REV Group's (NYSE:REVG) investors will be pleased with their splendid 133% return over the last year

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the REV Group, Inc. (NYSE:REVG) share price had more than doubled in just one year - up 132%. In more good news, the share price has risen 9.9% in thirty days. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report. Having said that, the longer term returns aren't so impressive, with stock gaining just 9.9% in three years.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for REV Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

REV Group went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We doubt the modest 1.2% dividend yield is doing much to support the share price. We think that the revenue growth of 4.0% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

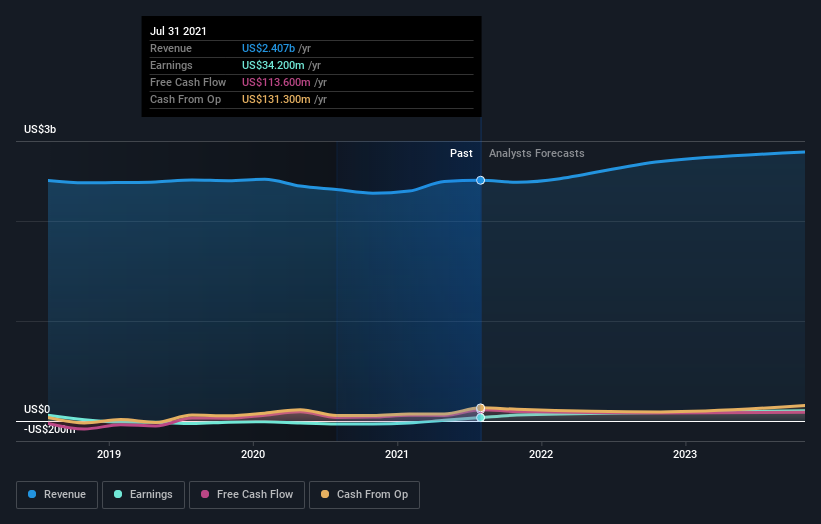

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on REV Group

A Different Perspective

It's nice to see that REV Group shareholders have gained 133% (in total) over the last year. That includes the value of the dividend. That gain actually surpasses the 5% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting REV Group on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for REV Group that you should be aware of.

REV Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance