Revolution Medicines Reports Q1 2024 Financial Results: Challenges and Strategic Advances in ...

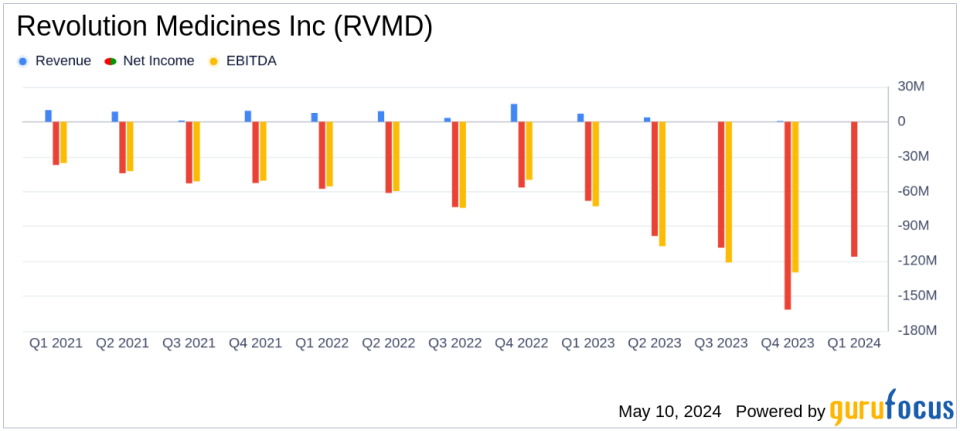

Revenue: Reported at $0 for Q1 2024, falling short of estimates of $1.44 million and down from $7.0 million in Q1 2023.

Net Loss: Increased to $116.0 million in Q1 2024 from $68.1 million in Q1 2023, below the estimated net loss of $120.96 million.

Earnings Per Share (EPS): Reported a loss of $0.70 per share, below the estimated loss of $0.75 per share.

Research and Development Expenses: Rose to $118.0 million, up from $68.9 million in Q1 2023, reflecting increased clinical trial and personnel expenses.

General and Administrative Expenses: Increased to $22.8 million from $13.2 million in the prior year, primarily due to higher personnel costs and stock-based compensation.

Cash Position: Ended Q1 2024 with $1.70 billion in cash, cash equivalents, and marketable securities, down from $1.85 billion at the end of 2023.

Financial Guidance: Reiterated full year 2024 GAAP net loss projection of $480 million to $520 million, with sufficient funds to support operations into 2027.

On May 8, 2024, Revolution Medicines Inc (NASDAQ:RVMD), a pioneering clinical-stage oncology company, disclosed its first-quarter financial results for 2024 and shared updates on its corporate progress through an 8-K filing. The company, known for its targeted therapies for RAS-addicted cancers, reported a challenging quarter with significant financial and operational highlights.

Company Overview

Revolution Medicines focuses on developing novel therapies that target critical oncogenic pathways, including RAS and mTOR signaling. Their flagship products, such as RMC-4630 and various RAS(ON) inhibitors, are designed to tackle hard-to-treat cancers by disrupting the underlying genetic mutations.

Financial Performance

For the quarter ending March 31, 2024, RVMD reported a net loss of $116 million, a substantial increase from the $68.1 million loss in the same period last year. This escalation in net loss was primarily due to increased research and development (R&D) expenses, which surged to $118 million from $68.9 million, reflecting heightened clinical trial activities and staffing costs. General and administrative expenses also rose to $22.8 million from $13.2 million, driven by expanded operations and higher stock-based compensation.

Operational Highlights and Future Plans

The company is advancing its RAS(ON) multi-selective inhibitor, RMC-6236, into pivotal trials for treating metastatic pancreatic ductal adenocarcinoma and non-small cell lung cancer. Additionally, RVMD is exploring RMC-6236 in various combinations and earlier treatment lines, aiming to broaden its applicability across different RAS cancer genotypes and tumor types.

Dr. Mark A. Goldsmith, CEO of Revolution Medicines, emphasized the strategic importance of these developments, stating,

The highly innovative investigational drug RMC-6236 continues to show progress in targeting RAS-addicted solid tumors, and our highest priority is to enable our goal of initiating pivotal monotherapy trials for patients with PDAC and NSCLC this year."

Financial Health and Projections

Despite the increased quarterly loss, Revolution Medicines maintains a robust financial position with $1.70 billion in cash, cash equivalents, and marketable securities. The company projects a full-year 2024 GAAP net loss of between $480 million and $520 million, inclusive of substantial non-cash stock-based compensation expenses. This financial outlook suggests that RVMD's current resources should support its operations well into 2027.

Challenges and Market Position

The termination of a collaboration agreement with Sanofi in 2023, which led to a drop in revenue to zero from $7 million in Q1 2023, poses challenges. However, the company's strategic focus on advancing its clinical programs and expanding its treatment pipeline demonstrates a clear path forward in its mission to address unmet needs in oncology.

Conclusion

While facing financial headwinds, Revolution Medicines is making significant strides in its clinical development programs. The company's focus on pioneering treatments for complex cancers positions it as a key player in the oncology sector, with potential long-term benefits that could arise from its current investments in R&D and clinical trials.

For detailed financial figures and more information on Revolution Medicines' strategic initiatives, visit the full earnings report and listen to the webcast here.

Explore the complete 8-K earnings release (here) from Revolution Medicines Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance