REV Group's (NYSE:REVG) Shareholders Are Down 67% On Their Shares

REV Group, Inc. (NYSE:REVG) shareholders will doubtless be very grateful to see the share price up 31% in the last quarter. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 67% in that period. So it's good to see it climbing back up. After all, could be that the fall was overdone.

Check out our latest analysis for REV Group

Because REV Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, REV Group saw its revenue grow by 3.7% per year, compound. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 19% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

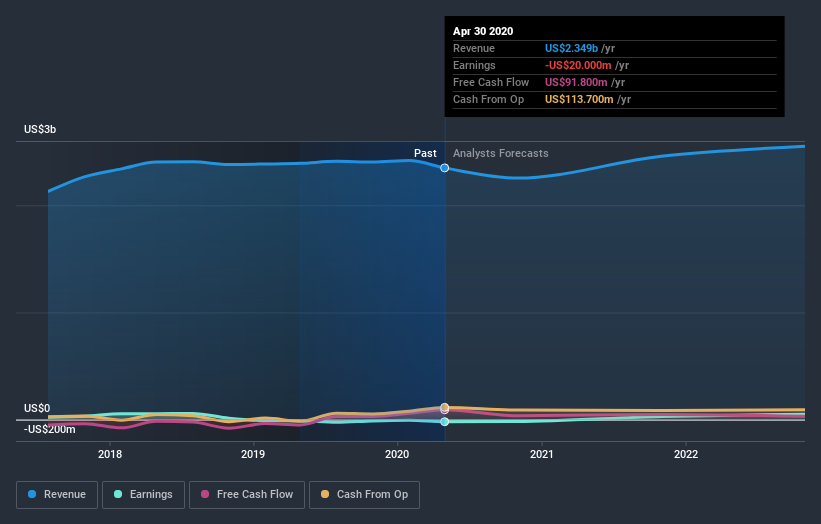

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think REV Group will earn in the future (free profit forecasts).

A Different Perspective

The last twelve months weren't great for REV Group shares, which cost holders 31%, while the market was up about 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 18% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand REV Group better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for REV Group you should be aware of, and 1 of them doesn't sit too well with us.

REV Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance