rent-to-own loans, of which:

The average amount of rent-to-own debt was £972

The average overall debt was significantly higher at £8,193

63% had dependent children

Its clients were three times more likely to be female than male

Yahoo Finance

Yahoo Finance