Revenge Doesn’t Explain Rise in Chinese Property Prices

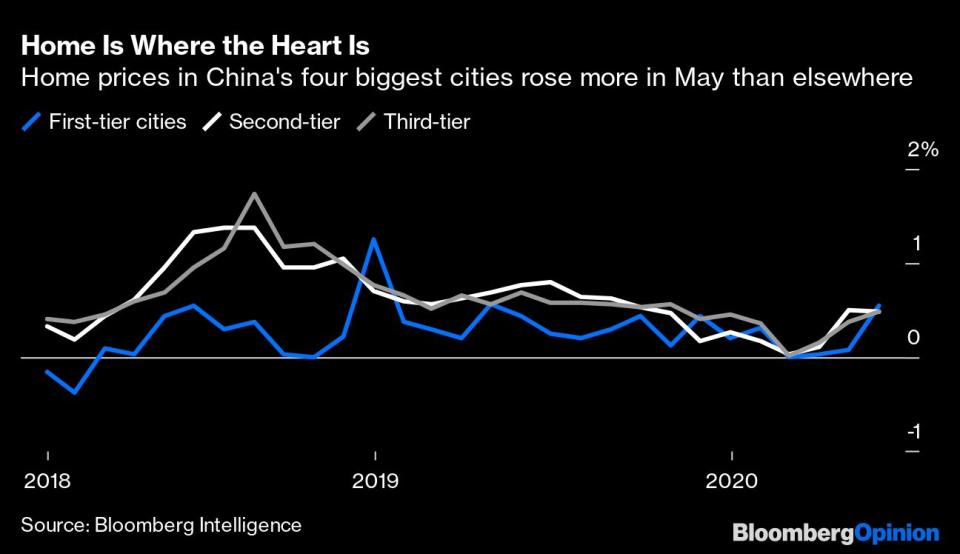

(Bloomberg Opinion) -- Real estate becomes a safe bet in uncertain times, and it’s proving true in China after months of pent-up demand from the pandemic runs into an outlook still filled with uncertainty.The problem, as we’ve seen time and again, is that anyone hoping for security from a market that’s heavily controlled may be in for disappointment, as the government will inevitably tighten limits when prices rise too much. Beijing should instead ramp up secure options for investors, such as accelerating the offering of real estate investment trusts. Recent gains in mainland real estate prices have all the hallmarks of so-called revenge spending for big purchases after lockdowns eased. Prices rose in May at the fastest pace in seven months, and analysts think June will be even better. Sales by the 16 developers Bloomberg Intelligence tracks rose an average 13% in June versus a year earlier. It might look like a splurge, yet there are signs that these gains will be sustainable, even if capped by government policy that discourages speculation in favor of habitation. Expect selective rises where people feel their money is safe, like big tier-one cities such as Shanghai and Beijing, as well as Guangzhou and Shenzhen, part of the government-promoted Greater Bay Area that encompasses Hong Kong and Macau.

There’s certainly a desire to scratch the spending itch. Much of China’s economy was shut in the spring as the government, keen to stop Covid-19 from spreading, halted land sales to developers and purchases of homes. Now developers have come back in with huge discounts. But there are deeper factors at play that should keep lifting prices.First, since the coronavirus hit, the government has been easing credit. Mortgage rates are at 33-month lows, with the average for a first-time home buyer at 5.28%. Many shut out from an increasingly unaffordable housing market are taking advantage, as are investors keen for something safer than volatile stocks.Second, the government is creating demand in some cities, loosening residency rules to encourage people to move in from rural areas. The theory is that a larger urban class boosts consumption — though what it has really lifted is buying homes. The reform of local residency permits includes easing access to these “hukou” for anyone with tertiary education in cities like Hangzhou, where Alibaba Group Holding Ltd. is based. The city of 10 million people added 554,000 residents last year, the biggest increase in permanent population of any city in China.

Martin Wong, Greater China associate director at Knight Frank LLP forecasts that home prices will rise between 2% and 3% this year in the first-tier cities, and between 3% and 5% in the Greater Bay Area cities. In contrast, urban areas not benefiting from hukou relaxation or lacking the kind of government-infrastructure spending drive to offset the pandemic’s economic impact should see prices stay flat or rise just around 2%, he says.

In May, Shanghai, Beijing, Guangzhou and Shenzhen saw new home prices increase more than 1% for the second month in a row. The last time the tier-one cities experienced gains of this magnitude was in late 2016; since then, much of the climb in property prices has been in smaller cities that have fewer restrictions on buying for investment. Older homes rose around 0.6%, beating gains elsewhere. In China, unlike most countries, local authorities cap prices on the sale of new homes, so they can actually be cheaper than older ones.

Still, these small percentages show that China is in no mood to allow a big housing boom, even though real estate spending and all its attendant construction and furnishings account for a quarter of the economy. Funding remains tight for developers. As an example, the one-year-loan prime rate is down 40 basis points to 3.85% since last August, but the five-year-loan prime rate on which mortgages are based has fallen just 20 basis points to 4.65%. Developers who want to build housing can only issue new onshore or offshore bonds to finance repaying existing bonds expiring in 12 months, according to Nomura Holdings Inc. analysts, and need approval for offshore loans. No wonder there’s a long queue spinning off their real-estate management arms — which tend to have better steady cash flow — for Hong Kong listings.

One solution that would ease the debt burden on developers while giving investors safer diversification is to expand a real estate investment trust trial that China kicked off in April. It has been focused on pooling capital to fund infrastructure such as highways and airports — perhaps no surprise, as this could give the economy a faster boost. But at some point, why not include real estate, both commercial and residential? That would let Chinese families, who have around 70% of their wealth tied up in property — more than double the U.S. — invest in their favorite asset and still diversify into stocks.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Nisha Gopalan is a Bloomberg Opinion columnist covering deals and banking. She previously worked for the Wall Street Journal and Dow Jones as an editor and a reporter.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Yahoo Finance

Yahoo Finance