Restructuring, Higher Rates Aid KeyCorp (KEY) Amid Cost Woes

KeyCorp KEY is well-placed for top-line growth, supported by the rise in loan balances and higher interest rates. Given a solid capital position, the company is expected to continue enhancing shareholder value through efficient capital deployment activities. However, KeyCorp’s significant exposure to risky loan portfolios might curb its growth in the near term. Elevated expenses are likely to hurt the bottom line.

KeyCorp has been witnessing robust organic growth over the past several years. Although its tax-equivalent revenues declined in 2019 and 2022, the same witnessed a CAGR of 3.1% over the last six years (2017-2022). During the five-year period (2018-2022), loans witnessed a CAGR of 7.5%, and deposits saw a CAGR of 7.4%. Aided by the steady rise in the demand for loans, along with the company’s efforts to strengthen fee income, its top line is expected to keep improving.

The Federal Reserve has been raising interest rates since March 2022 to tame the raging inflation. Supported by higher rates, KeyCorp’s net interest margin (NIM) is likely to witness growth. The company’s NIM from continuing operations was 2.64% in 2022 compared with 2.50% in 2021.

KeyCorp, through the buyouts/expansion initiatives, is expected to strengthen its product suites and market share. The company is expected to continue with opportunistic acquisitions, which are likely to further help diversify revenues. Also, as demand for digital banking services continues to rise, the company has been consolidating its branch network, with management looking for opportunities to right-size its footprint.

However, the company’s expenses witnessed a six-year (2017-2021) CAGR of 1.5%. The rise was mainly due to higher personal costs. The company’s investments in franchise, technological upgrades, inflationary pressure and inorganic growth strategy will likely keep costs elevated in the near term.

Given the current macroeconomic concerns, the Zacks Consensus Estimate for the company’s 2023 and 2024 earnings has been revised 8.2% and 9% lower, respectively, over the past 30 days. KEY currently carries a Zacks Rank #3 (Hold).

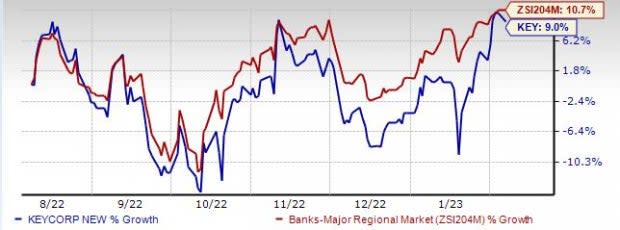

In the past six months, shares of the company have gained 9% underperforming the industry’s growth of 10.7%.

Image Source: Zacks Investment Research

Bank Stocks Worth a Look

A couple of better-ranked stocks from the finance space are The Bank of New York Mellon BK and State Street STT.

The Zacks Consensus Estimate for BNY Mellon’s current-year earnings has moved 6% higher over the past 30 days. Its shares have gained 17.4% in the past six months. Currently, BK sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

State Street currently carries a Zacks Rank #2. Its earnings estimates for 2023 have been revised 3.8% upward over the past 30 days. In the past six months, STT’s shares have rallied 29.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

State Street Corporation (STT) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance