Returns On Capital At SSE (LON:SSE) Paint An Interesting Picture

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. In light of that, when we looked at SSE (LON:SSE) and its ROCE trend, we weren't exactly thrilled.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on SSE is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.091 = UK£1.5b ÷ (UK£20b - UK£3.7b) (Based on the trailing twelve months to September 2020).

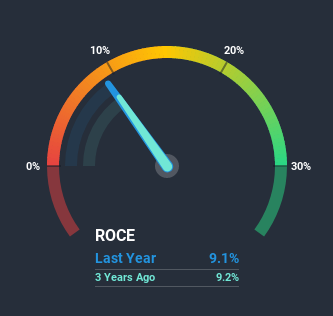

So, SSE has an ROCE of 9.1%. On its own that's a low return, but compared to the average of 6.6% generated by the Electric Utilities industry, it's much better.

Check out our latest analysis for SSE

In the above chart we have measured SSE's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering SSE here for free.

So How Is SSE's ROCE Trending?

Over the past five years, SSE's ROCE and capital employed have both remained mostly flat. This tells us the company isn't reinvesting in itself, so it's plausible that it's past the growth phase. With that in mind, unless investment picks up again in the future, we wouldn't expect SSE to be a multi-bagger going forward. That being the case, it makes sense that SSE has been paying out 88% of its earnings to its shareholders. These mature businesses typically have reliable earnings and not many places to reinvest them, so the next best option is to put the earnings into shareholders pockets.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 18% of total assets, is good to see from a business owner's perspective. Effectively suppliers now fund less of the business, which can lower some elements of risk.

The Bottom Line

We can conclude that in regards to SSE's returns on capital employed and the trends, there isn't much change to report on. Although the market must be expecting these trends to improve because the stock has gained 55% over the last five years. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

One final note, you should learn about the 3 warning signs we've spotted with SSE (including 2 which shouldn't be ignored) .

While SSE may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance