Retail sales stage partial recovery as households prepare for lockdown end

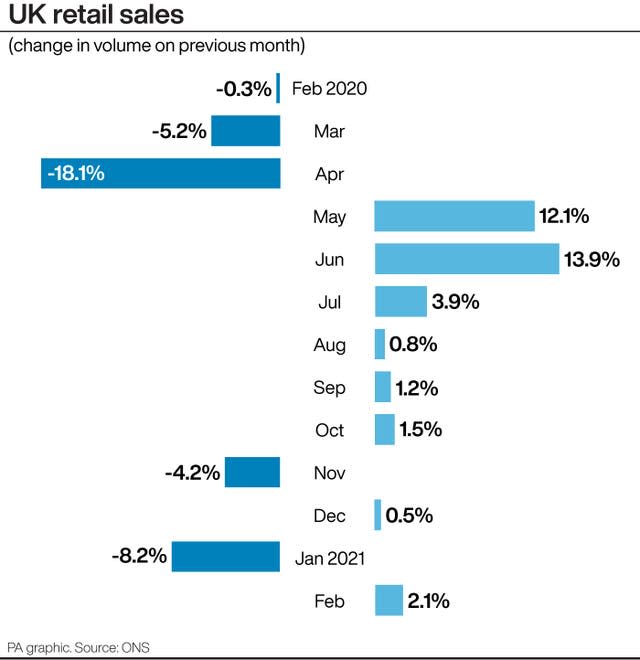

Retail sales volumes recovered slightly in February but not enough to offset heavy falls a month earlier, new data from the Office for National Statistics (ONS) has suggested.

Volumes rose 2.1% but only partially recovered on the 8.2% fall in January, with sales still down 3.7% on a year earlier and before the Covid-19 pandemic impact.

Clothing retailers reported the largest fall – down 50.4% – in sales volumes when compared with February 2020 and petrol stations (or “automotive fuel stores”, according to the ONS) fell 26.5% as the travel sector took a bad hit.

By comparison, online retailers continued to enjoy huge gains in customer spend, with 36.1% of all cash spent at retailers going to online operations in February. A year ago the proportion was just 20%.

It set a new record, beating the previous record set in January.

The amount of money spent in retail was also up in February by 2.2% compared with a month earlier, but down 4.4% on the same month a year ago.

February saw some positives in the non-food sector, with the ONS highlighting strong sales volumes in department stores and household goods stores – up 16.2% and 16.1% respectively.

Watch: How to save money on a low income

The ONS said it sees budget stores, such as B&M Bargains and Wilko, as “department stores” which have remained open during the latest lockdown restrictions where bosses have claimed to be “essential” retailers.

A similar pattern emerged in the first national lockdown in 2020, the ONS said, with those stores seeing falls in sales in March only to recover strongly in April and May as customers took advantage of their continued store presence.

DIY stores also enjoyed continued growth, with some respondents to the ONS survey suggesting strong sales of outdoor furniture in preparation for lockdown restrictions easing as separate households can soon meet in private gardens.

The British Retail Consortium pointed out that sales fell 1.3% in overall sales, on a non-seasonally adjusted basis and excluding fuel – equating to a £27 billion fall during the various national lockdowns over the past year.

Chief executive of the organisation Helen Dickinson said: “Retail sales fell for the second consecutive month in February, and non-food stores saw their fourteenth month of decline with a massive 25% drop.

“UK stores have now lost a whopping £27 billion from lost sales during the three lockdowns.

“This is already impacting retail employment, with 67,000 retail jobs lost between December 2019 and 2020.”

James Sproule, chief economist at Handelsbanken, said there were positives in the strong online sales growth, which is likely to stick around after lockdown restrictions end.

Our latest data show that retail sales increased by an estimated 2.1% in February 2021 https://t.co/kCOGByLHGY pic.twitter.com/k8uW6sJ04D

— Office for National Statistics (ONS) (@ONS) March 26, 2021

He said: “Handelsbanken is forecasting that online retail sales will account for 30% of overall retail sales post-lockdown, meaning that the progress towards online buying previously expected to take place over the next decade has been achieved in just 12 months.”

And whilst many analysts suggest the reopening of the economy would provide a welcome boost to bricks and mortar retailers, other warned that the rebound may be underwhelming.

James Smith, developed markets economist at ING, suggested the pent-up demand is more likely to focus on services and online sales could stay high.

He said: “Unfortunately, the combination of these two factors means it’s likely to be a further challenging time for traditional high street retailers (or those without a well-developed online offering).

“These businesses will also be vulnerable when support measures such as the commercial eviction ban are removed later in the year, given many are perceived to be behind on rent payments due to the pandemic.

“Further signs of consolidation are therefore likely on the high street over the coming months, which may result in higher unemployment in the sector.”

Watch: How to prevent getting into debt

Yahoo Finance

Yahoo Finance