Revealed: The most affordable property hotspots for first-time buyers

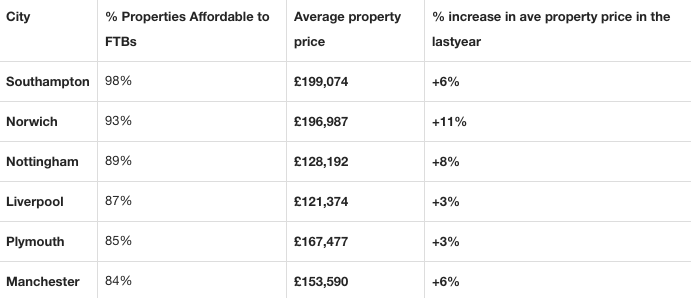

Southampton, Nottingham and Norwich are among the most affordable places for first-time buyers in the UK, according to new research.

The study by Post Office Money found that Southampton is the most affordable location for those trying to get on the housing ladder, with a massive 98 per cent of homes in the city affordable to first-time buyers at an average price of less than £200,000.

However, surprisingly the study found that London was not the most unaffordable place for first-time buyers. Brighton took the dubious honour instead, with an average property price of £352,303 and just two per cent of homes in the seaside town affordable to first-time buyers.

By comparison, though the average property price in the capital is a painful £534,2772, the study revealed this was affordable to a much larger 30 per cent of London residents looking to make the leap onto the property ladder.

MORE: Revealed: How much the biggest earners make in the capital, by industry

Bristol is also now below London in terms of affordability for first-time buyers, with the west coast cultural hub seeing a dramatic 20 per cent fall in the percentage of affordable properties for the group over just the last year.

Increasing numbers of young Brits are being forced to compromise on location in order to get on the housing ladder, the study found.

Some 70 per cent of first-time buyers chose to buy a home an average of 26 minutes from their original ‘preferred’ location, according to the research, as soaring house prices over recent years force young people to recalibrate their expectations.

MORE: Brexit will hit southern regions hardest while ‘vote leave’ areas to be least affected

“With average house price growth having increased by 48 per cent since 2005, compared with an increase to the average FTB income of only 37 per cent over the same period, there is no question that the UK housing market remains a challenging environment for many,” managing director of Post Office Money Owen Woodley said.

“In spite of this we’re seeing that first time buyers approach the market with enthusiasm and flexibility.”

Overall the study of more than 1,000 people found that 16 per cent did not have to adjust their expectations on location at all, while others made compromises over having a suitable garden — five per cent — or availability of car parking spaces — three per cent.

Yahoo Finance

Yahoo Finance