Reviving Economy to Drive 2H20 Market Rally: 5 Must-Buy Stocks

The three major U.S. indices, namely, the Dow Jones Industrial Average, the S&P 500 and the Nasdaq ended June and second-quarter 2020 on a bright note.

After the lows hit in March, their recovery in the past three months has been astonishing, driven by an unprecedented government stimulus and the reopening of the U.S. economy.

In the second quarter, the Dow Jones Industrial, the S&P 500 and the Nasdaq grew 17.8%, 20% and 30.6%, respectively.

Notably, since the Mar 23 lows, Nasdaq is up almost 51%, better than the Dow Jones Industrial’s rise of 41.7% and the S&P 500’s return of 41.4%.

Per a MarketWatch report, both the Dow Jones Industrial and S&P 500 recorded their best quarterly performance in the second quarter of 2020 since 1938, while the Nasdaq had its best quarter since 1999.

Optimism on Steady Economic Recovery

Positive data points about improving consumer confidence and higher home prices have fueled optimism over steady revival of a coronavirus-ravaged economy.

Notably, the Conference Board’s Consumer Confidence Index rose to 98.1 in June, rebounding from May’s reading of 85.9 and April’s 85.7. This is the index’s largest jump since 2011, which however, is much lower than its average reading of about 126 in 2019.

Moreover, the Expectations Index that evaluates how Americans view their next six months in terms of income, business and labor market conditions increased from 97.6 in May to 106 in June.

Further, per S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, existing home prices in April 2020 increased 4.7% year over year despite coronavirus-led nationwide lockdowns and a sharp drop in home sales. The steady pricing can be attributed to record low mortgage rates.

Additionally, sales of newly constructed single-family homes, accounting for roughly 10% of all U.S. home sales, jumped 16.6% in May from the prior month. (Read More: May New Home Sales Strong: 5 Key Housing Picks)

After a surprising positive May report, the Bureau of Labor Statistics June jobs report is now anticipated to show another 3 million job additions. The unemployment rate is expected to decline to 12.2% from 13.3% in May, which however, is much higher than 3.5% at the end of 2019.

Wall Street’s Rally to Continue in 2H20

Wall Street’s upbeat momentum is expected to continue in the second half driven by the growing optimism over steady economic revival.

Although resurgence in coronavirus infection cases in 35 states over the past 14 days is worrying, chances of another nationwide lockdown is minimal, which should boost investor optimism.

Further, the Trump administration’s draft proposal of a $1-trillion stimulus plan to strengthen infrastructure, including roads, bridges and 5G, is expected to help the economy revive.

Here we pick five stocks that have shown great resilience amid the pandemic. Apart from having solid fundamentals, these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

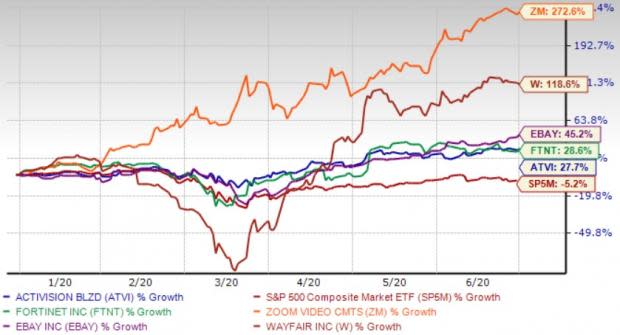

Notably, each of these stocks has a market cap of more than $10 billion and has outperformed the S&P 500 composite on a year-to-date basis.

Year-to-Date Performance

Top Picks

Activision Blizzard’s ATVI popular franchises, including Call of Duty, Overwatch, Candy Crush Saga and Candy Crush Friends Saga, are expected to attract home-confined gamers. Higher in-game spending is expected to drive net bookings and the top line of this Zacks Rank #1 company in the near term.

The Zacks Consensus Estimate for this $58.17-billion company’s 2020 earnings is pegged at $2.77 per share, having been revised 11.7% upward over the past 60 days. Earnings are expected to increase 23.1% from the figure reported in the previous year.

Fortinet FTNT is benefiting from dominance in the Unified Threat Management (UTM) space, which is one of the fastest-evolving segments in the network security space. Moreover, this Zacks Rank #1 company is gaining from rising cyber-attack risks that are propelling demand for its FortiMail platform.

The consensus mark for this $21.58-billion company’s 2020 earnings stands at $2.81 per share, having moved 8.9% north over the past 60 days. Earnings are expected to increase 13.8% from the prior-year reported number.

eBay EBAY is gaining on strong momentum across its managed payment offerings, which bodes well for its gross merchandise volume. Additionally, strength in promoted listings is encouraging for this $36.05-billion company.

Further, this Zacks Rank #1 company’s initiatives toward enhancing seller experience by offering innovative seller tools and delivering better buyer experience by building product catalogs utilizing structured data hold promise.

The consensus mark for eBay’s 2020 earnings has risen 11.7% to $3.45 per share over the past 60 days, suggesting growth of 22% from the year-ago reported figure.

Wayfair W has been witnessing strong acceleration in new and repeat customer orders. Also, an expanding active customer base and strength in this $18.95 billion-company's direct retail business are positives.

Moreover, this Zacks Rank #1 company is aggressively investing in international regions in order to bolster presence and expand in-house-brand offerings.

The Zacks Consensus Estimate for its 2020 bottom line is pegged at a loss of $4.23 per share, having narrowed from a loss of $8.79 in the past 60 days. The company reported loss of $8.03 per share in the prior-year period.

Zoom Video Communications ZM is riding on the coronavirus-induced work-from-home and online-learning trend. Moreover, this $70.12-billion company’s efforts to eliminate the security and privacy loopholes like “zoombombing” are expected to help maintain its existing enterprise user base as well as attract more customers.

Zoom Video currently flaunts a Zacks Rank of 1. The Zacks Consensus Estimate for its fiscal 2021 earnings is pegged at $1.18 per share, having been raised 174.4% in the past 60 days. Earnings are expected to surge 237.1% from the prior-year reported number.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Activision Blizzard, Inc (ATVI) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Wayfair Inc. (W) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance